We have the chance to reflect on the previous year and attempt to look ahead while the market is dozing off. Despite many shocks, 2022 was a fairly straightforward year for the markets. Central banks increased interest rates as inflation accelerated. As a result, US stock indices ended the year with their worst performance in a decade, but investors had hoped for better after 2022. The Fed and other regulators will make every effort to ensure a soft landing for the global economy even if it is on the verge of going into recession. Let's see if it functions.

A decline in inflation in 2023 is the main hope of the financial markets. Central banks are starting to tone down their previously "hawkish" remarks, though not everyone is convinced of this. The upcoming meetings of the ECB and Federal Reserve will be highly anticipated. They can choose to delay monetary restrictions, take a break from them, or even reverse the "dovish" rule. The data will determine everything. Consumer price growth will no longer be the primary newsmaker on the forex market if it truly slows down. The labor market will handle this task.

The Fed and other regulators currently believe that the main issues are historically high wage growth and the constant rise in service prices. The latter's slowdown is a sure sign that the cycles of tightening monetary policy are about to come to an end.

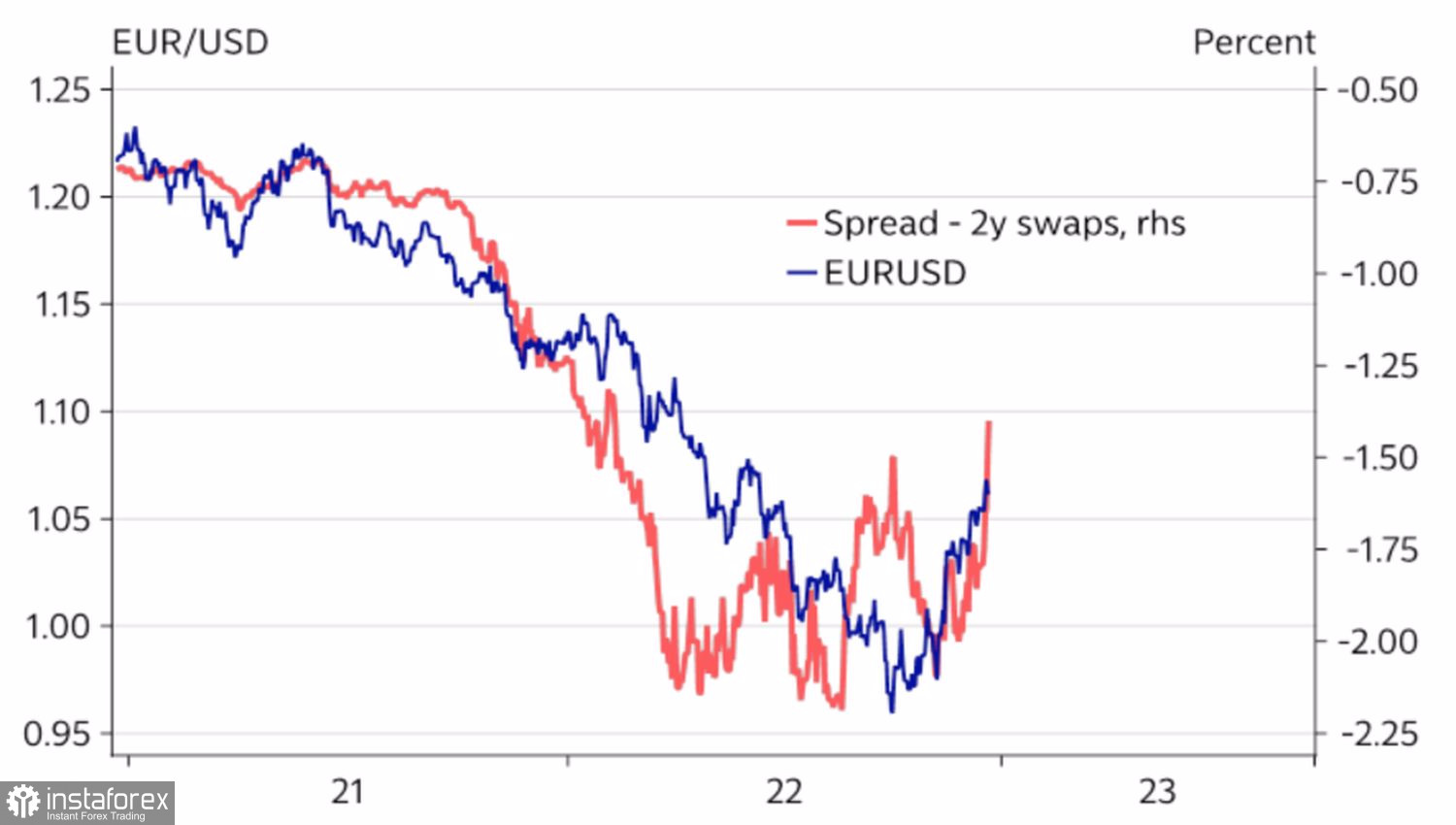

In any case, investors should pay close attention to macroeconomic statistics and market indicators because central banks, including the Federal Reserve, will continue to control the Forex market. The future direction of the EURUSD can be inferred from changes in the yield spreads between American and German bonds and interest rate swap differentials. According to the most recent indicator, the euro appears to be undervalued so far.

