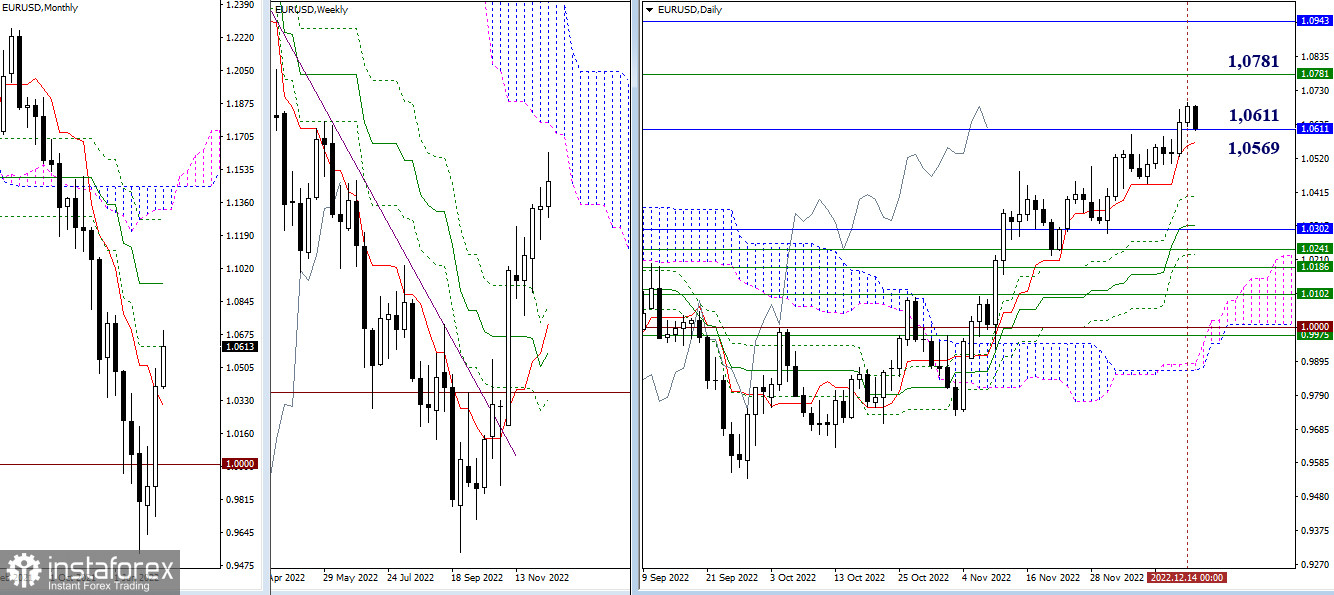

EUR/USD

Larger timeframes

Yesterday, EUR/USD managed to close above a one-month high of 1.16011. The question is still open whether the bulls will be able to notch this result at the end of the week. Higher upward targets on larger time frames are seen at 1.0781 (the lower border of the weekly cloud) and 1.0934 (a one-month medium-term trend line). In case the price declines and retraces back to levels below 1.0611, the nearest support will coincide with the levels of the daily Ishimoku cross: 1.0569 and 1.0405.

