Long-term outlook.

The GBP/USD currency pair initially continued its upward movement during the current week, which we have long regarded as illogical. Then came a "correction," which began with a fairly strong fall. This week saw many significant events and reports, just like with the euro. In the UK, the Bank of England held a meeting and published reports on the GDP, industrial production, unemployment, wages, inflation, and business activity index in services and manufacturing. And this is only for British data; American data is not included. You can see that there were so many things going on that we could anticipate much more erratic movements throughout the week.

I want to note right away that the Bank of England meeting, the outcome of which was as predictable and neutral as possible, appears to have been the most significant factor in the decline of the British pound at the end of the week. The rate increased by 0.5%, BA head Andrew Bailey remained silent this time, and the company's predictions were as gloomy as usual. Consequently, the regulator's decisions could have been overturned in advance because nothing surprised the market. Second, the market has yet to see any new reasons to buy due to the pound's substantial growth even before the meeting. Consequently, a long-awaited downward correction that could start this week could finally materialize.

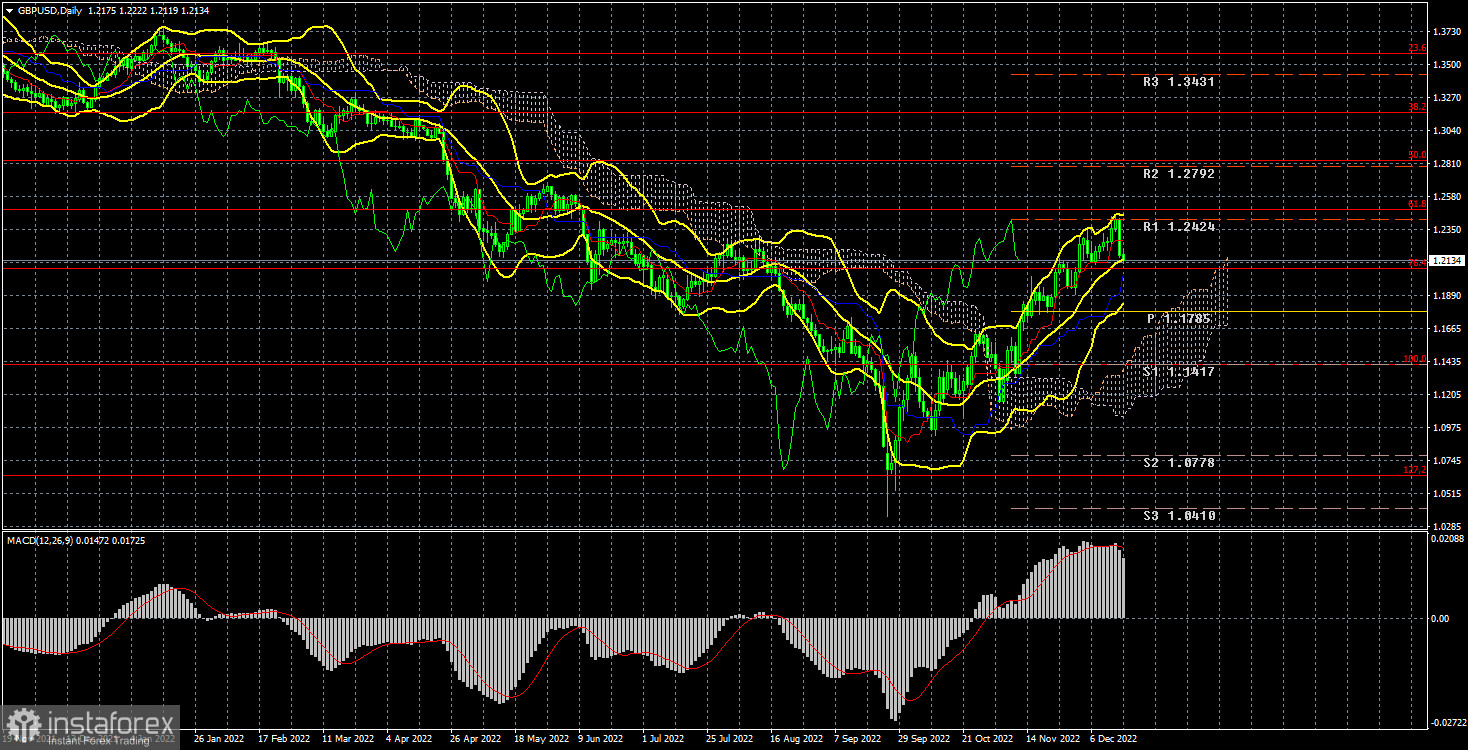

Technically, the pair is still above all of the Ichimoku indicator's lines on the 24-hour TF, but on the 4-hour, the indicators started to decline. Consequently, the initial sell signals were ultimately received. No matter how trite it sounds, everything will now depend on the market itself. We have frequently seen a scenario lately where the pound is rising against a neutral or negative fundamental backdrop. The pound can easily resume growing even without any special reasons if this market sentiment holds.

COT evaluation.

The most recent COT report on the British pound noted a slight easing of the "bearish" mood. The Non-commercial group opened 3.5 thousand buy contracts and 1000 sell contracts for the week. As a result, non-commercial traders' net position increased by 2,5000. The net position indicator has been rising steadily over the past few months. However, the major players' outlook is still "bearish." Even though the pound sterling is strengthening against the dollar, it is challenging to explain why from a fundamental standpoint. We consider the possibility that a new, significant decline in the pound's value will start soon. Also, note that both major pairs are moving almost identically but that the net position for the euro is positive and even suggests that the upward momentum will soon be completed. In contrast, the net position for the pound is negative. The non-commercial group has now opened a total of 58 thousand sales contracts and 32 thousand purchase contracts. As we can see, the difference is still very significant. The bulls are in the lead by about 5,000 open buy and sell positions overall. While there are technical reasons for this, geopolitics does not support such a strong and quick strengthening of the pound sterling, so we continue to be skeptical about the currency's long-term growth.

