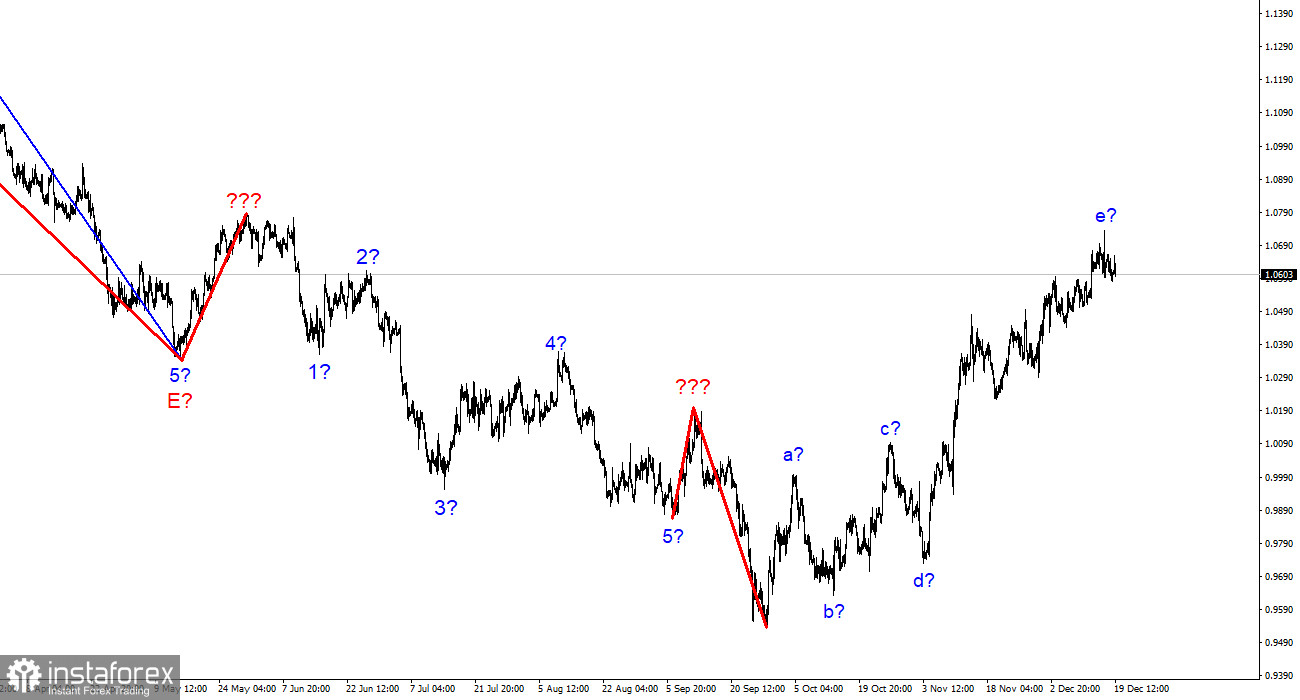

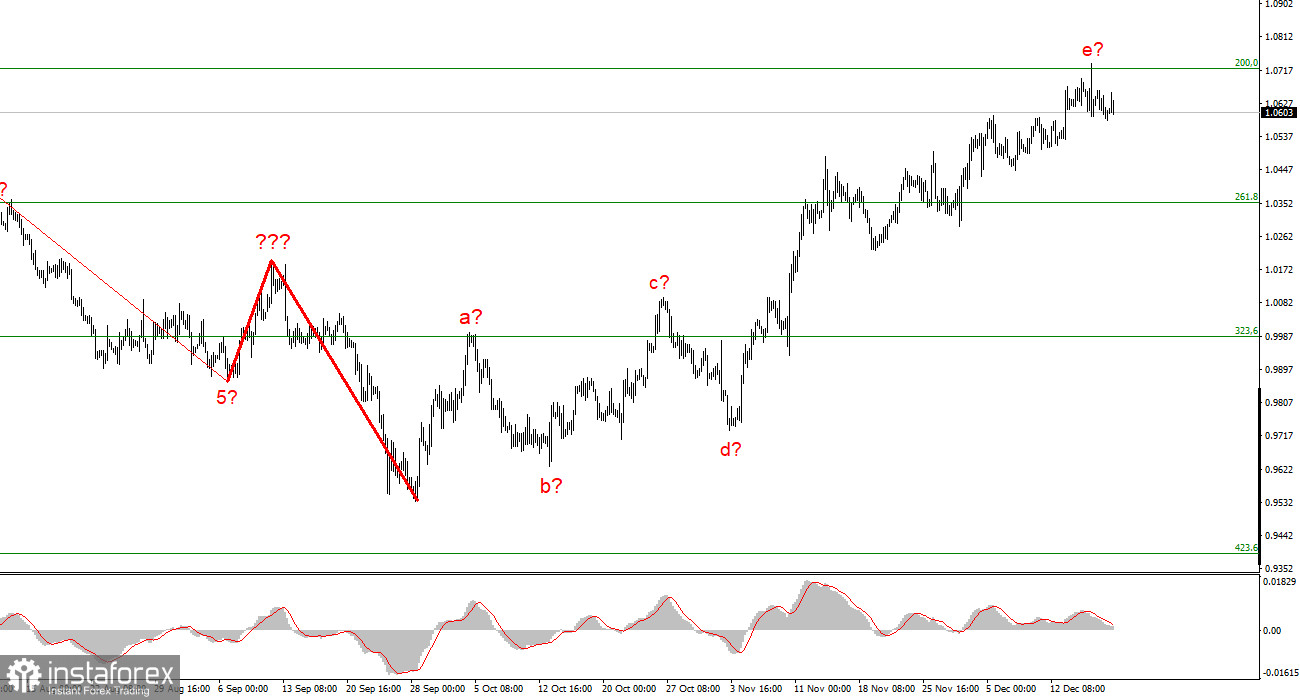

The wave marking on the euro/dollar instrument's 4-hour chart still appears to be quite accurate, but the entire upward section of the trend is becoming more convoluted. It has already assumed a clear corrective and somewhat prolonged form. Waves a-b-c-d-e have been combined into a complex correction structure, with wave e having a significantly more complex form than the other waves. Since wave e is much higher than the peak of wave C, if the wave markings are accurate, construction on this structure may be nearly finished. In this instance, it is anticipated that we will construct at least three waves downward, but if the most recent phase of the trend is corrective, the subsequent phase will probably be impulsive. Therefore, I am preparing for a new, significant decline in the instrument. The market is likely to be ready to sell if an attempt to break through the 1.0726 level, which corresponds to 200.0% Fibonacci, fails. However, the recent increase in the instrument's quotes suggests that the overall wave e may end up longer. The demand for US dollars is still not increasing, and wave e's internal wave structure needs to be clarified. The wave pattern keeps getting more perplexing and intricate.

There is one negative indication.

On Friday, the euro/dollar instrument fell by 40 basis points; on Monday, it slightly rose. However, today's movements had a moderate amplitude, and there was no discernible direction. The beginning of the new week is also peaceful, and it will be much calmer than the previous one. Because there won't be any news today or tomorrow, the market has nothing to analyze. There is only one thing left: go back to last week, which had enough news and events to fill three weeks. However, since the market has already had ample time to consider everything and draw conclusions, I see little value in bringing up old events. If there was no movement today, on Monday, the market did not perceive anything special in that information.

Additionally, the entire current week may be quite dull. The market may act entirely differently on the eve of a holiday. I recall when the market was in one location on the same days, and activity peaked in the year's final days. It is doubtful that this year's events can be predicted. What can we anticipate from this week if the market was unimpressed by the news backdrop from last week? In light of this, my only hope is for the wave markup to continue screaming about the need to create a descending wave or series of waves and for an unsuccessful attempt to break through the 200.0% Fibonacci level. It will only be left to heedlessly follow the market, without attempting to inject any rationale into it, if the euro's decline does not start even after this signal. But I continue to believe that the decline will start. Although the market is very late with it, given the slowdown in the ECB rate hike, the European currency cannot continue to be in high demand.

Conclusions in general

I conclude from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. Although there is a strong likelihood that the upward portion of the trend will become even more extended and complicated, there is currently a signal to turn lower.

The wave marking of the descending trend segment becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this section is finished, work on a downward trend section may resume.