A recession in the second half of 2022 was widely discussed. Overall, the entire year has proven to be very full of noteworthy events. Unfortunately, not all of them had the plus sign. The currency market, however, is unconcerned with the type of signal that one event or another had. We trade up if "plus" and down if "minus." Only the movement's direction is up for debate. The ongoing military conflict between Russia and Ukraine took up the majority of the first half of the year. Not because there aren't any battlefield events anymore, but rather because they no longer qualify as "shock" content, the media has recently stopped covering them all. Despite how absurd it may sound, the world is already accustomed to the military conflict in Ukraine, especially considering that it is not the first such conflict to occur since the Second World War. The dollar actively increased during the first half of the year against the backdrop of market anti-risk sentiment.

Demand for US currency increased as a result of the Fed's aggressive interest rate hikes. Together, these two elements gave the dollar strong support. However, by the end of the year, when it became apparent that the conflict in Ukraine was taking on the appearance of being a protracted one that could last for years, the European Union and the United States would not cave to Russia and would continue to support Ukraine, and that sanctions on both sides, despite hurting the economies of both, did not alter either side's position, the interest in the conflicts around the world started to wane a little. The market has already stopped retaliating violently when one of the parties makes a move on the battlefield or when missiles are fired at cities, military installations, storage facilities, or infrastructure.

No one is surprised anymore by the recession. The USA, the UK, and the European Union are the most likely locations. The only remaining query is how durable and strong. Despite this, the market is no longer concerned about it now that the issue has already been thoroughly explored. Additionally, economic growth is no longer interesting because it is obvious that all economies will experience a slowdown. Only inflation is still up for debate. Since inflation is declining quickly and, more importantly, steadily, the United States is in a leading position in this area. However, this is also detrimental to the dollar because the Fed is finding it harder and harder to justify raising interest rates. As a result, demand for the euro and the pound may remain high over the next three to six months because the ECB and the Bank of England will need to raise their interest rates faster than the Fed. This presumption, however, does not eliminate the requirement to first construct a corrective set of waves and only then to construct a new upward section of the trend. I currently view this scenario as the primary one.

