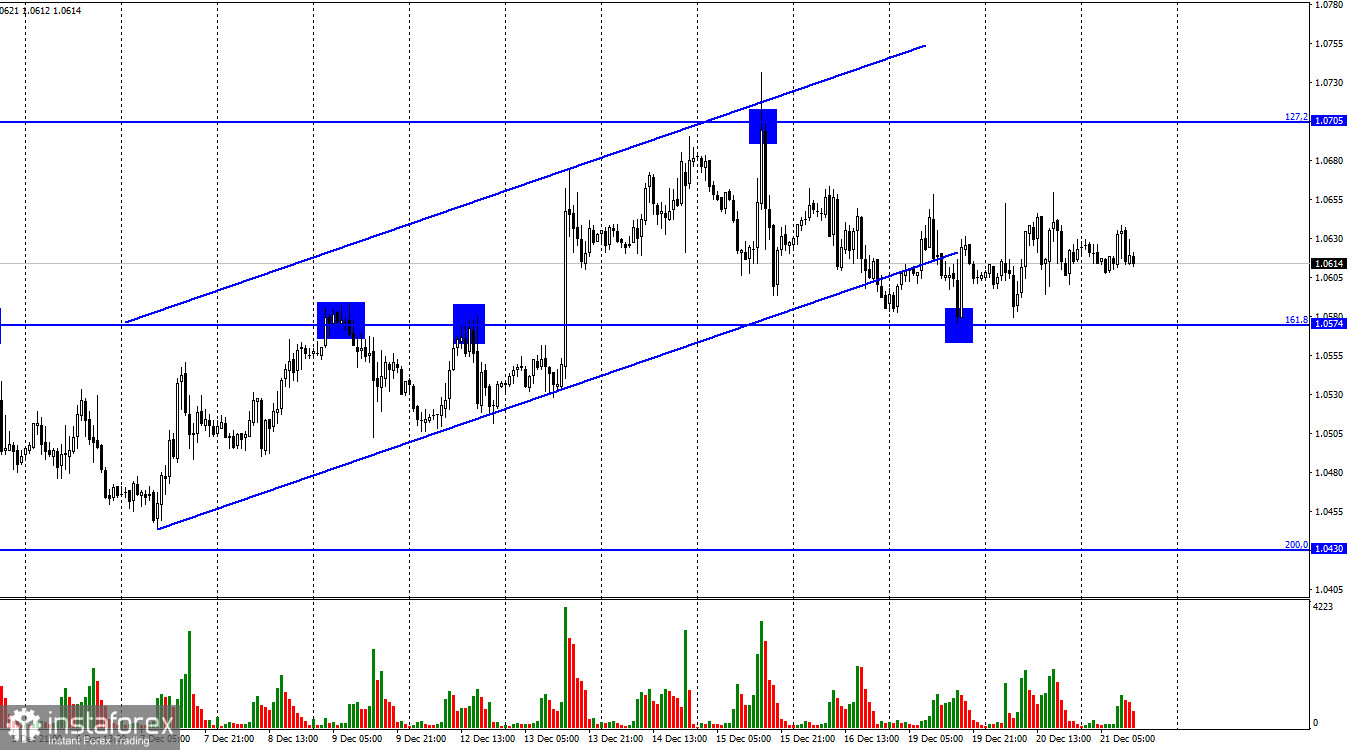

Hi, dear traders! On Tuesday, EUR/USD approached the retracement level of 161.8% at 1.0574, but did not rebound this time. Traders did not receive a buy signal, which could have brought them 50-60 pips of profit, and the horizontal momentum continued. There is hardly any information to analyze at this point. Now, traders can only recall the events of last week or speculate about what will happen next year, as new data releases are required to make a detailed outlook. Market players should wait for the sideways trend to end alongside the year 2022. Only then new conclusions can be made based on new information. So far, the market is clearly unwilling to make any sharp moves in the final weeks of the year.

The year 2023 may begin with the euro and the pound sterling dropping strongly against the US dollar, as these currencies performed well in the last quarter of 2022. Usually, such periods of rapid growth end with a correction, and it is unlikely that the pair will continue to rise after a few weeks of trading flat. This is mere speculation as bulls continue to dominate the market and nothing is stopping them from continuing to push EUR/USD upwards in January. However, the last meetings of the ECB and the Fed suggest that the European currency will not have as much support from traders as it has had over the last three months. This is because the European regulator has also started to slow down the pace of interest rate hikes.

