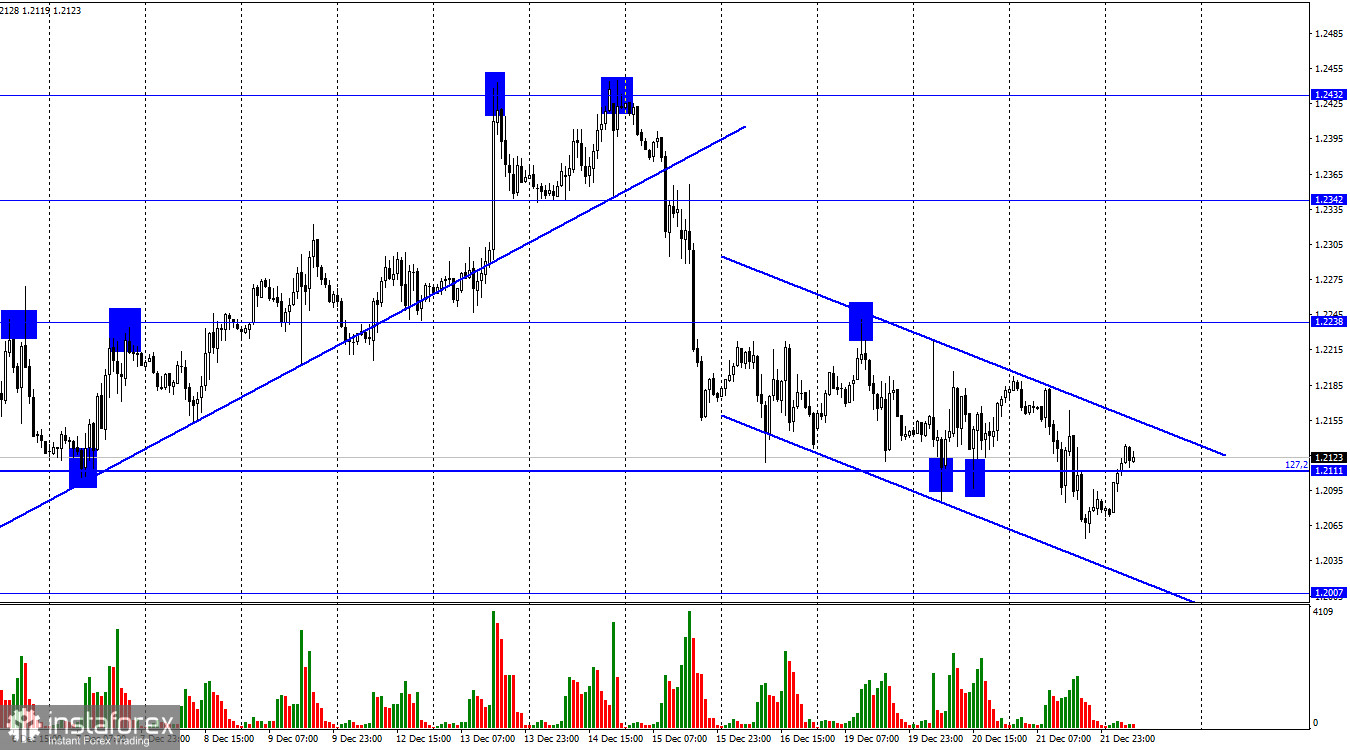

Hello, dear traders! On the 1-hour chart of GBP/USD, a bearish reversal occurred on Wednesday, and the quote settled below the 127.2% retracement level of 1.2111. However, by the end of the day, already a bullish reversal took place, and the pair consolidated above 1.2111. The quote is now trading in a descending corridor, reflecting a bearish bias. There is a high likelihood of a fall to 1.2007 if the price fails to close above the corridor.

The greenback may strengthen today, following the release of upbeat data on US GDP and pessimistic UK GDP results. All in all, the pair is now moving in a descending corridor. In fact, it was bearish in the first three days of this trading week despite the fact that there were no fundamental factors to affect their value.

According to Scotiabank economists, right now is the perfect time for a bearish correction. The pound is now driven by fundamental factors, which may allow it to grow in the future. Therefore, by the end of 2022, signals coming from charts will be more important than the monetary policy of world central banks. The pair's further movement will be determined already after a correction. That is, already next year.

