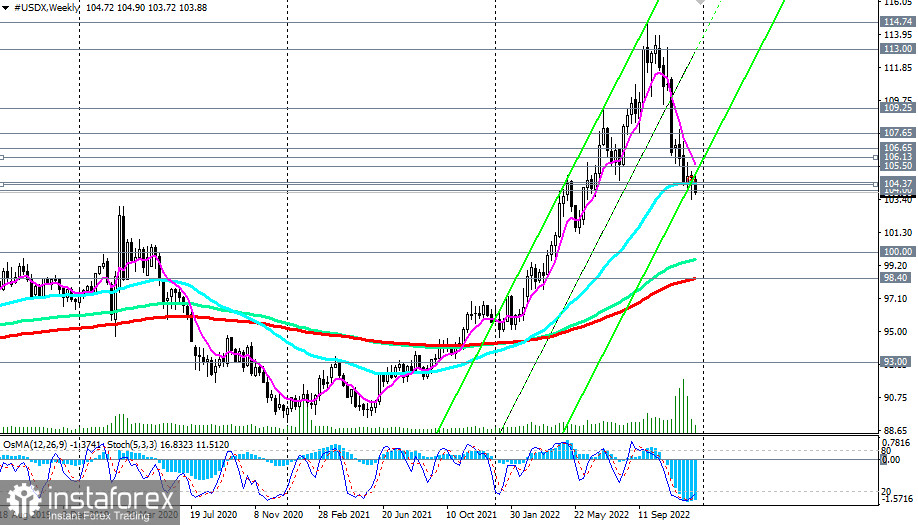

The dollar and its DXY index (CFD #USDX in the MT4 trading terminal) has been under pressure since October. Market participants are preparing for a further slowdown in the Fed's monetary policy tightening. Many economists are already predicting that the Fed will cut the size of the rate hike again in early 2023, moving to 0.25% hikes in February and March. And this is a harbinger of a deeper drop in DXY.

From a technical point of view, the breakdown of the recent local low near 103.50 will confirm our assumption and the main scenario. In this case, the price may move towards 100.00, the "round" and psychologically significant support level. The breakdown of the 98.40 support level (200 EMA on the weekly chart) significantly increases the risk of breaking the bullish trend. The breakdown of the long-term support level 93.00 (200 EMA on the monthly chart) will finally break the DXY bullish trend.

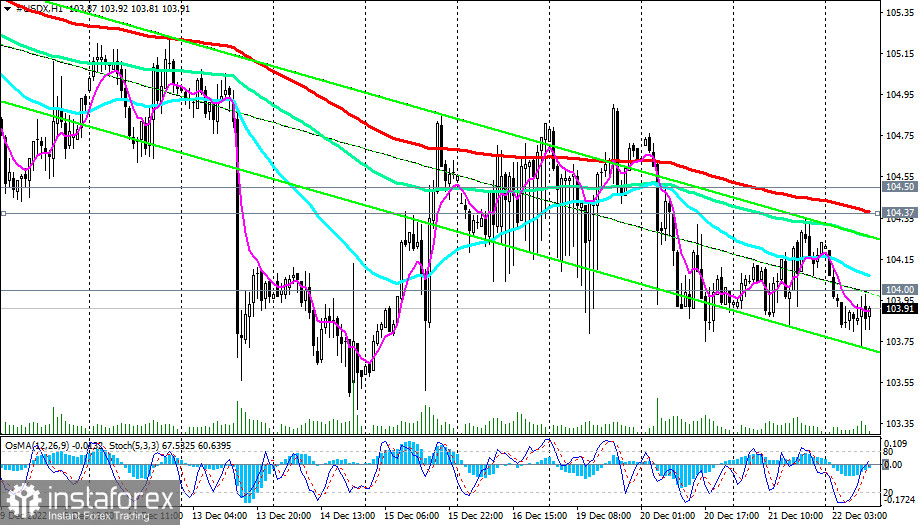

In the alternative scenario, DXY will resume growth, returning to the bull market zone above the 105.50 resistance level (200 EMA on the daily chart). The first signals for the implementation of this scenario will be the breakdown of the resistance levels 104.37 (200 EMA on the 1-hour chart), 104.50 (50 EMA on the weekly chart).

The breakdown of resistance levels 106.13 (200 EMA on the 4-hour chart), 106.65 (144 EMA on the daily chart) will confirm this scenario.

In the meantime, even below the resistance levels 104.50 and 105.50, short positions remain preferable.

Support levels: 104.00, 103.52, 103.00, 102.00, 101.00, 100.00, 99.00, 98.40

Resistance levels: 104.37, 104.50, 105.50, 106.13, 106.65, 107.65

Trading Tips

Dollar Index CFD #USDX: Sell Stop 103.60. Stop Loss 104.60. Take-Profit 103.50, 103.00, 102.00, 101.00, 100.00, 99.00, 98.40

Buy Stop 104.60. Stop-Loss 103.60. Take-Profit 105.00, 105.50, 106.13, 106.65, 107.65