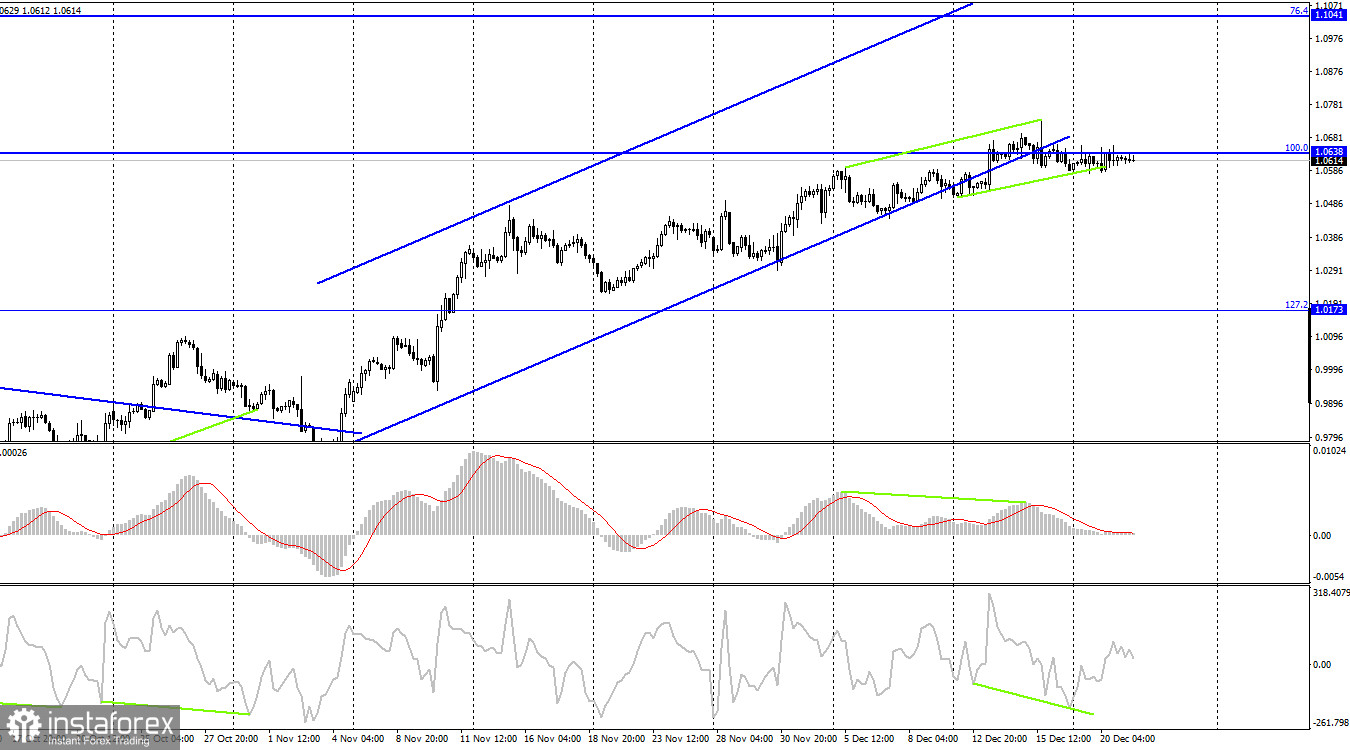

According to the H4 chart, the pair reversed downwards after it formed a bearish MACD divergence and consolidated under the 100.0% Fibo level. This suggests that the pair may continue to decline. Furthermore, it also closed below the ascending corridor. Over the past few days a bullish divergence in the CCI indicator has been emerging. It could bring the bulls back to the market, but for now, the pair prefers to move sideways.

