M5 chart of GBP/USD

On Monday, GBP/USD spent the entire day moving sideways. We can't say that volatility was "at zero", but still, the closer Christmas and New Year holidays come, the more it decreases. Volatility was around 125 points on Monday. There were several reversals during the day, which had absolutely nothing to do with macroeconomics or fundamentals, because there were neither of those. The price did not settle below the Senkou Span B line, therefore, the pound will not fall further for the time being. The pair may trade relatively flat this week and probably until the New Year. So far, the lines of the Ichimoku indicator are still strong, but if the flat continues for several more days, they will become weaker. In any case, GBP needs to cross the area below the bottom of the Ichimoku cloud in order to continue moving down.

As for the trading signals, almost all of them were formed near 1.2185. And, since all but the fourth turned out to be false, traders could try to work out only the first two. After the sell signal, the price could not pass even 20 points in the right direction, so the short position was closed with a small loss. After the buy signal, it went up about 40 pips, but failed to reach the target level of 1.2259, so the trade most likely closed at Stop Loss at breakeven. The last signal to work out was a rebound from the Senkou Span B line, which took a 30 pips profit as GBP returned to 1.2185.

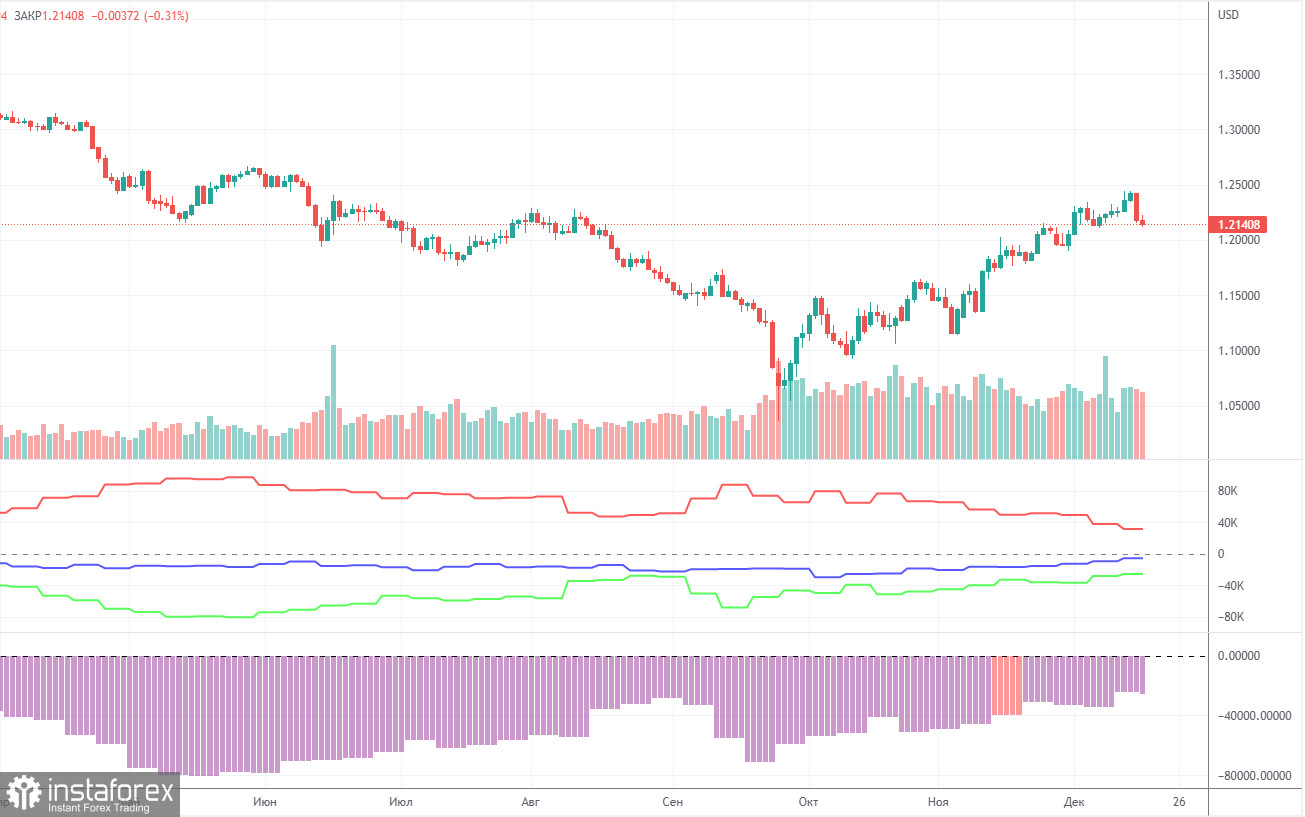

COT report

The latest COT report showed a decrease in bearish sentiment. During the given period, non-commercial traders opened 3,500 long positions and 1,000 short positions. The net position grew by about 2,500. This figure has been on the rise for several months. Nevertheless, sentiment remains bearish, and GBP/USD is on the rise for no reason. We assume that the pair may well resume the downtrend soon. Notably, both GBP/USD and EUR/USD now show practically identical movement. However, the net position on EUR/USD is positive and negative on GBP/USD. Non-commercial traders now hold 58,000 short positions and 32,000 long ones. The gap between them is still wide. As for the total number of open longs and shorts, the bulls have a 5,000 advantage here. Technical factors indicate that the pound may move in an uptrend in the long term. At the same time, fundamental and geopolitical factors signal that the currency is unlikely to strengthen significantly.

H1 chart of GBP/USD

On the one-hour chart, GBP/USD could not cross the Senkou Span B line at the first attempt. Therefore, the downtrend seems to persist, but paused for the time being. The pair can also go flat. If GBP manages to cross the Senkou Span B line, then we can count on a stronger downward movement, which I have been waiting for a long time. On Tuesday, the pair may trade at the following levels: 1.1874, 1.1974-1.2007, 1.2106, 1.2185, 1.2259, 1.2342, 1.2429-1.2458. The Senkou Span B (1.2120) and Kijun Sen (1.2282) lines may also generate signals. Pullbacks and breakouts through these lines may produce signals as well. A Stop Loss order should be set at the breakeven point after the price passes 20 pips in the right direction. Ichimoku indicator lines may move during the day, which should be taken into account when determining trading signals. In addition, the chart does illustrate support and resistance levels, which could be used to lock in profits. There are no important events planned for today, neither in the UK, nor in the US. The key point will be the Senkou Span B line.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.