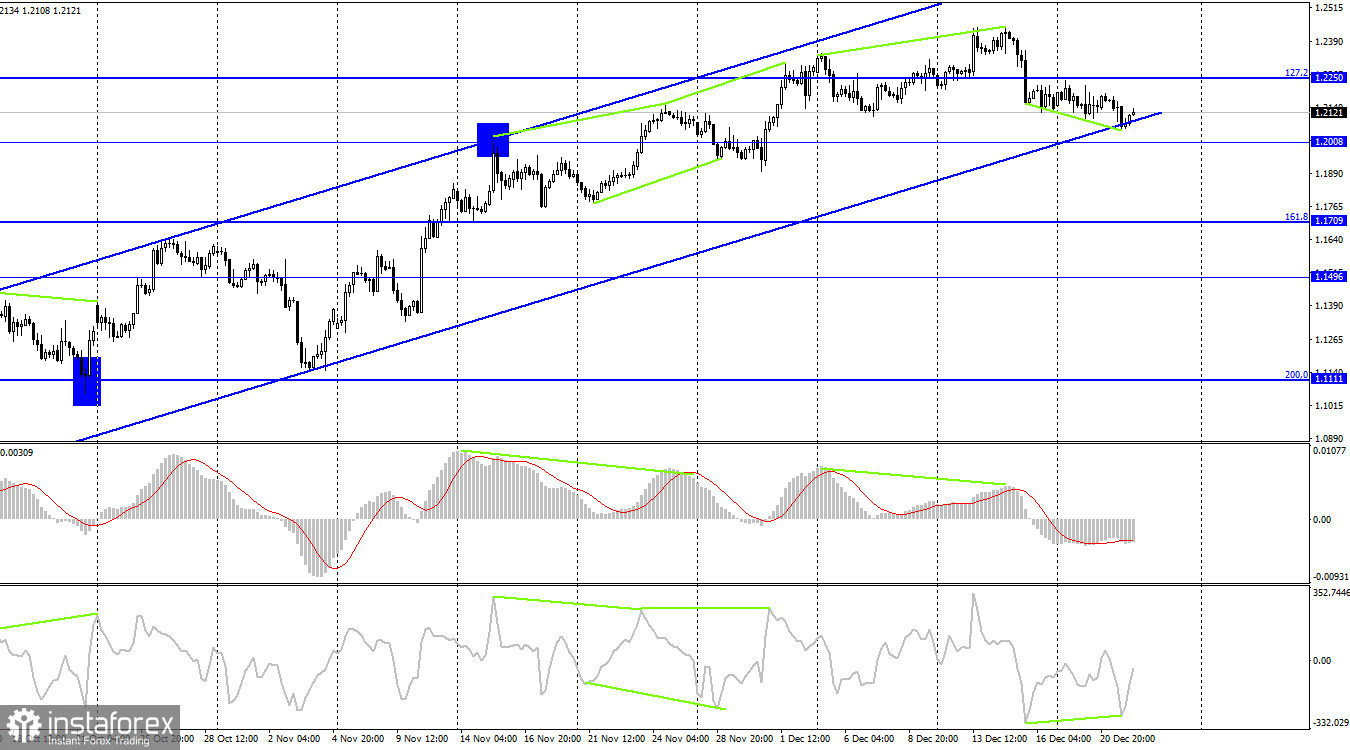

On the 4-hour chart, the quote fell to the lower limit of the corridor after the formation of a MACD divergence. In case of consolidation below the limit, the price is likely to head to the 161.8% retracement level of 1.1709. A rebound from it will allow traders to push the price to the 161.8% retracement level of 1.2674.

