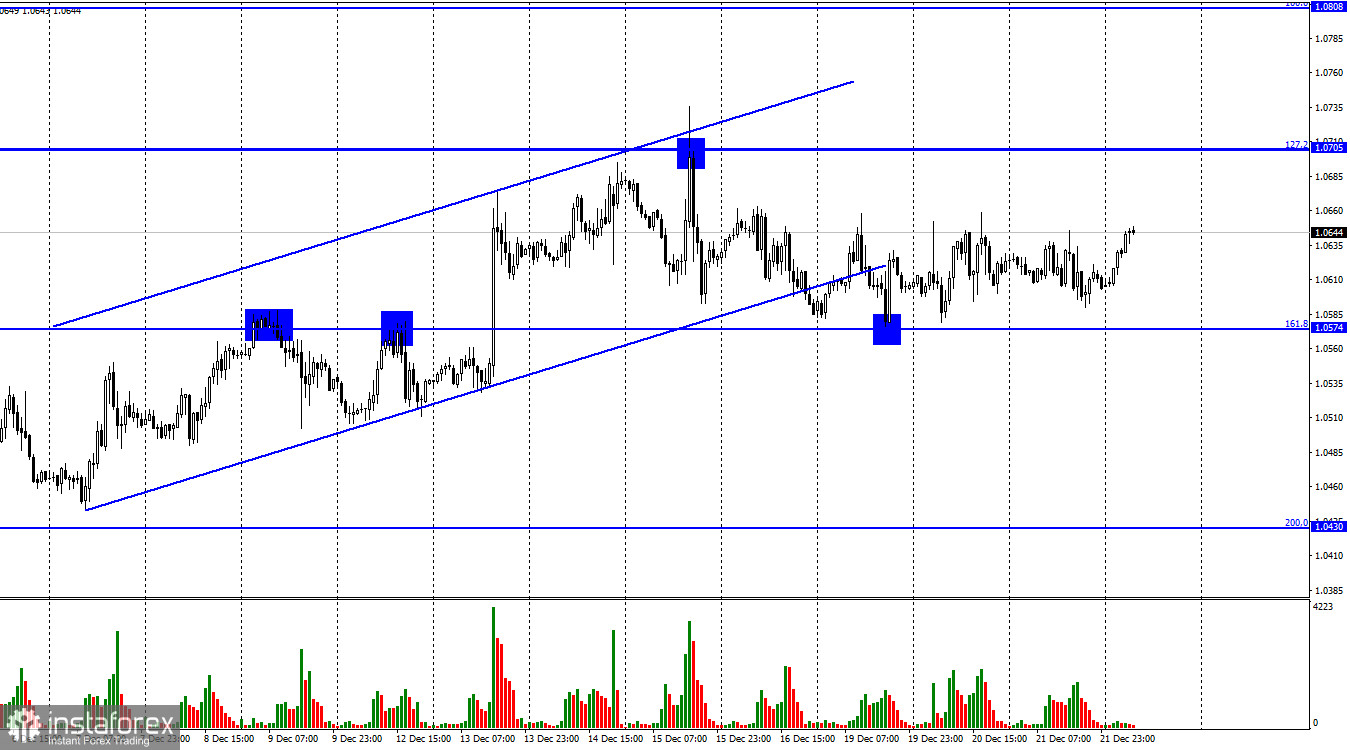

Hi, dear traders! On the 1-hour chart of EUR/USD, a bearish reversal occurred on Wednesday, and the quote headed to the 161.8% retracement level of 1.0574. The bears failed to break through the mark. Moreover, no pullback followed or a buy signal was made. The pair keeps trading horizontally. No signals are now coming. Therefore, it is wiser to wait for signals or the resumption of the trend in order to trade the instrument.

On Thursday, the US will see the release of GDP results for the third quarter. Although traders are awaiting the report, it is unlikely to somehow affect the market as figures are likely to come in line with preliminary estimates. Still, the greenback may rise slightly.

The pair also settled below the ascending corridor. So, a downtrend continuation is likely. In fact, Scotiabank analysts are on the same page. They predict risks for EUR to mount in the coming weeks. "We continue to think the EUR has reached a short-term peak and may consolidate somewhat in the next few weeks. The likelihood of more ECB tightening steps in early 2023 suggests the EUR will remain supported on dips, however," they said. "More range trading looks likely in the near term. Spot is more or less mid-way between support at 1.0575/80 and resistance at 1.0655/60."

