Futures contracts on the S&P 500 and Nasdaq 100 indices were down at least 1.1% each. The demand for safe-haven assets also supported the US dollar and the Swiss franc amid a wave of rate hikes from Taiwan to Norway. Against this backdrop, the euro paused its two-day gains as traders await important policy decisions from the European Central Bank, which may also disappoint. Oil fell in price amid signs of increased supply.

Apparently, the rally caused by lower-than-forecasted inflation in the US has stopped and we have another downward correction ahead. This may return the bear market again if signs of a recession begin to emerge in the US. Yesterday, Chairman Jerome Powell confirmed that the central bank would not stop its fight against inflation despite growing fears of job losses in the labor market.

The Fed was more hawkish than markets had expected. Policymakers still want to continue monetary policy tightening, which will lead to larger declines in stock prices. The end of the year is not the best time to fill your portfolio with cheap assets.

The US dollar index has hit its highest level since December 5. At the same time, the euro fell from a six-month high. The Swiss franc held its gains after the country's central bank doubled its rate to 1%, as predicted. The Chinese yuan fell due to poor economic data and a rise in Covid cases.

The European Stoxx 600 index fell due to sharply cheaper shares of companies from the consumer sector. Tesla shares plunged by 2.6% during the premarket trading session as it was revealed that Elon Musk sold nearly 22 million shares of the electric car maker for $3.58 billion.

Short-term Treasury bond yields rose. Two-year bonds added 3 basis points. The 10-year bond rate was virtually unchanged as investors digested the economic consequences of the Fed's hawkish policy and decided to refrain from trading.

Crude fell after rising by almost 9% in the previous three sessions.

Important US retail sales data is expected today, which could lead to another sell-off in stock indices.

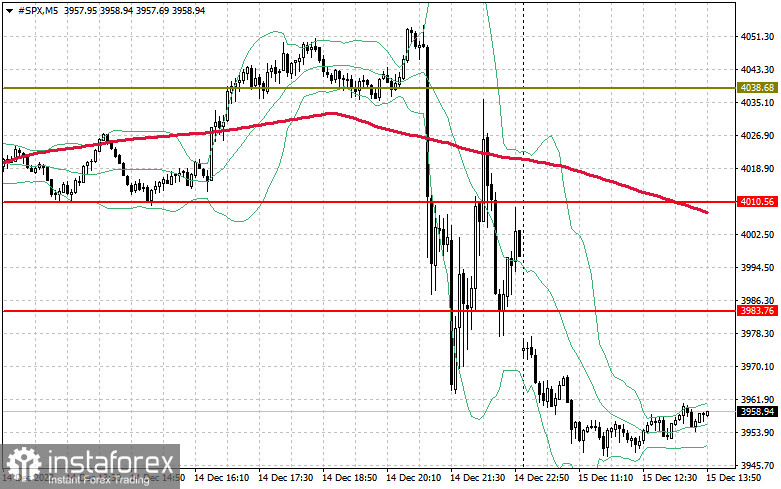

As for the S&P 500 index, it may continue to fall. Bulls need to protect $3,923 today. As long as the instrument is trading above this level, we may expect demand to return. This is likely to strengthen the price and push it to $3,983 and $4,010 with the prospect of going to $4,038 and $4,064. If the price settles above $4,091, it is unlikely to go below this level. If the trading instrument declines, bulls will have to show their activity near $3,923. Going below this level, the pressure on the index may increase. if this level is pierced from above, the price may go down to $3,894 and $3,861.