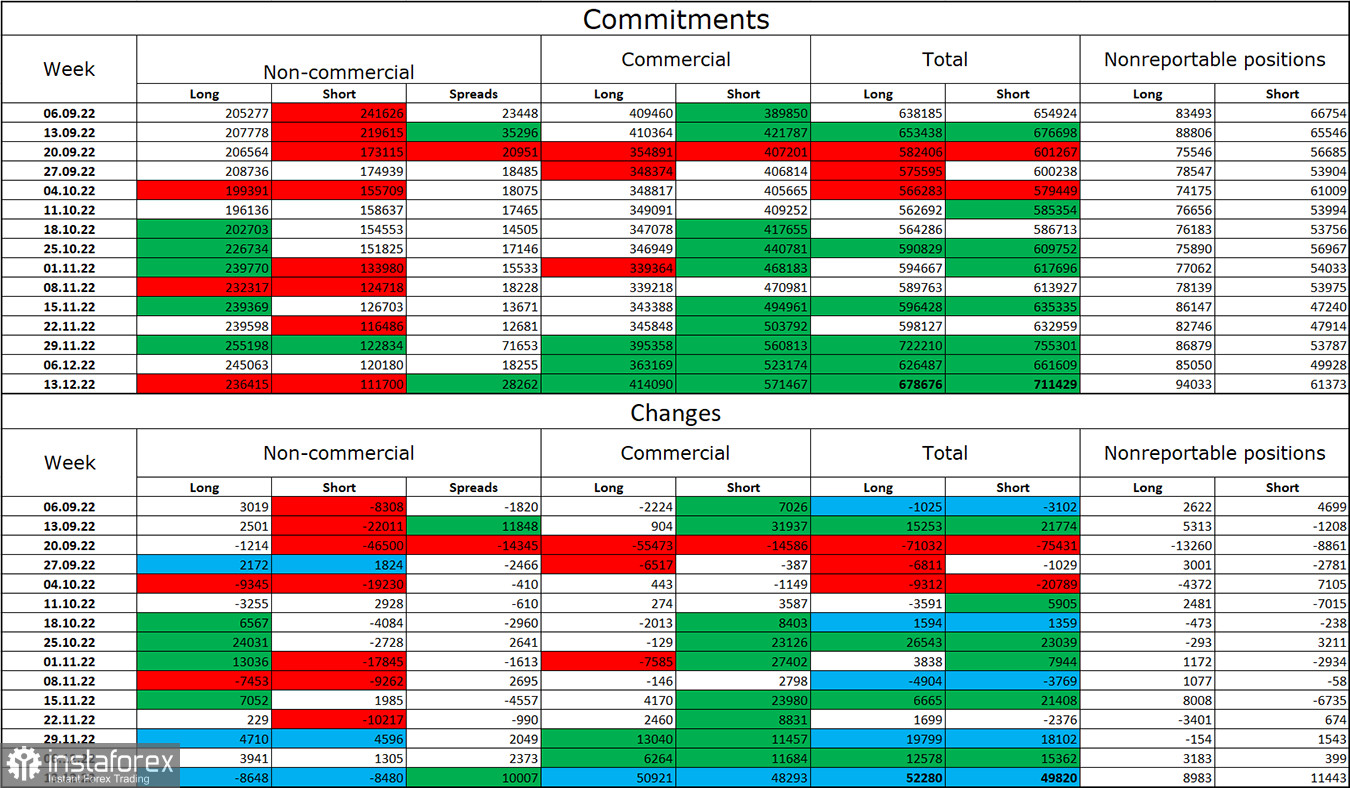

Commitments of Traders (COT) report:

Last week, traders closed an almost equal number of positions – 8,648 Long positions and 8,480 Short ones. The mood of major traders remains bullish, and it did not change during the last week covered by the report. The number of open Long positions now stands at 236,000 versus 111,000 Short positions. The euro is currently on the rise, which is in line with the COT reports, but at the same time the number of Long positions is already two times higher than the number of Short positions. In the last few weeks EUR has been growing steadily, but now this begs the question if EUR has grown too much. After a long losing streak, the euro's situation continues to improve, so its outlook remains positive. However, if it moves out of the ascending corridor on the H4 chart, the positions of bears might get stronger in the short term.

US and EU economic calendar:

There are no important events on the economic calendar today that could influence traders.

Outlook for EUR/USD:

Traders are recommended to sell the pair if it consolidates below 1.0574 on the H1 chart with 1.0430 being the target. New long positions can be opened if EUR/USD bounces off 1.0574 on the H1 chart targeting 1.0430. However, it may likely rise by only 60-70 pips.