Examination of fundamental occurrences

The BA meeting was the main event of the week in the UK. However, the Central Bank also met in the United States, which has always been regarded as more important. The US central bank made no unexpected announcements to the market, and the pair fluctuated throughout the day. The market's response to one meeting affected its response to the next. Additionally, a report on inflation that showed a new sharp decline and business activity indices in the manufacturing and services sectors that decreased even further than last month were published in the United States. Theoretically, there were roughly equal reasons for the dollar to rise or fall this week. Except, of course, when we forget that the dollar has already declined by 2,000 points in just 2.5 months. We anticipate a significant downward correction because the US dollar is severely oversold. While macroeconomic statistics are significant at the moment, the market sometimes needs to follow them logically. It preferred to buy the pound based on all recent news and events. If this situation continues, the pound will be free to increase in value indefinitely.

Weekly trading strategy for December 19–23:

1) The pound/dollar pair has technical justification for moving upward because it is above all of the Ichimoku indicator's critical lines. The closest targets are 1.2307 and 1.2759, with 1.2307 already being calculated. We continue to think that a downward correction is required, and that correction will be very evident on the 4-hour TF. Given that the price has now settled below the 4-hour TF moving average, the correction may now start.

2) The pound sterling is still forming what appears to be a brand-new upward trend. It now has solid grounds for growth, but it has gained nearly 2,000 points in just two months. How much longer will traders want to keep purchasing? Although sales are irrelevant, we are still anticipating a significant correction in the vicinity of the Senkou Span B. Since the price has settled below the 4-hour moving average, sales can be considered.

Explanations for the examples:

Fibonacci levels, or targets when beginning purchases or sales, are price levels of support and resistance (resistance/support). Take Profit levels may be close by.

Bollinger Bands, MACD, and Ichimoku indicators (standard settings) (5, 34, 5).

The net position size of each trading category is represented by indicator 1 on the COT charts.

The net position size for the "Non-commercial" group is represented by indicator 2 on the COT charts.