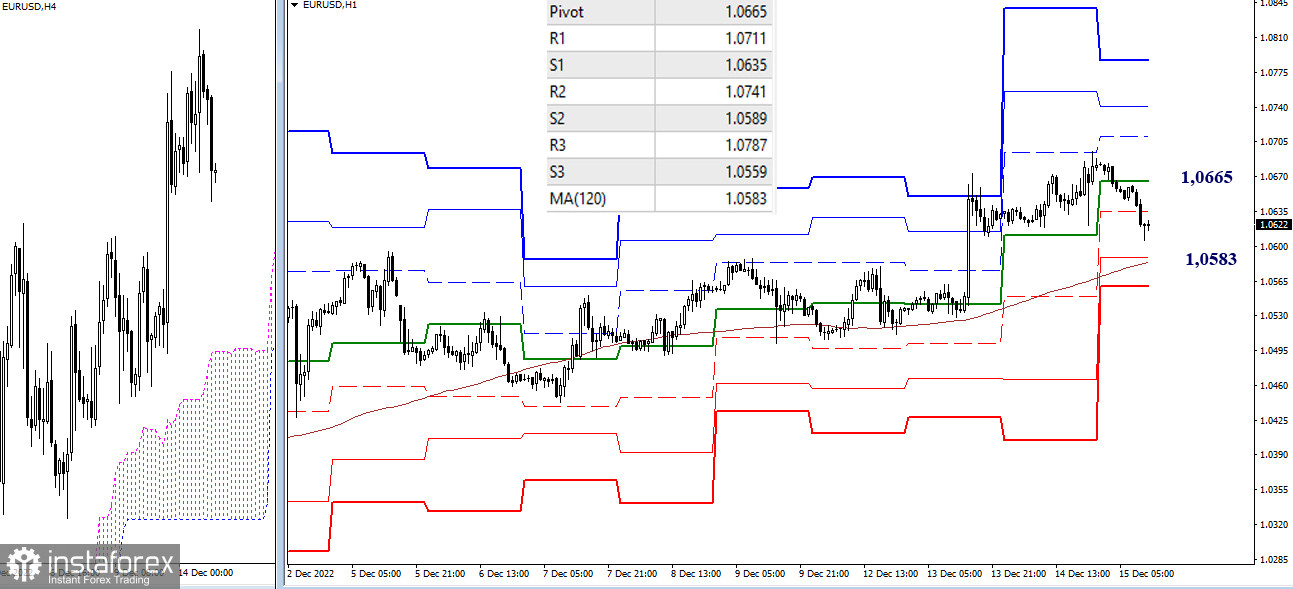

H4 – H1

On smaller timeframes, the bears are holding the upper hand. The most important target for them is 1.0583, the support of a weekly long-term trend line. The bears have a chance of reinforcing their positions in the long term on the following conditions: consolidation below the support as well as passing the intraday short-term trend line of 1.0569. The bullish scenario will come into play on the following conditions. The bulls need to regain control over the intraday pivot point at 1.0665.