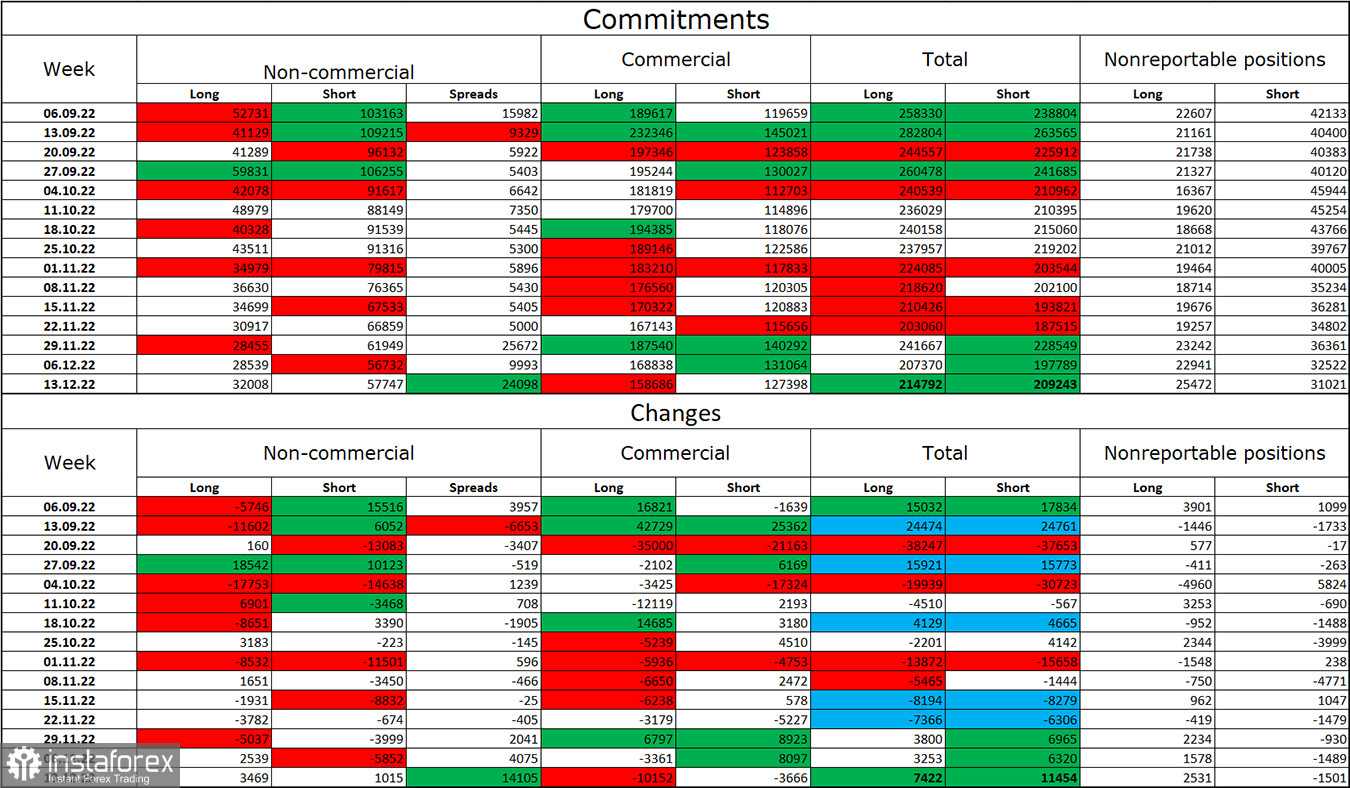

Commitments of Traders:

The bearish sentiment of non-commercial traders decreased last week. Speculators opened 3,469 new long positions and 1,015 short positions. Overall, sentiment is still bearish with a wide gap between shorts and longs. Traders continue selling the pair although bullish sentiment has started to grow in recent months. Nevertheless, it is a long and slow process. It has lasted for several months now, but the number of shorts still twice exceeds that of longs. Graphic analysis of the 4-hour chart shows that the pound may continue strengthening against the dollar. Still, there are factors that may boost the greenback. Anyway, we now see the long-awaited growth.

Macroeconomic calendar:

United Kingdom – Q3 GDP (07-00 UTC).

United States – Q3 GDP (13-30 UTC); Initial Jobless Claims (13-30 UTC).

On Thursday, fundamental factors will have little influence on market sentiment.

Outlook for GBP/USD:

It will become possible to open short positions if the pair settles below 1.2111 on the 1-hour chart or below the corridor on the 4-hour chart. The targets are seen at 1.2007 and 1.1883. Meanwhile, if the pair closes above the corridor on the 1-hour chart, it will become possible to go long with targets at 1.2238 and 1.2432.