Therefore, the pair may close below 1.0574 when the sideways movement ends. The price may then drop to 1.0430. EUR/USD may go even deeper, but the ECB's moves will unlikely allow it to get back to parity with the dollar.

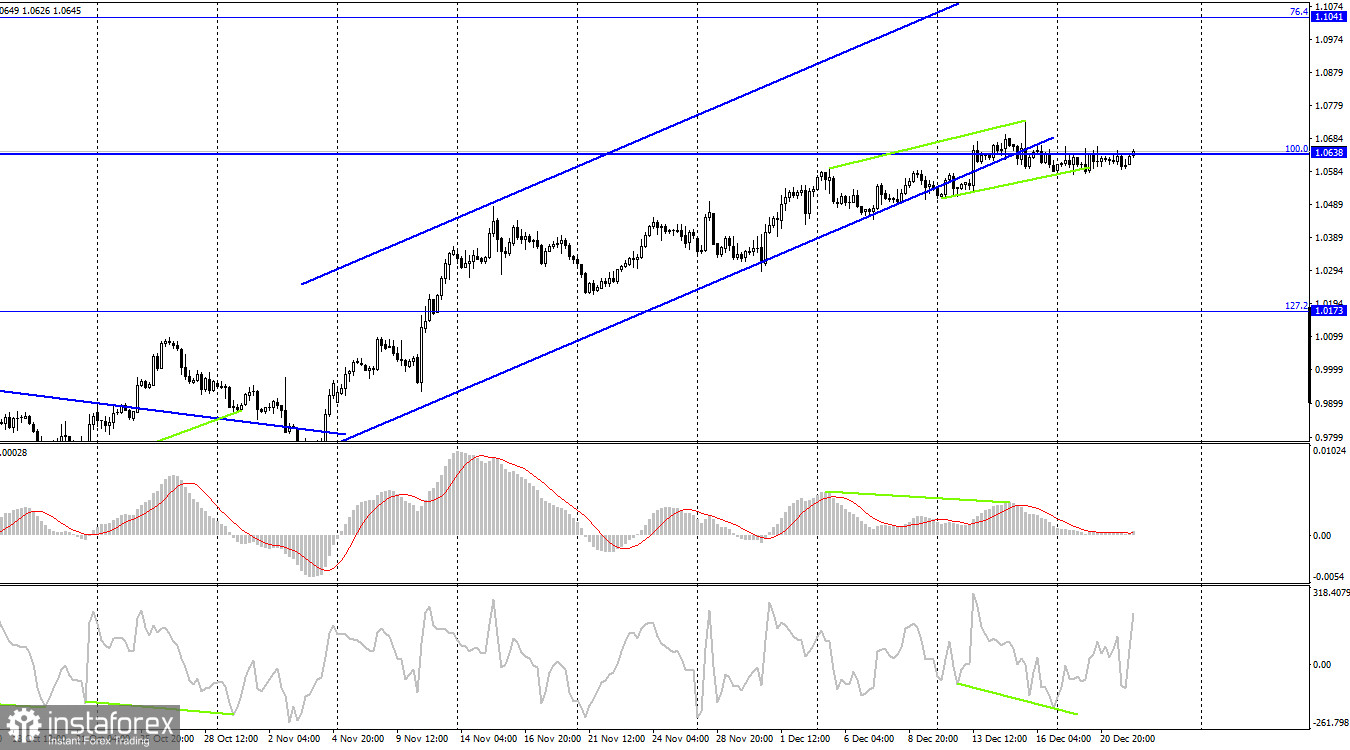

On the H4 chart, a bearish reversal occurred after a bearish MACD divergence and consolidation below the 100.0% Fibo level. This suggests that the downtrend may continue. In addition, the pair closed below the ascending corridor. Over the past few days, a bullish CCI divergence has been emerging. It could bring the bulls back to the market. For now, the pair keeps trading horizontally.

