The speech of Fed Chairman Jerome Powell suggested further rate hikes over a longer period of time. He admitted that the last two CPI reports were promising, however, they are incomplete.

"The data we have so far on inflation does show a welcome reduction in price pressures, but there needs to be much more evidence to be confident that inflation will come down," he said.

Powell's statements supported the Fed's determination and commitment to maintain interest rates at current levels or higher until inflation hits 2%. Speaking about the possibility of a recession, he simply said that "nobody knows whether there will be a recession or not."

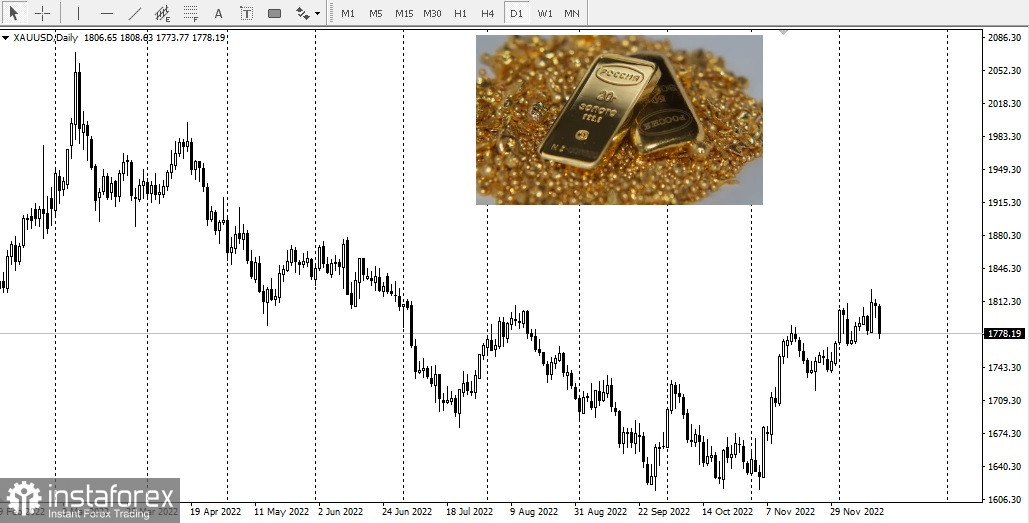

All this, along with the economic forecasts, led to a decline in dollar, US equities and precious metals. In fact, the most active gold contract for February 2023 was down $6.70 or 0.37%.

Dollar was also down 0.33% at 103.43, which prompted a $6.70 rise to spot gold. However, gold prices still fell by $9.40.

Powell's statements made it clear that inflation would persist longer than expected and interest rates would follow the same course.