Futures on the S&P 500 and the Nasdaq 100 rose slightly, as did shares of energy and technology companies. Many investors, after the recent interest rate hike in the US, have started to worry about a recession, which is likely to be triggered by high interest rates. Markets are also counting on inflation declining next year, which may allow central banks to reconsider their approach to future policy, thereby preventing a major slowdown in economic growth. This will help riskier assets, such as high-yield fixed-income instruments and stocks.

As it was noted above, investors were also encouraged by the promise of China's leaders to stimulate the economy next year by reviving consumption and supporting the private sector. At the same time, news of the Covid surge in China limited the growth in the Asian markets.

The US dollar fell against a basket of currencies as money markets weighed the prospect of a slowdown in US rate hikes and heightened expectations of higher rates in other countries. The euro continues to show gains after a series of hawkish comments from the regulator last week, while the Japanese yen benefited from statements that the Bank of Japan might be mulling a hawkish reversal. Against this backdrop, Japan's five-year bond yields reached their highest level in more than seven years.

Yields on other large government bonds also rose, with British 10-year securities suffering the worst sell-off as the Bank of England prepared to start selling debt early next year.

As for the commodities market, Beijing's promise of an economic stimulus led to a rise in oil futures.

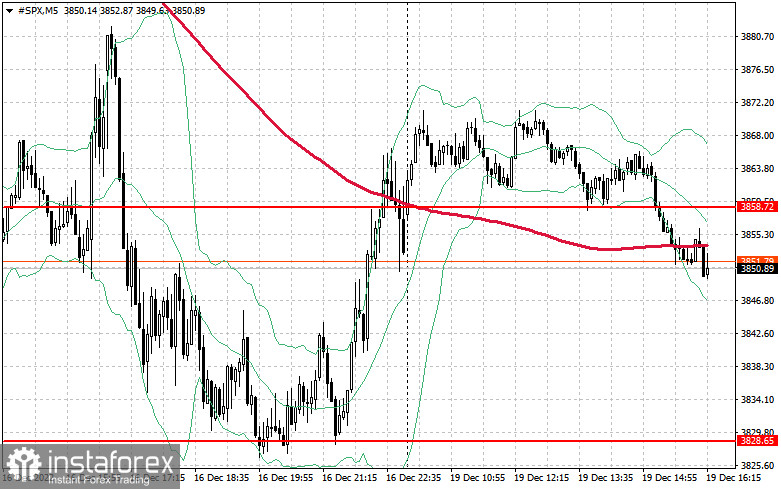

As for the S&P 500 index, the price may continue to fall. Bulls need to defend $3,828 today. As long as the instrument is trading above this range, we can expect the demand to return. This also creates good conditions for the strengthening of the trading instrument to $3,858 with the prospect of reaching $3,891. However, the level of $3,923 can hardly be reached. If the price declines, bulls should protect $3,828. Plunging below this level, the pressure on the index may increase. If this level is broken through, the instrument may drop to $3,802, allowing a decline to $3,773.