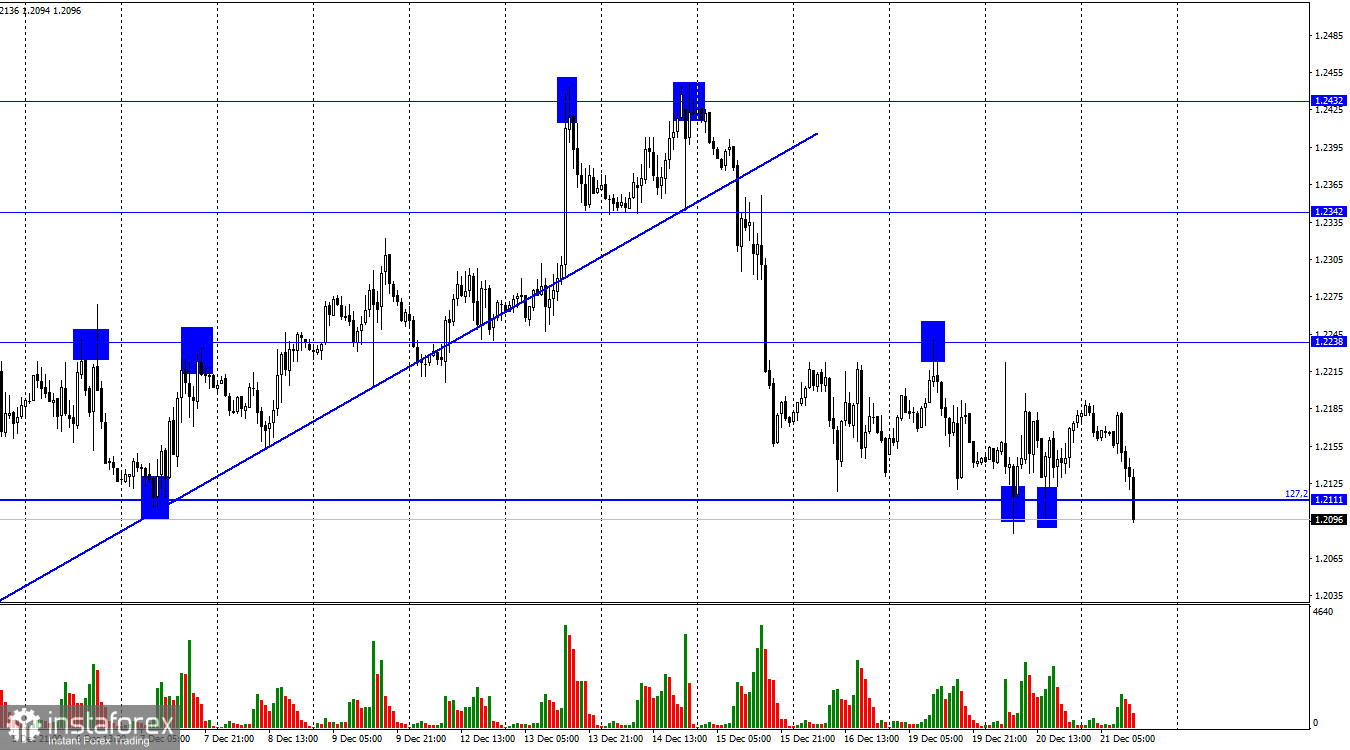

On Tuesday, GBP/USD dropped twice to the Fibonacci retracement level of 127.2% at 1.2111 on the H1 chart and rebounded from there. Although a rebound is considered a buy signal, the pound has been recently trapped between the levels of 1.2111 and 1.2238. Today, the pound bounced off the 1.2111 level for the third time, allowing the price to move up by 80-90 pips. This is an approximate profit traders could gain if they go long on the pair.

The information background was absent both in the UK and the US. Unlike the euro, the pound is not trading flat but its movements are too weak to be called a trend. On Thursday, the UK will publish its GDP report for the third quarter. This might be the only release that can potentially move the market. Other publications will most likely have no impact on traders' sentiment. For instance, the data on US initial jobless claims and personal income and spending may be downplayed by market participants.

There is one more report on US GDP for the third quarter. Yet, in economic calendars, it is not marked as important. This is because traders usually take into account only the first estimates of the GDP report. The estimates that follow later do not differ much from the first one. Amid a thin market, we may see some reaction to this data. However, the pair is likely to be moving within the horizontal channel rather than developing a trend. Therefore, the sterling may fluctuate without any clear direction until the end of the year.

