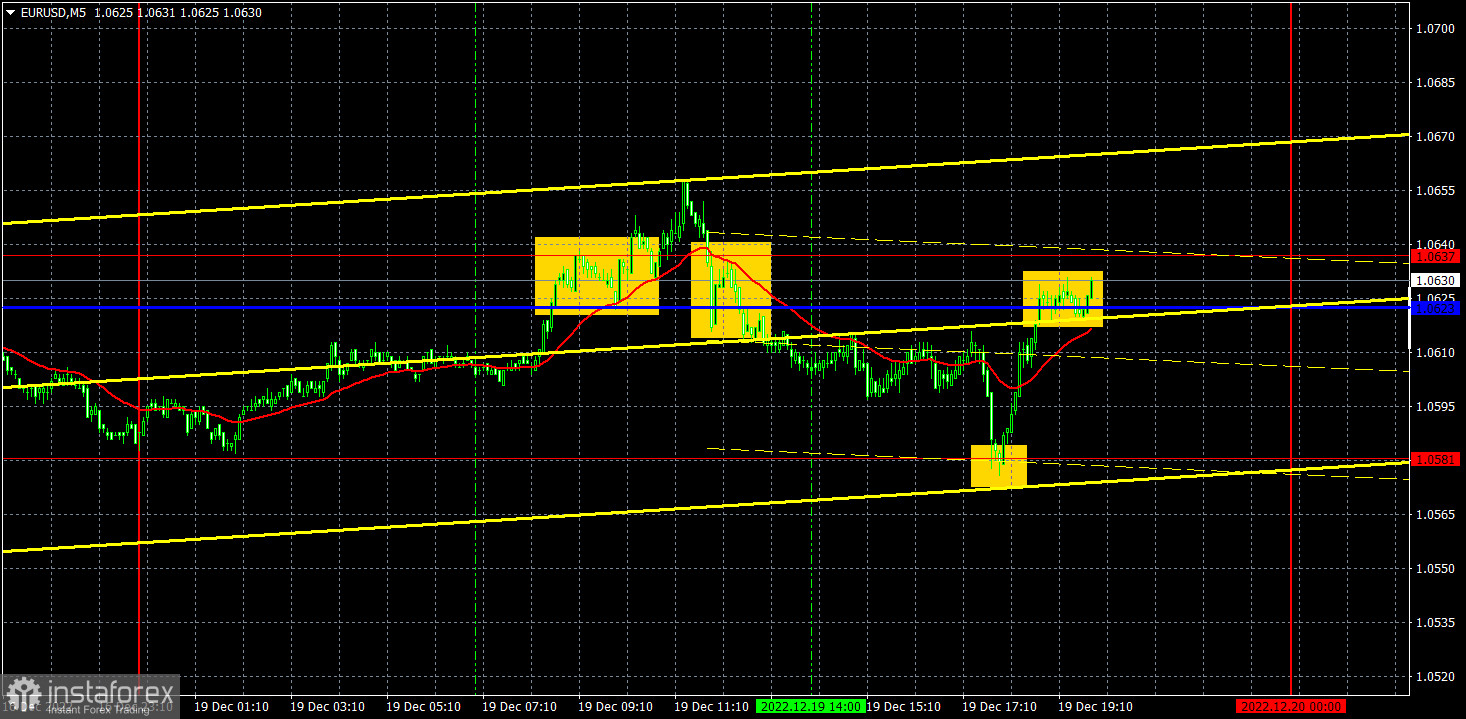

M5 chart of EUR/USD

EUR/USD continued its sluggish decline on Monday. It is particularly visible on the one-hour chart. The pair reversed several times, which made it inconvenient to trade. But now we are close to the Christmas and New Year's holidays, so the trend may change to a flat. Basically, there was no fundamental or macroeconomic reason for the pair to show the movements it did. Calendars of events of the European Union and the US were empty. So I conclude that the correction continues, but the very nature of the current movement may be quite unfavorable for us. I don't know if the flat will begin today, but at the same time, volatility has significantly decreased lately. Consequently, traders will also become less active and will start to leave the market quietly before the holidays.

Speaking of trading signals, yesterday was quite unfavorable for obvious reasons. The first buy signal, breaking through the 1.0623-1.0637 area, turned out to be false, and the price was up by 15 points, which gave traders a chance to place the Stop Loss to breakeven. This was followed by a sell signal around the same area, after which the pair reached the nearest target level of 1.0581, which made it possible to earn about 20 pips. You could also use the buy signal near 1.0581, the price went back to the critical line, so traders could gain 20 pips more. In general, the day was not that bad, but at the same time the pair can go flat, which is fraught with false signals and losing trades.

