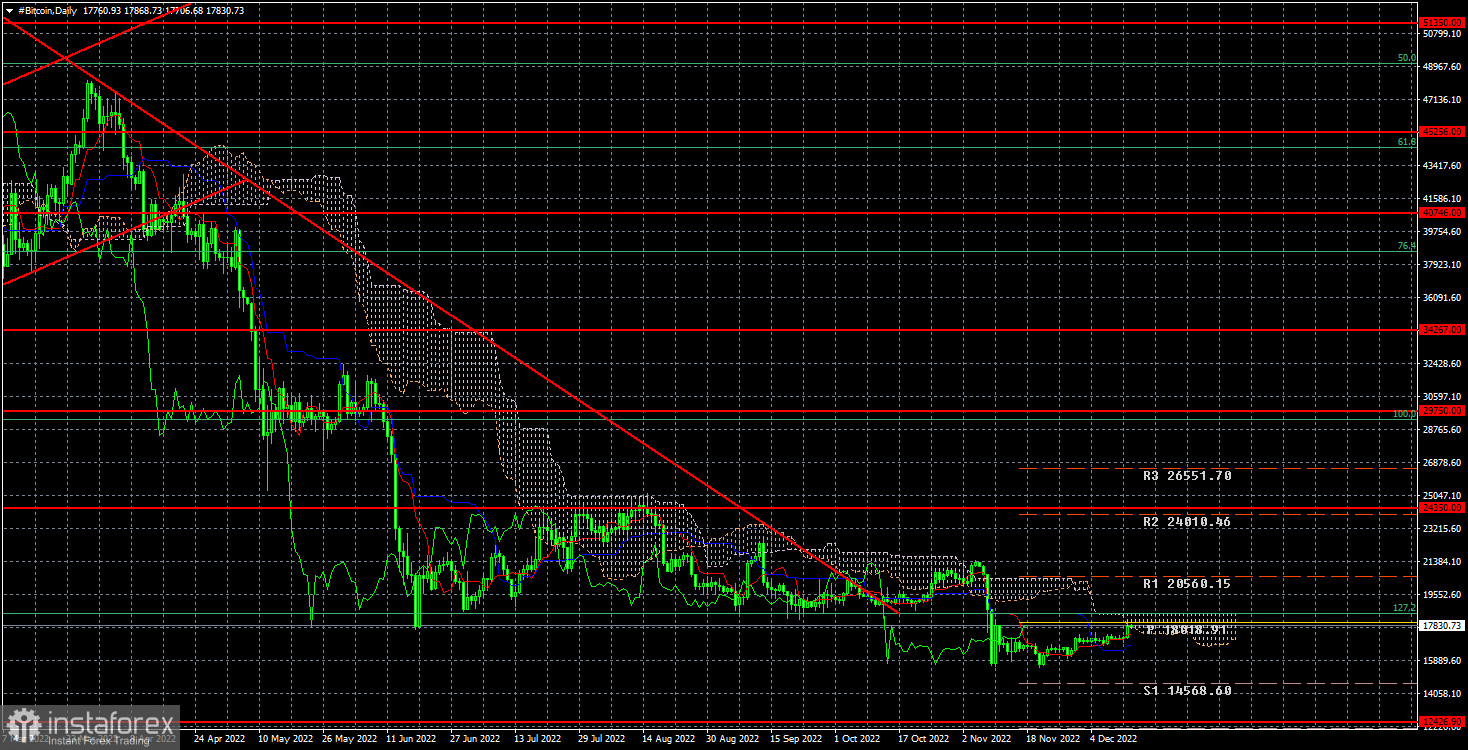

Bitcoin was ready to touch $18,500 yesterday, the 127.2% Fibonacci level. However, the level was missed as the token failed neither to overcome nor test it. Thus, we have reasons to assume that bitcoin will make another bearish leg in the near time. Perhaps it will not be a nosedive but a new bearish sequence in the flat market where the crypto has been stuck following the recent fall. Still, we cannot expect a strong rally. All it can do now is add a few thousand dollars in value.

Yesterday, in a widely expected move, the Federal Reserve increased its funds rate, albeit not as sharp as 4 precious times. The federal funds rate was raised by 50 basis points. At the press conference in the wake of the meeting, Jerome Powell pledged to go ahead with rate hikes next year. The US dollar did not assert its strength as the Fed's decision has been already priced in by markets. In response, bitcoin shed almost $1,000. I suppose, this response comes as no surprise unlike the response of the US dollar. Whatever sharp rate hike the Fed announces, it means just another round of monetary tightening. Therefore, safe haven assets yield more gains while borrowing costs go up. Under tight financial conditions, investors are poised to avoid risky assets. Bitcoin is one of the most popular risky assets among modern financial instruments. Hence, no one is surprised by its decline, though earlier it was able to neglect Fed's policy updates at previous meetings.

All in all, the Federal Reserve signalled that several rate hikes would be still ahead in 2023. In this context, there are no preconditions for bitcoin's growth. Moreover, the federal funds rate will be kept at its ultimate level at least for another year while the QE program will be running for the same period. In essence, QE represents the program of withdrawing extra liquidity from the economy. Therefore, the money supply will be squeezed. In turn, investments will hardly expand. To sum up, until inflation remains at elevated levels, it is out of the question that the US Fed will begin reducing interest rates. So, there are no fundamentals to help bitcoin develop a steady bullish trend. Indeed, yesterday Jerome Powell stated openly that the central bank does not consider the agenda for lowering interest rates in 2023.

Meanwhile, the ascending trendline on the 4-hour chart doesn't allow bitcoin to begin a new decline. Still, once this level is surpassed, this will generate a strong sell signal.

In the 24-hour timeframe, the bitcoin price has settled below $18,500. From my viewpoint, the token could extend its fall, heading for the downward target at $12,426. Let me warn you that overcoming the downtrend line doesn't mean the completion of the bearish trend because the price was locked inside the sideways channel in parallel. As of now, the lower border of this channel has been broken. So, the price is expected to continue its downward move.