***

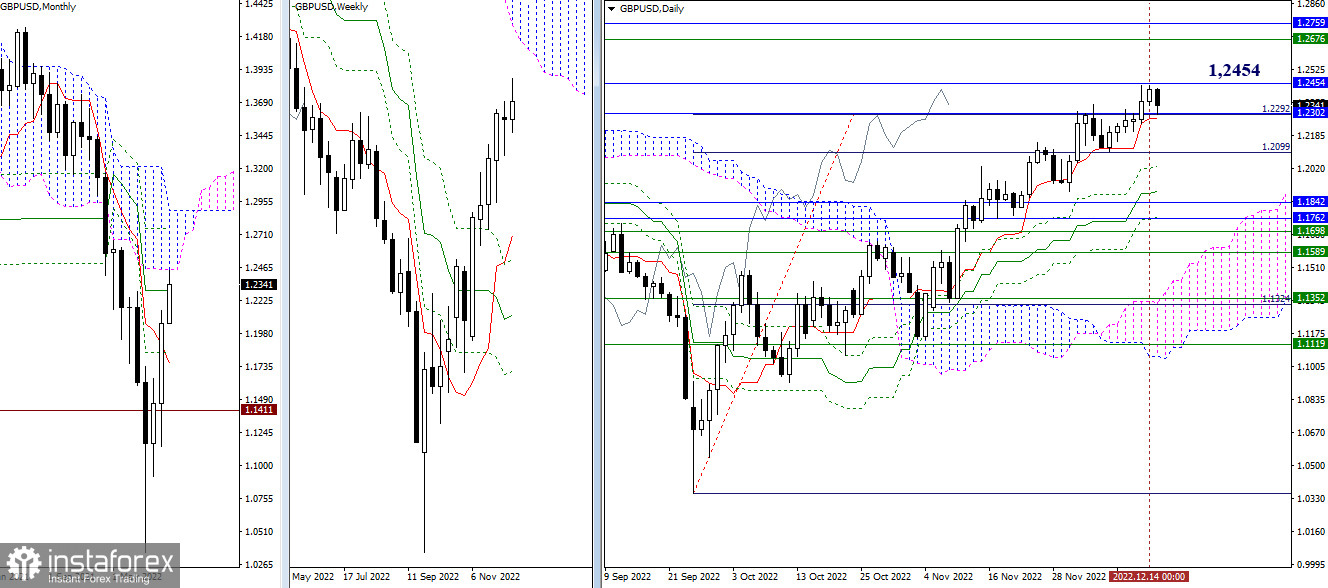

GBP/USD

Larger timeframes

Earlier, GBP/USD faced resistance at 1.2454 which matched a one-month Ishimoku cloud. This is a strong and crucial resistance. Therefore, it might take some time for the price to respond to its interaction with the resistance. Currently, support is defined between 1.2302 and 1.2099, the levels from different timeframes. In case the lower border of the one-month cloud (1.2454) is broken, the price will focus on the resistance area of 1.2676 – 1.2759 which represents the lower border of a one-week cloud and a one-month Fibo Kijun.

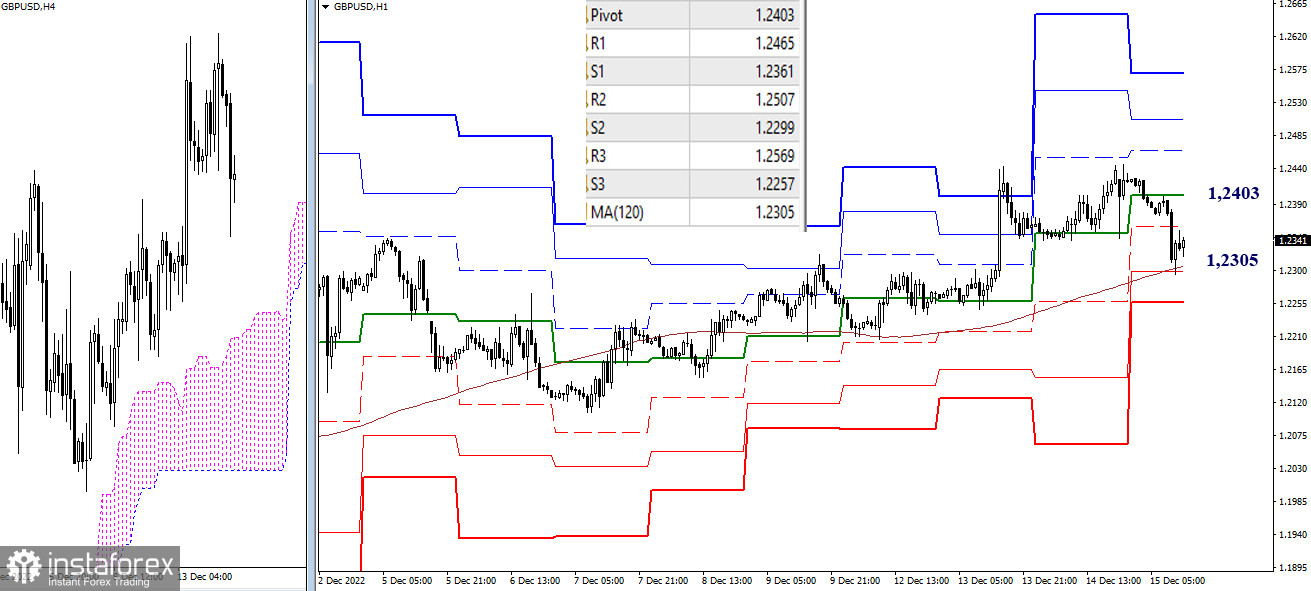

H4 – H1

At the moment, the support of a one-week long-term trend line at 1.2305 is being challenged. This level is responsible for the overall bullish dominance. Trading above this level will support the bulls, thus cementing the upward scenario. The key level for the bulls is seen at 1.2403, the intraday pivot point. The bears will take over from the bulls in case of a breakout and consolidation below 1.2305. The next intraday target will be 1.2257, the final support of classical pivot levels.

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot points + 120-period Moving Avarage (weekly long-term trendline)