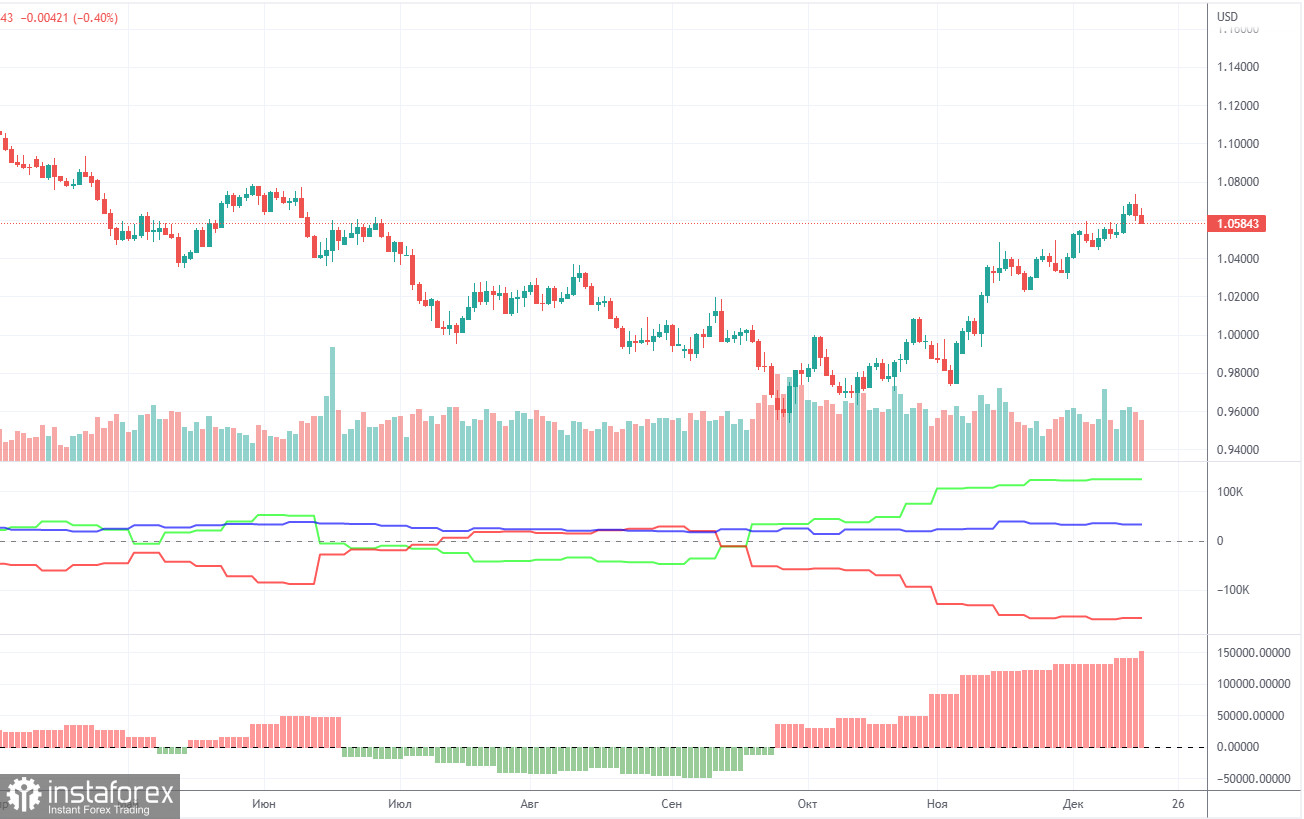

COT report

In 2022, the COT reports for the euro are becoming more and more interesting. In the first part of the year, the reports were pointing to the bullish sentiment among professional traders. However, the euro was confidently losing value. Then, for several months, reports were reflecting bearish sentiment and the euro was also falling. Now the net position of non-commercial traders is again bullish and strengthens almost every week. The euro is growing but a fairly high value of the net position may point to the end of the upward movement or at least, to a correction. During the given period, non-commercial traders opened 8,600 long positions, whereas the number of short positions rose by 8,500. Thus, the net positions fell by 100. Notably, the green and red lines of the first indicator have moved far apart from each other, which may mean the end of the ascending trend (which wasn't actually an uptrend because the upward movement of the last two and a half months fits under the "correction" category against the global downtrend). The number of long positions is 125,000 higher than the number of sell positions opened by non-commercial traders. Thus, the net position of the non-commercial group may continue to grow. However, the euro may remain unchanged. The overall number of short orders exceeds the number of long orders by 33,000 (711,000 vs. 678,000).

H1 chart of EUR/USD

EUR/USD is still in a high position on the one-hour chart, and it has hardly settled below the critical line. So far, we're not sure whether it will continue to move down, though I have been waiting for it to do so for several weeks now. I believe that there is a high probability that it will fall, but the market may think otherwise. Also, keep in mind that the New Year is less than 2 weeks from now, and volatility may drop significantly and the movement may turn into a flat. On Tuesday, the pair may trade at the following levels: 1.0340-1.0366, 1.0485, 1.0581, 1.0736, 1.0806, as well as Senkou Span B (1.0550) and Kijun Sen (1.0630). Lines of the Ichimoku indicator may move during the day, which should be taken into account when determining trading signals. There are also support and resistance levels, but signals are not formed near these levels. Bounces and breakouts of the extreme levels and lines could act as signals. Don't forget about stop-loss orders, if the price covers 15 pips in the right direction. This will prevent you from losses in case of a false signal. There are no important reports or events scheduled for today in the EU and the US. And the pattern will remain the same all through this week. I believe that this is a good opportunity for a bearish correction, but the market may think otherwise...

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.