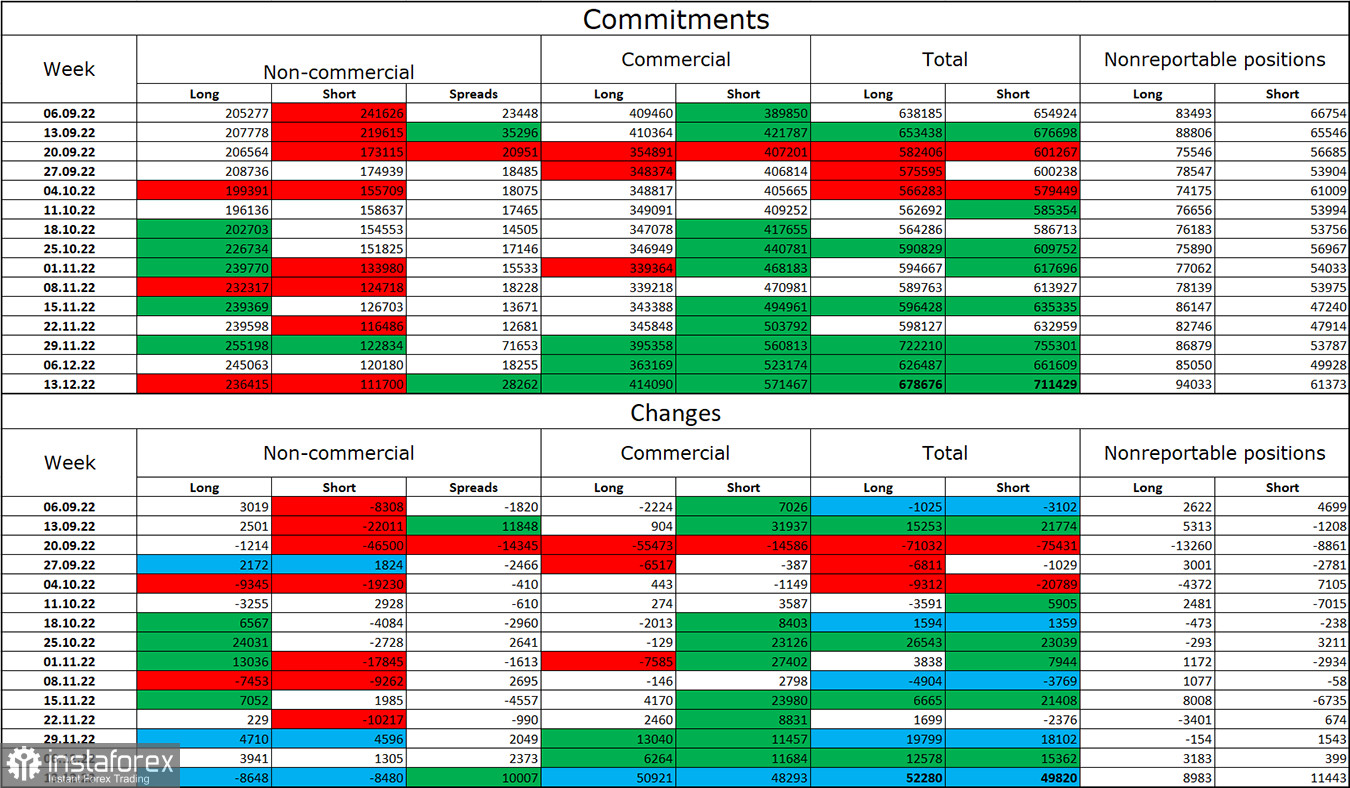

Commitments of Traders:

Last week, speculators closed 8,648 long positions and 8,480 short positions, that is, an almost equal number. The sentiment of major players remains bullish and has not changed since last week. Speculators now hold 236,000 long positions and 111,000 short positions. EUR/USD is currently bullish, in line with the COT reports. At the same time, the number of longs twice exceeds the number of shorts. The euro has been growing steadily lately. It now remains to be seen whether it has increased too much. After a prolonged bear run, the situation is getting better, so the outlook for EUR/USD remains positive. However, if the pair leaves the ascending corridor on the H4 chart, bearish sentiment may get more robust in the short term.

Macroeconomic calendar:

United States – Q3 GDP (13-30 UTC); Initial Jobless Claims (13-30 UTC).

On Thursday, fundamental factors will have little influence on market sentiment.

Outlook for EUR/USD:

It will become possible to sell the pair after consolidates below 1.0574 on the H1 chart. The target is seen at 1.0430. Long positions could be opened if EUR/USD pulls back from 1.0574 on the H1 chart, targeting 1.0430. All in all, the price is likely to rise by 60-70 pips.