A 0.50% rate hike was decided during the Fed meeting on Wednesday, so interest rates are at 4.50% as expected. Forecasts for GDP, unemployment, interest rates and inflation for the coming years were also announced.

At first, markets reacted negatively to the decision, but then showed positive momentum. Even so, overall trading in the US ended in red territory. The main reason was that the Fed increased the average level of interest rates to 5.25%, which suggests that next year, there may not be any decrease in rates all throughout the year. Fed Chairman Jerome Powell also did not say anything new, only that the economic outlook remains uncertain.

But by today's European session, the US stock market has moved into positive territory due to growing expectations that rates may be raised in the first quarter as previously thought, followed by a pause. Analysts from Goldman Sachs even assume that three further rate increases of about 0.25% are to be expected, and that will be the end of it. Bond traders, meanwhile, are saying that there is no need to raise rates anymore and that inflation will continue to decline because of the pressure of the previous increases.

What is highly likely though is a 0.50% hike at the start of the year, then a 0.25% rise by March. If inflation accelerates by that time, the rate could be raised once by 0.50%, or twice by 0.25%, followed by a pause.

Looking back at markets, weak data on US retail sales, industrial production and manufacturing activity will push demand for stocks higher, accompanied by a weaker dollar.

Forecasts for today:

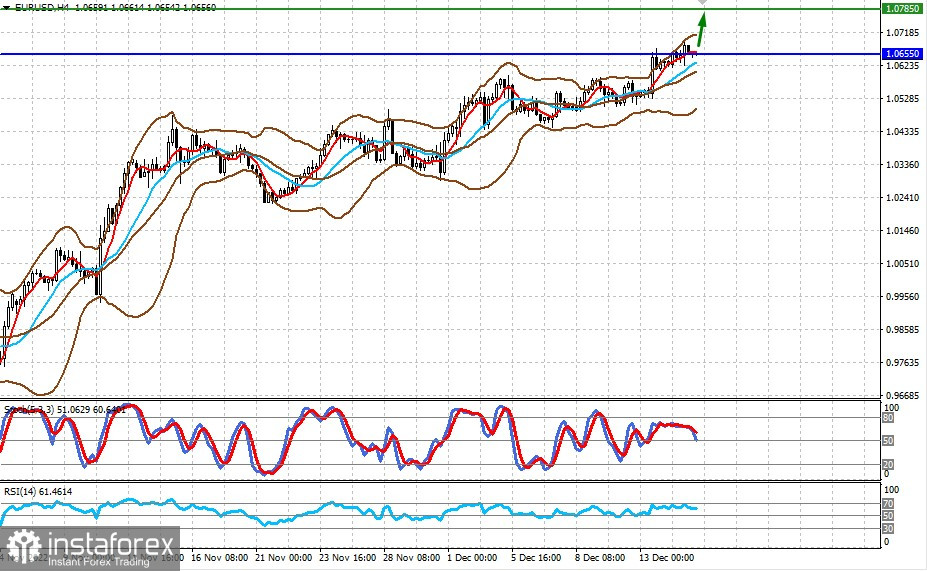

EUR/USD

The pair is consolidating above 1.0655. ECB's decision to raise interest rates by 0.50% could push the pair further up towards 1.0785.

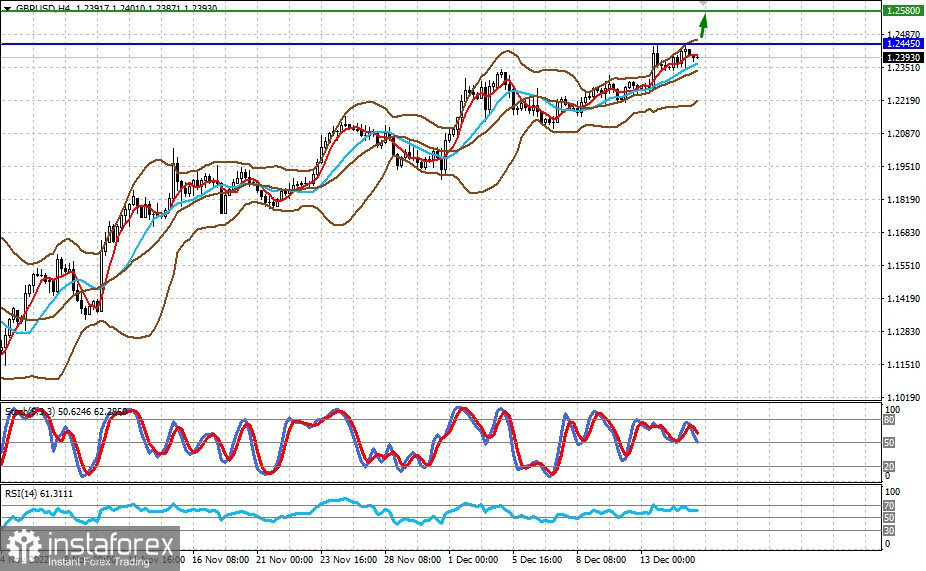

GBP/USD

The pair is trading below the level of 1.2445. An ECB rate hike could push the pair higher to 1.2580.