Today is the most important day for market participants who follow the dynamics of EUR/GBP: at 12:00 and 13:15 (GMT), the central banks of the UK and the Eurozone will publish their decisions on interest rates.

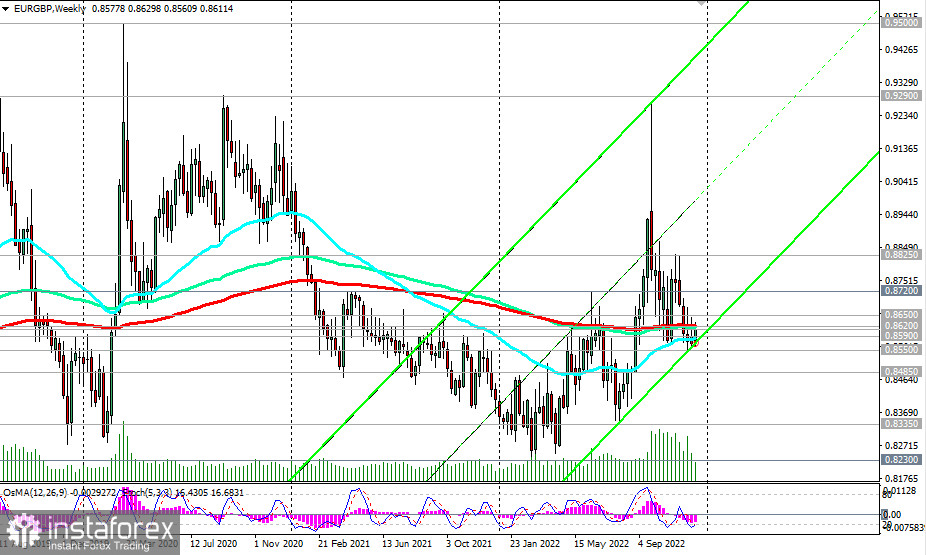

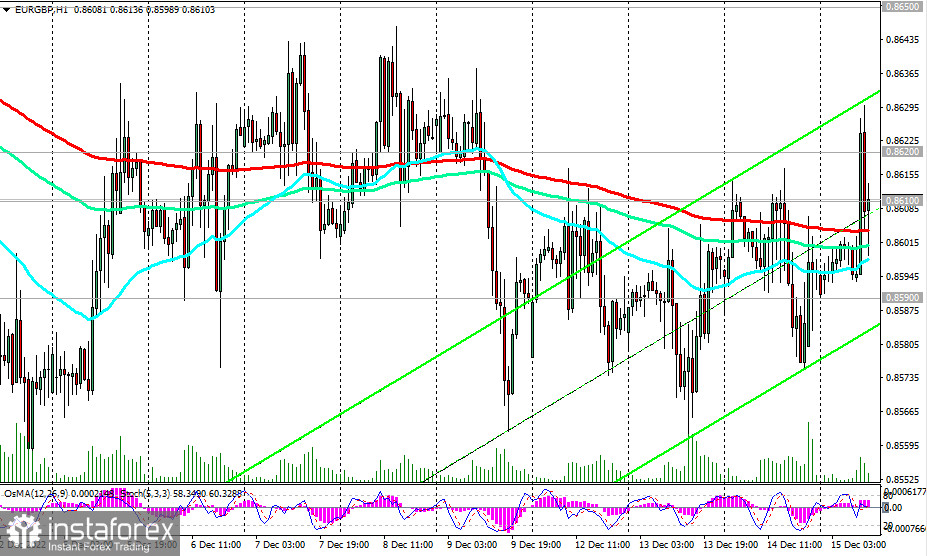

Since the beginning of the month, EUR/GBP remained squeezed in a narrow range between 0.8650 (50 EMA on the daily chart) and 0.8550 (local support level) and in an even narrower range between the key levels 0.8620 (200 EMA on the weekly chart) and 0.8590 (200 EMA on the daily chart). The conditional spring is clamped very tightly.

The situation requires detente, which may result in a breakout of the specified ranges and a strong movement, to which direction—much will depend on the outcome of today's meetings of the Bank of England and the ECB.

The breakout of the upper limit of the range 0.8650 will lead to further growth of the pair, and the first signal for this movement may be a breakout of today's intraday high at 0.8630, with the nearest growth target near the local resistance level 0.8825.

Alternatively, after the breakout of the lower boundary of the range at 0.8550, EUR/GBP will move towards the 0.8380 long term support (144 EMA on the monthly chart) and after its breakdown—to the 0.8200 key long term support (200 EMA on the monthly chart), which separates the long-term bullish trend from the bearish one. The first signal for the realization of this scenario will be a breakdown of the 0.8590 support level.

We are leaning in favor of the main scenario and growth of the pair. However, the situation can unfold in a completely different scenario, as it always happens. In both cases we should not forget about the stop limit.

Support levels: 0.8600, 0.8590, 0.8550, 0.8485, 0.8380, 0.8200

Resistance levels: 0.8610, 0.8620, 0.8650, 0.8700, 0.8720, 0.8825

Trading Tips

Sell Stop 0.8575. Stop-Loss 0.8635. Take-Profit 0.8650, 0.8700, 0.8720, 0.8825, 0.8900

Buy Stop 0.8635. Stop-Loss 0.8575. Take-Profit 0.8600, 0.8590, 0.8550, 0.8485, 0.8380, 0.8200