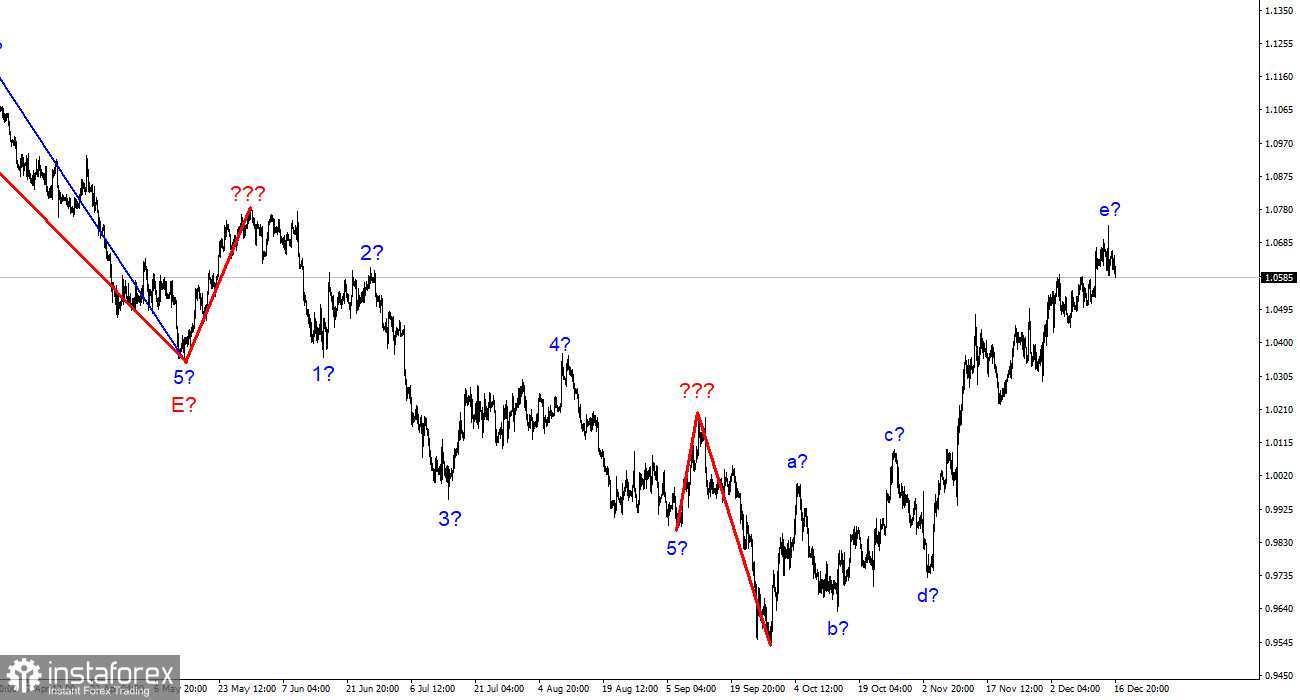

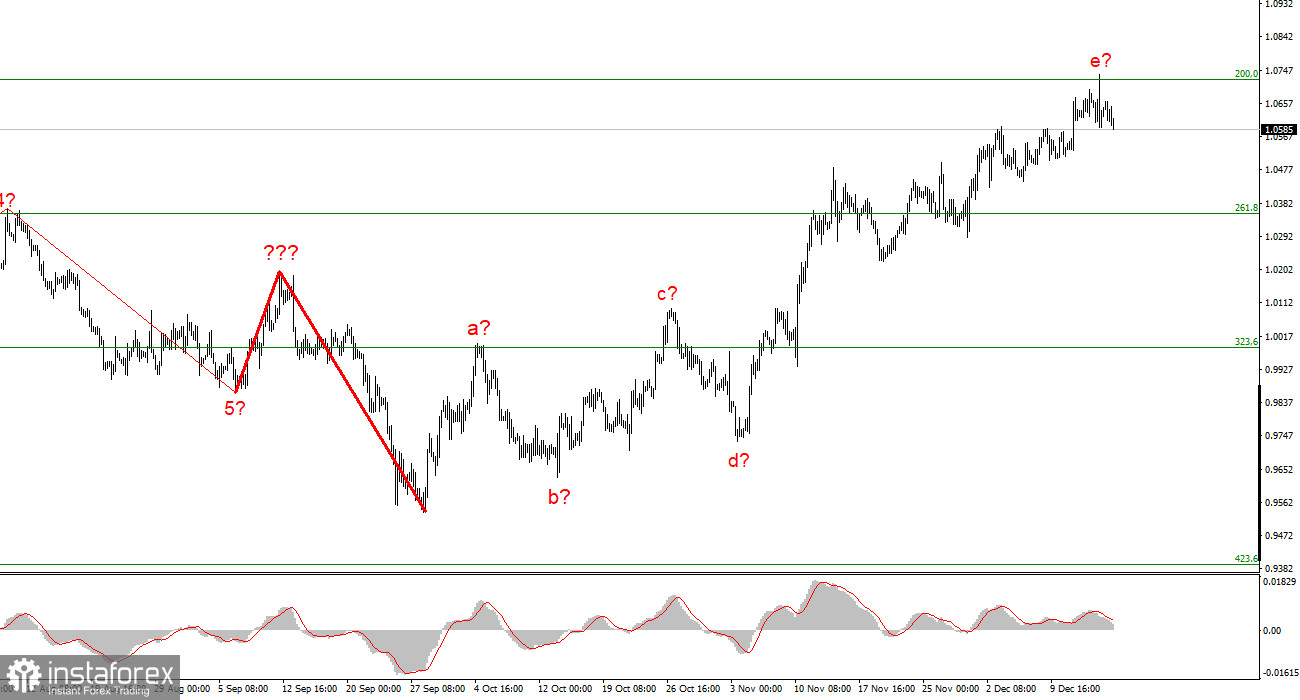

The wave marking on the euro/dollar instrument's 4-hour chart still appears to be quite accurate, but the entire upward section of the trend is becoming more complicated. It has already assumed a clear corrective and somewhat prolonged form. Waves a-b-c-d-e have been combined into a complex correction structure, with wave e having a significantly more complex form than the other waves. Since wave e is much higher than the peak of wave C, if the wave markings are accurate, construction on this structure may be nearly finished. In this instance, it is anticipated that we will construct at least three waves downward, but if the most recent phase of the trend is corrective, the subsequent phase will probably be impulsive. I'm preparing for a new, sharp decline in the instrument (even if it is a corrective section of the trend). The market is prepared to sell when an attempt to surpass the 1.0726 level, which corresponds to 200.0% Fibonacci, fails. However, the recent increase in the instrument's quotes suggests that the overall wave e may end up longer. The demand for US dollars is still not increasing, and wave e's internal wave structure needs to be clarified. The wave pattern keeps getting more perplexing and intricate.

The ECB meeting prevented a decline in the euro.

On Friday, the euro/dollar instrument decreased by 40 basis points while rising by 40 points for the entire week. Therefore, the strong news backdrop has yet to result in a decline in demand for the euro currency, which is required to create a segment of a downward trend. This week saw a lot of news, as I previously mentioned. The market anticipated a 50 basis point rate increase at the end of the ECB meeting. Christine Lagarde revealed at a press conference that she intended to start a quantitative tightening program in addition to raising interest rates. All of this, according to the president of the ECB, should help bring inflation back to 2%.

The manufacturing and services business activity indices in the European Union were released on Friday. They showed stability and remained below the critical level of 50.0, though they slightly increased from November. The final November inflation report, which turned out to be worse than the prior one, was also made public. In November, prices in the European Union rose by 10.1%. While the news on Friday was not the best in America, where business activity indices also fell, losing an average of 2 points, it is difficult to say that it was favorable for the euro.

It would be very challenging to categorize this week's news as an asset or a liability for the dollar or the euro. It is simply impossible to state clearly and accurately that the market has unambiguously worked out this or that event because the market was forced to win back a lot of different data. This week's news environment was unfavorable to either the euro or the dollar. To support my conclusions, I still rely on the wave markup, which continues to show the required decline in quotes.

Conclusions in general

I conclude from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. Wait for powerful sales signals because there is a chance that the upward portion of the trend could become even more extended and complicated, and this possibility still has a high probability.

The wave marking of the descending trend segment becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this section is finished, work on a downward trend section may resume.