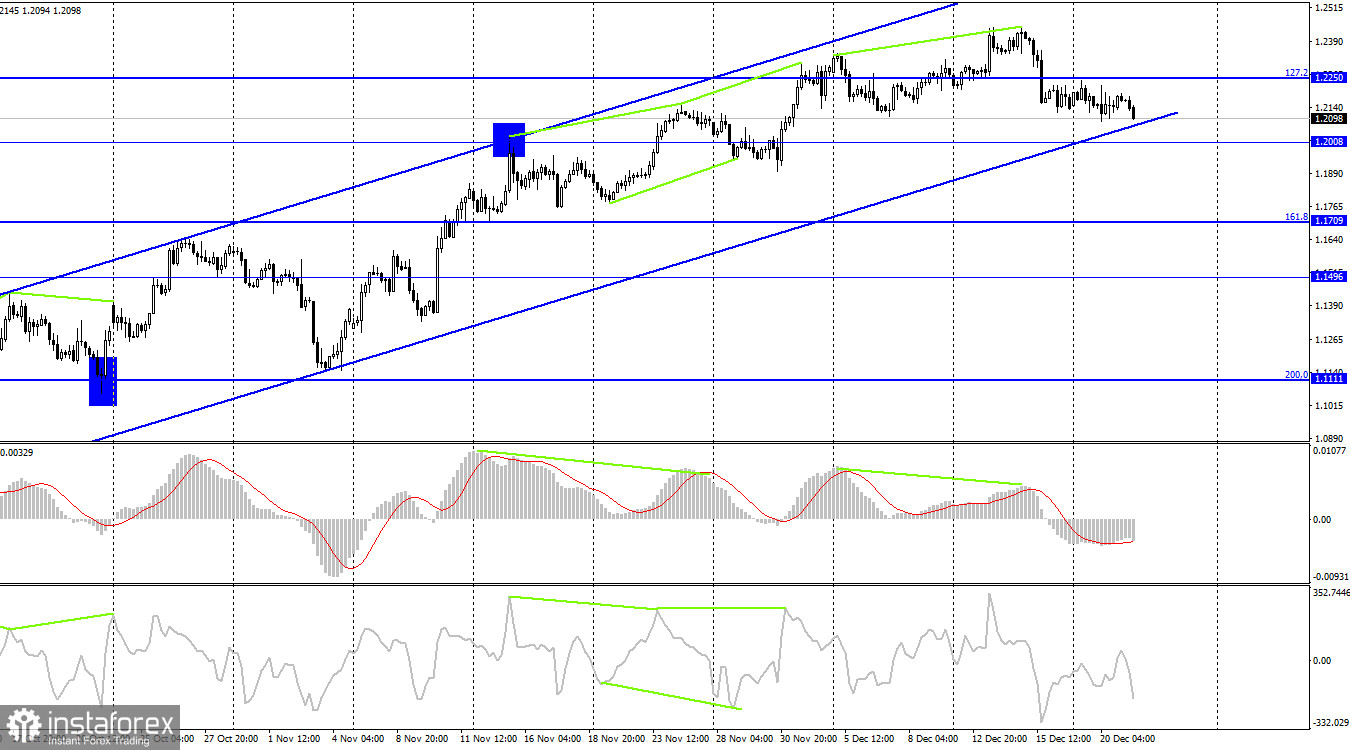

On the 4-hour chart, the pair has extended its decline toward the lower boundary of the channel after the MACD indicator formed a bearish divergence. Consolidation below this line will most likely push the pound down to the Fibonacci retracement level of 161.8% at 1.1709. A rebound will allow the price to rise toward the retracement level of 100.0% at 1.2674. But actually, the pair may stay flat for the rest of the week.

