The pound sterling continued its rapid fall amid the news that economic activity in the UK is still contracting. Yet, after a sharp drop, bulls were back in the game and started to buy up the pound at the low.

For long positions on GBP/USD:

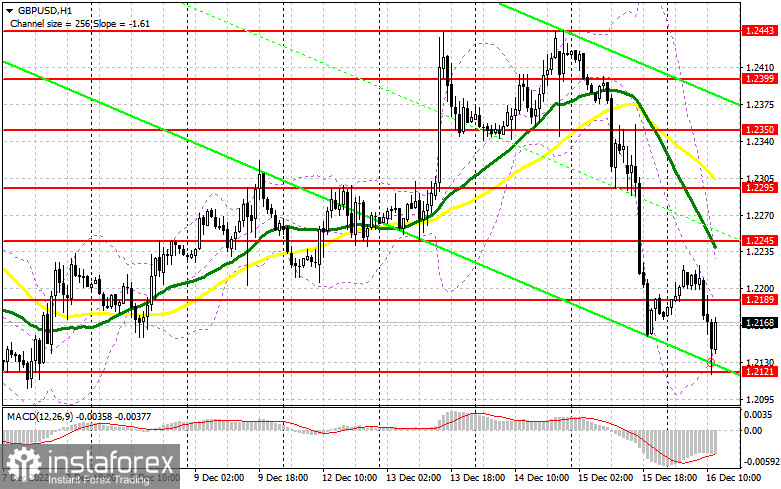

In the afternoon, markets will take notice of the manufacturing and services PMIs and the US Markit Composite PMI. The data is expected to be negative which can potentially support the pound. In the existing conditions, bulls will benefit greatly from a retest of the support at 1.2121 that was formed in the first half of the day. So, the best moment to buy the pair will be a false breakout of this level. This will give us a good entry point into long positions, with a possible surge to the new resistance of 1.2189. A breakout of this level and its downward retest amid downbeat data from the US will form a nice entry point for opening long positions. If so, bulls may push the price back to 1.2245 where moving averages support the bears. A breakout of this range will allow bulls to spread their wings by forming a buy signal which may potentially bring the price to the high of 1.2295. This is where I recommend profit taking. If the buyers fail to push the price above 1.2121 in the second half of the day, the pressure on the pair may increase at the end of the trading week. In this case, I recommend buying the pair only at the level of 1.2057 after a false breakout has been formed. Going long on GBP/USD right after a rebound is recommended from the level of 1.1999 or 1.1954, keeping in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Bears have successfully reached all their targets and will most likely stay calm at the end of the week. Therefore, I would advise you to be cautious when going short. Strong macroeconomic data from the US may be a reason to consider selling the pair from the level of 1.2189. A false breakout at this level will generate a signal for opening short positions, bearing in mind a possible pullback to 1.2121. Only a breakout of this level and its upward retest will give an additional signal for selling the pair and limit the bullish pressure. If so, the price may decline to the level of 1.2057 where bears will face an obstacle. If the price breaks through this level and retests it, it may then head for the lower target at 1.1999 where I recommend profit taking. If bears fail to develop a strong downward movement from 1.2189, bulls will seize this opportunity to regain control of the market. In this case, the price may surge to the level of 1.2245 where moving averages support the sellers. A false breakout of this range will create a good entry point into short positions with a further consequent decline. If bears show no activity there as well, I recommend selling GBP/USD immediately after a rebound from the level of 1.2295, considering an intraday correction of 30-35 pips.

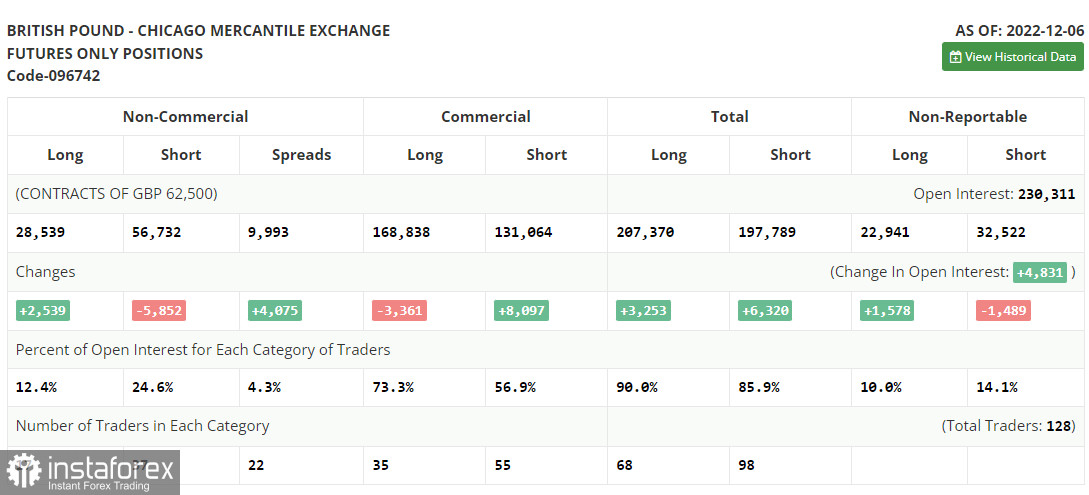

COT report

The Commitments of Traders (COT) report for December 6 showed a rise in long positions and a drop in the short ones. Apparently, the pound buyers expect it to rise further given that the monetary policy of the US Fed is getting less aggressive. Besides, the Bank of England has managed to catch up with the interest rate set by the Fed. At the same time, the recent data on business activity in the UK signals that the country has entered a recession although its scope is smaller than economists had predicted. The fresh GDP report has exceeded expectations. However, it had been contracting for the three previous months which is another proof that the recession is here. The Bank of England is determined to tackle inflation further and raise borrowing costs which means that the UK economy has more hurdles ahead. Therefore, it is hardly surprising that traders do not rush to buy the pair although they still do so in the short-term perspective. According to the latest COT report, short positions of the non-commercial group of traders declined by 5,852 to 56,732, while long positions went up by 2,539 to 28,539. This led to a decrease in the negative value of the total non-commercial net position to -28,193 from -36 584. The weekly closing price increased to 1.2149 from 1.1958 a week ago.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a change in the market trend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair advances, the upper band of the indicator at 1.2245 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.