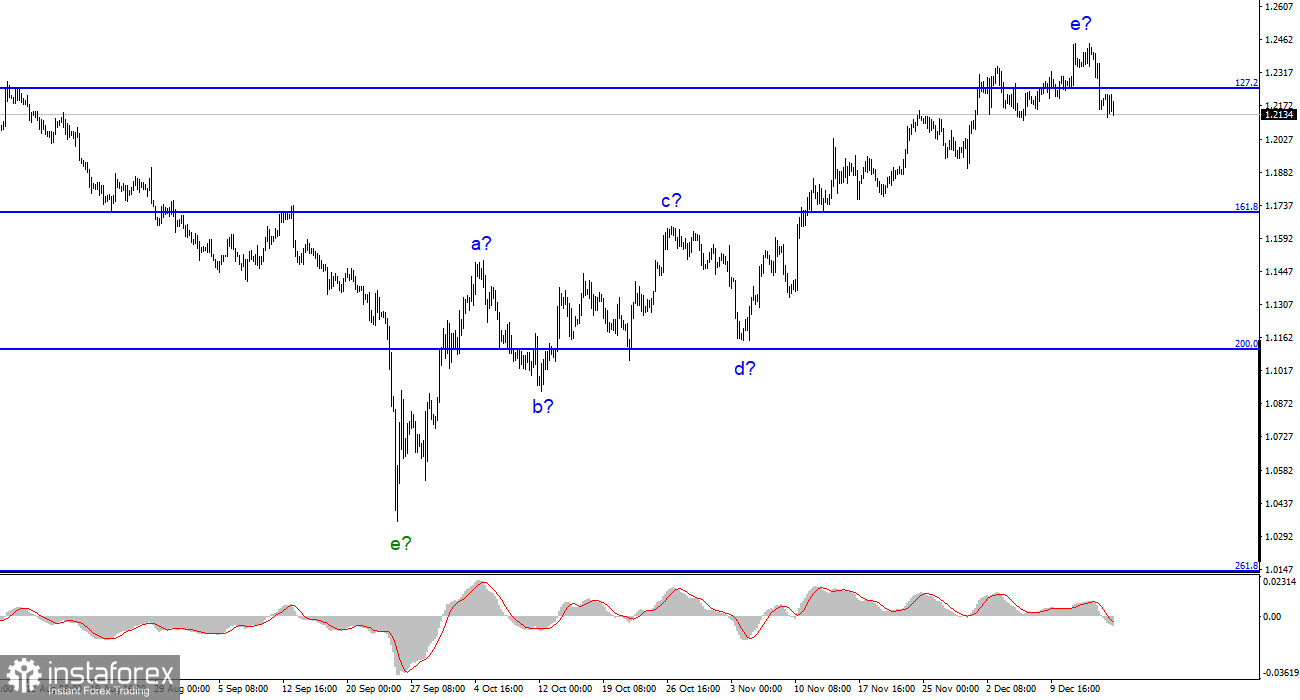

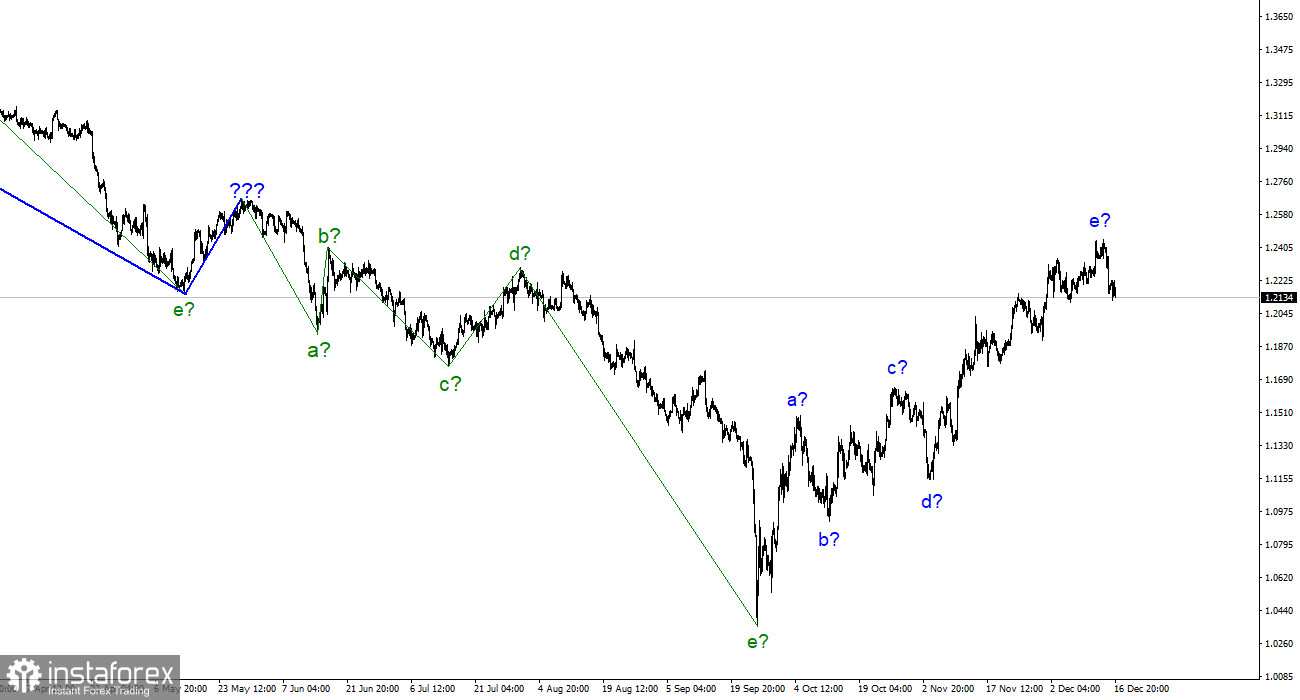

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. As a result, the instrument's price increase may last for a while. Both instruments are still forming an upward trend segment that will eventually lead to a mutual decline. It is impossible to say what the instrument's movement should have been given the recent diversity and intensity of the British news environment. The British pound has generally been rising during this time, although, as I said, the news background was different. The proposed wave e has become more complicated due to the recent rise in quotes. It has already evolved into a long enough form to be finished soon. I am currently waiting for the decline of both instruments. Still, these trend sections may take an even longer form because the wave marking on both instruments allows the ascending section to be built up to completion at any time.

Indicators of business activity decreased in both the US and Britain.

The pound/dollar exchange rate decreased by 45 basis points on Friday. This week, the British experienced a greater decline than the Europeans, but overall, their movements were quite similar. It is challenging to determine whether the outcomes of the ECB, Fed, and Bank of England meetings were positive or negative. Except for Christine Lagarde's declaration that she is prepared to begin a quantitative tightening program, they can all be classified as "walk-throughs." This element slightly aided the euro, which declined weaker as a result.

The reports on business activity and UK retail sales released on Friday were all disappointing. Retail trade fell by 0.4%, while business activity indices fluctuated below 50. The situation wasn't any better in the US, where all three indices were down from a month ago. As a result, no report from Friday pointed the market in a particular direction. As a result, we observed restricted amplitude and heterogeneous dynamics. The word "heterogeneity" was used to describe the past week because so many reports and events clashed with one another and were difficult to interpret. I still rely more on wave marking as a result. The market appears ready to reduce demand for the pound after a successful attempt to break through the 127.2% Fibonacci level, and the instrument appears ready to decline as well. Still, this could be another false start of a downward wave. Unfortunately, this week prevented us from determining the instrument's future movement. If the British have been increasing over the past month, they should continue to increase through the end of the year, even in the absence of pertinent news. This week, I have not observed anything that might support strong demand for the pound in the upcoming weeks.

Conclusions in general

The construction of a new downward trend segment is predicated on the wave pattern of the Pound/Dollar instrument. Since the wave marking permits the construction of a downward trend section, I cannot advise purchasing the instrument. With targets around the 1,1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer shape.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.