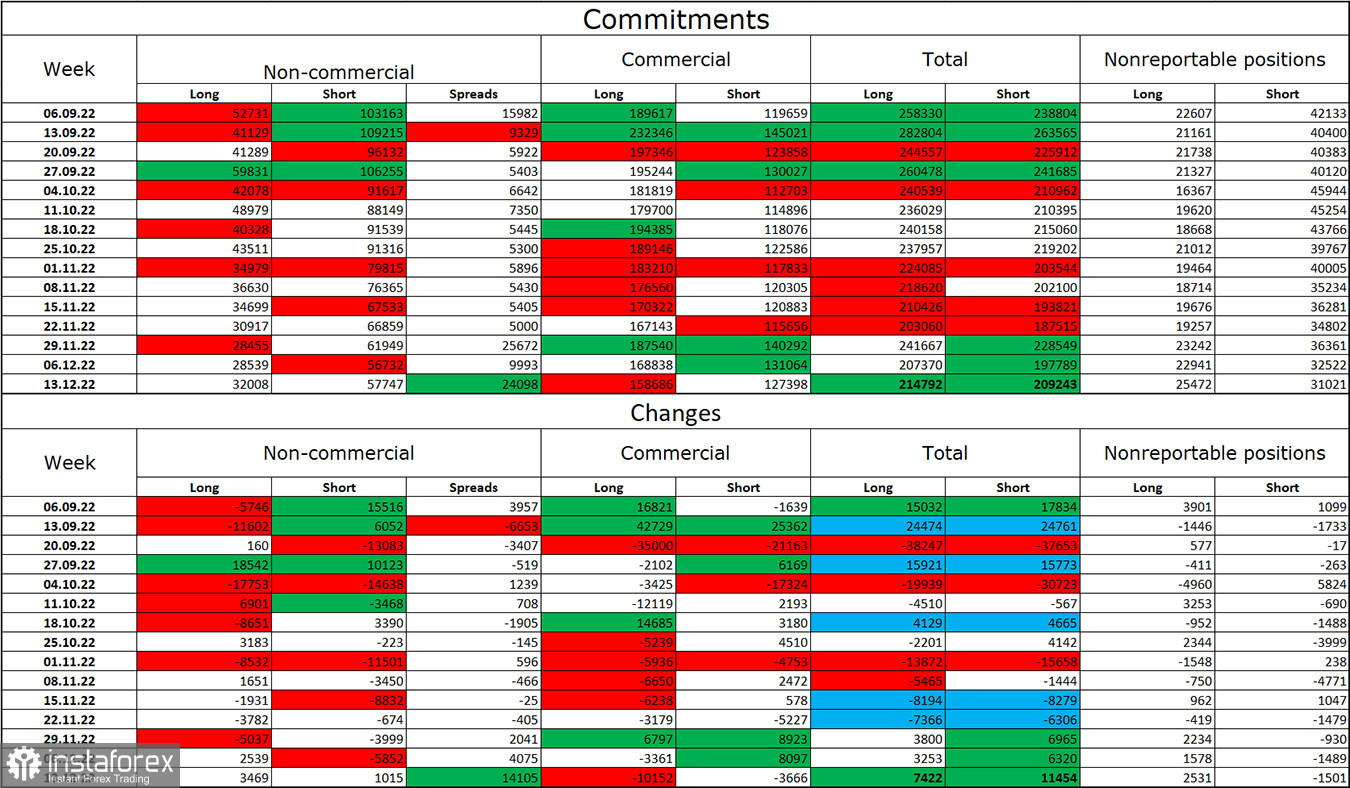

Commitments of Traders (COT) report

Last week, the non-commercial group of traders became less bearish on the pair than a week ago. The number of long contracts rose by 3,469 while short contracts increased by 1,015. Overall, large market players maintain a bearish outlook for the pair as short contracts still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound although their sentiment has been slowly shifting toward bullish in recent months. Yet, this process is taking too long to develop. It has been going on for several months already. Still, the number of short positions is twice as high as the long ones. Based on the chart analysis, we can assume that the pound may continue to rise. For instance, the trend channel on the 4-hour chart confirms this scenario. However, the pound is not so strong from the fundamental point of view. Besides, the US dollar also has its drivers. Nevertheless, we can observe a long-awaited uptrend.

Economic calendar for US and UK:

On Wednesday, no important events are expected either in the US or the UK. The same will be true for the rest of the week. Therefore, the influence of the information background on the market will be zero today.

GBP/USD forecast and trading tips:

I recommend selling the pound with the targets at 1.2007 and 1.1883 if the price settles below 1.2111 on the 1-hour chart or below the trend channel on the 4-hour chart. You can buy the pound after a rebound from 1.2111 with the target at 1.2238 but keep in mind that in that the quote may move by just 80 pips.