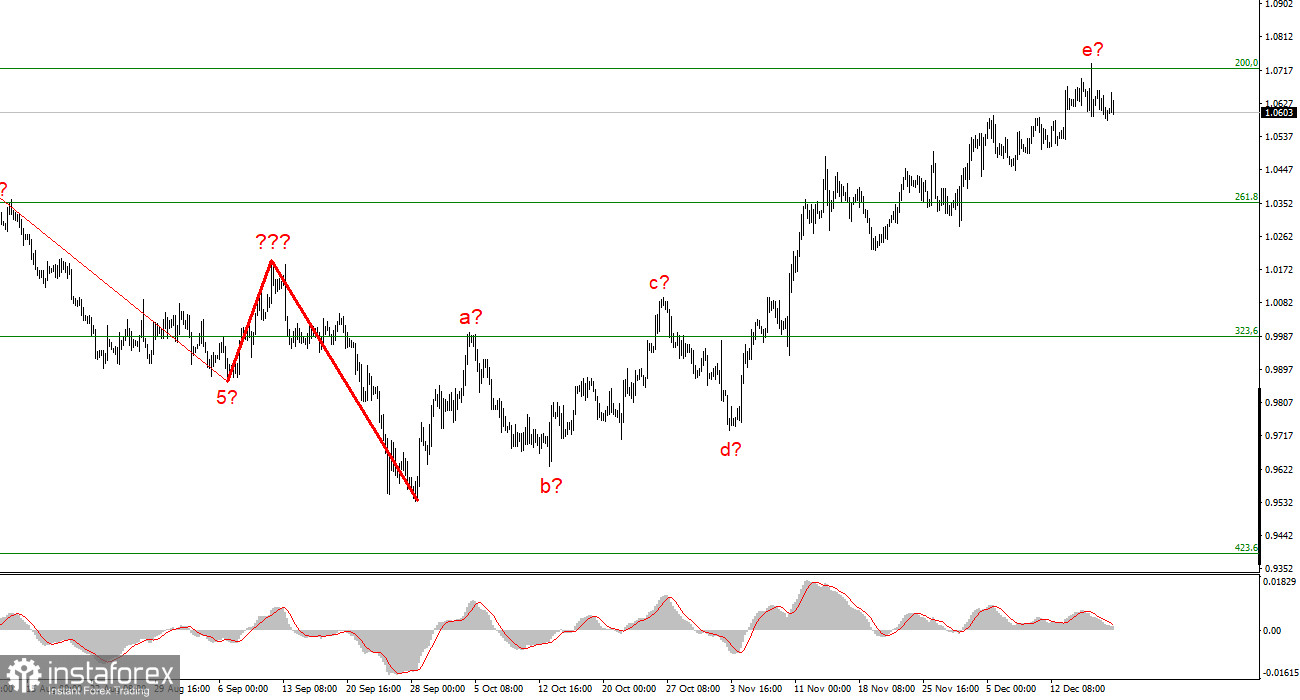

I conclude from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. Although there is a strong likelihood that the upward portion of the trend will become even more extended and complicated, there is currently a signal to turn lower.

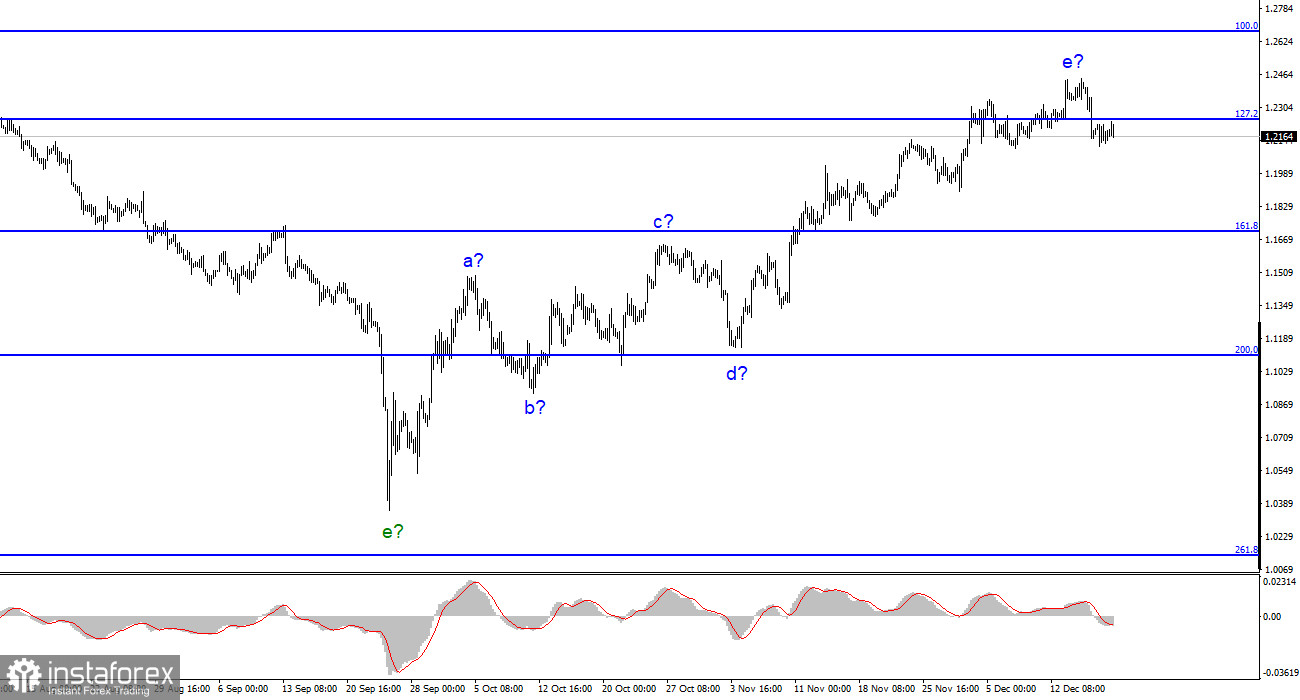

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. Since the wave marking permits the current construction of a downward trend section, I am unable to advise purchasing the instrument. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. Wave e is likely finished, though it could take on an even longer form.