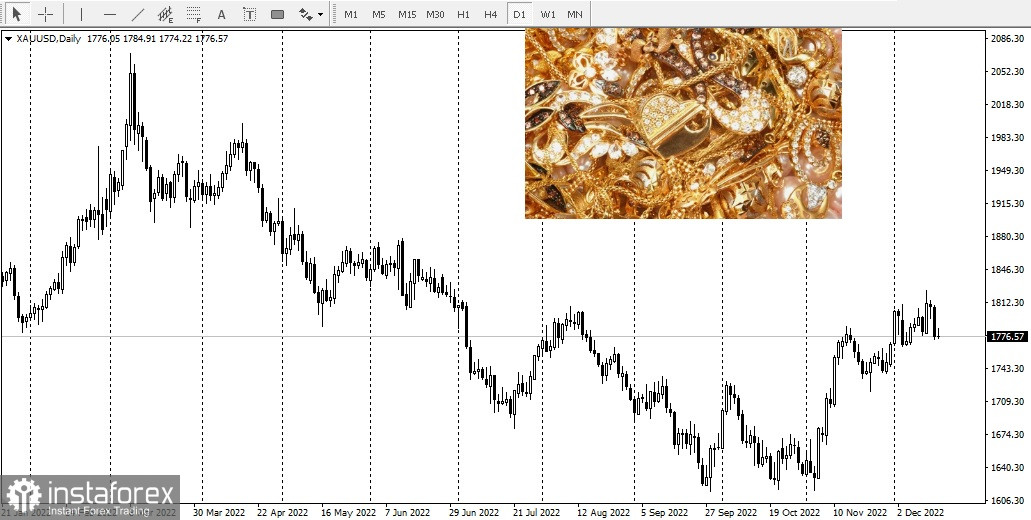

According to BubbaTrading.com editor Todd Bubba Horwitz, gold will be in extraordinary demand in 2023.

"Gold feels, as does silver and platinum, like they want to explode to the upside," he said. "They're not waiting for an event, but an opportunity, to attract some new-money buyers that will push them out of these ranges that they've been trading at for quite a while."

Horwitz predicts that in addition to good price performance for precious metals, 2023 would be a general commodities boom.

"I think in 2023, we're going to have a commodities boom, and that includes the hard asset commodities of gold, silver, and platinum," he said.

Digital currencies:

Horwitz said one of the reasons people will increase their investment in gold and silver will be their disdain for government-issued digital currencies that can track users and limit their access to funds.

"People don't want to disclose every single thing they do. If you give more power and more control to two organizations, government and central banking, that only create debt and don't create any industry, I think that you could see a much bigger demand for gold," he explained.

Horwitz suggested that the government would ban paper money and force U.S. residents to purchase digital currencies. This will then force them to turn to hard assets such as precious metals.

"Some of the non-believers in gold could become believers," Horwitz said.

He added, "if we go to digital currency, you have no freedom. The government knows what you're doing every moment of every day... if you spend money, they'll know about it. I don't think people are really comfortable with that."

Inflation and currency collapse:

Another reason for the increased demand for gold and silver, according to Horwitz, is related to inflation. He stated that, compared to fiat currencies, gold retains its value over a long period of time.

"Gold is still a real store of value," he said. "Your dollar buys less because of inflation. Gold is retaining value better."

He added that the upcoming collapse of fiat currencies could force people to use gold and silver as a medium of exchange.

Horwitz explained: "what happens when the fiat currency markets explode and they no longer take fiat currency?... you have precious metals, and that could be used as currency."

He hinted that "inflation" and high "taxation without representation" would force people to take it upon themselves to create their own money.