Dynamics of the EUR/USD and interest rate swaps

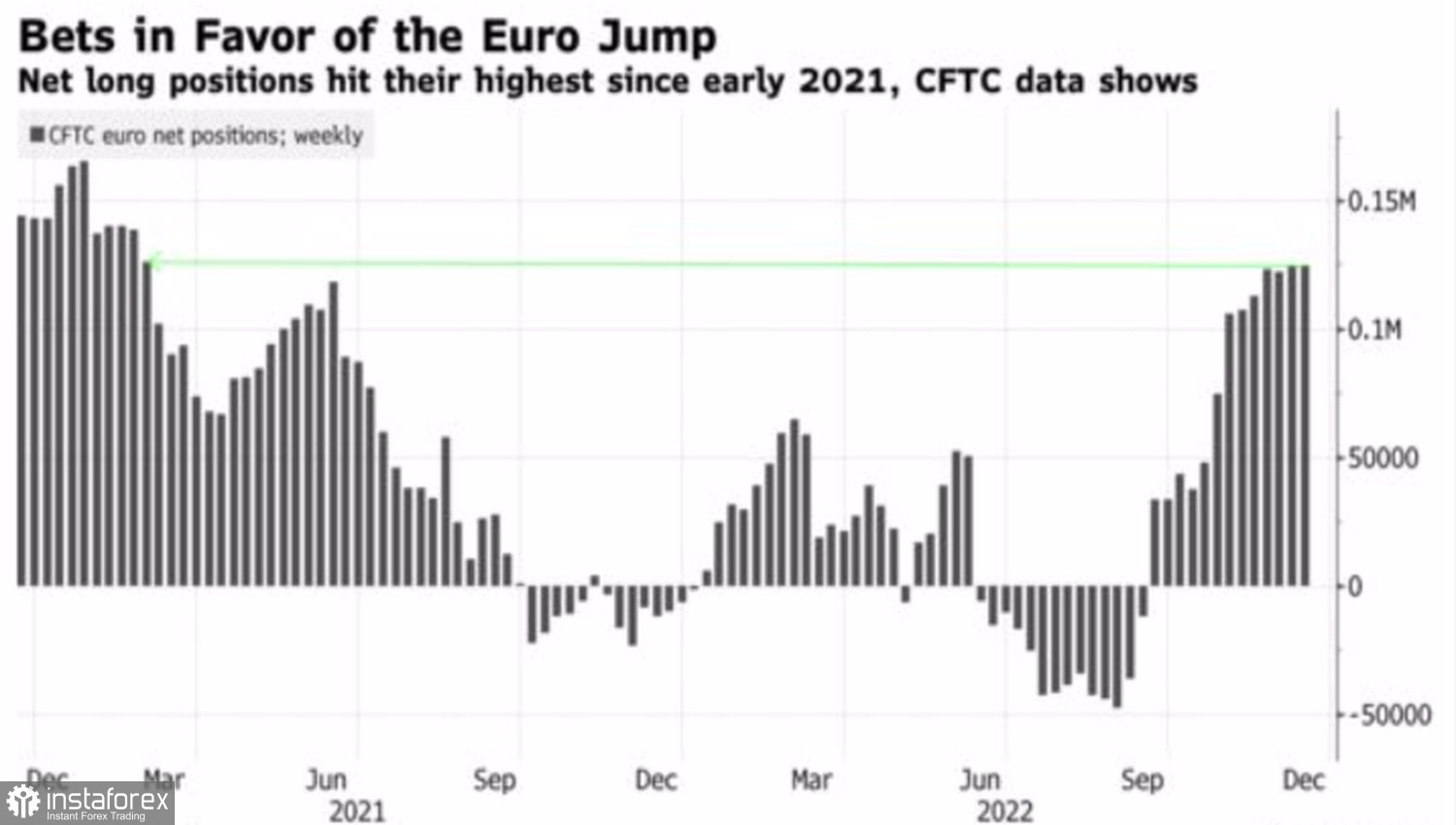

On the other hand, excessive zeal on the part of speculators actively accumulating long positions in the regional currency raises the danger of a sharp decline in the value of the main currency pair if long positions collapse in an avalanche-like fashion amid profit-taking.

Speculative position changes on the euro

Positioning analysis demonstrates that falling will be easier for EURUSD than rising. The euro requires a new force to maintain its upward trend against the US dollar. There may be a Christmas rally on the US stock market, but there haven't been any indications of it during the daytime with fire up to this point. Although it has gained 1.5% on average since 1950 by the end of the final month of the year, the S&P 500 has dropped by 5% since the start of December. Let's see, maybe the stock index "bulls" are reserving their power for a decisive breakthrough.

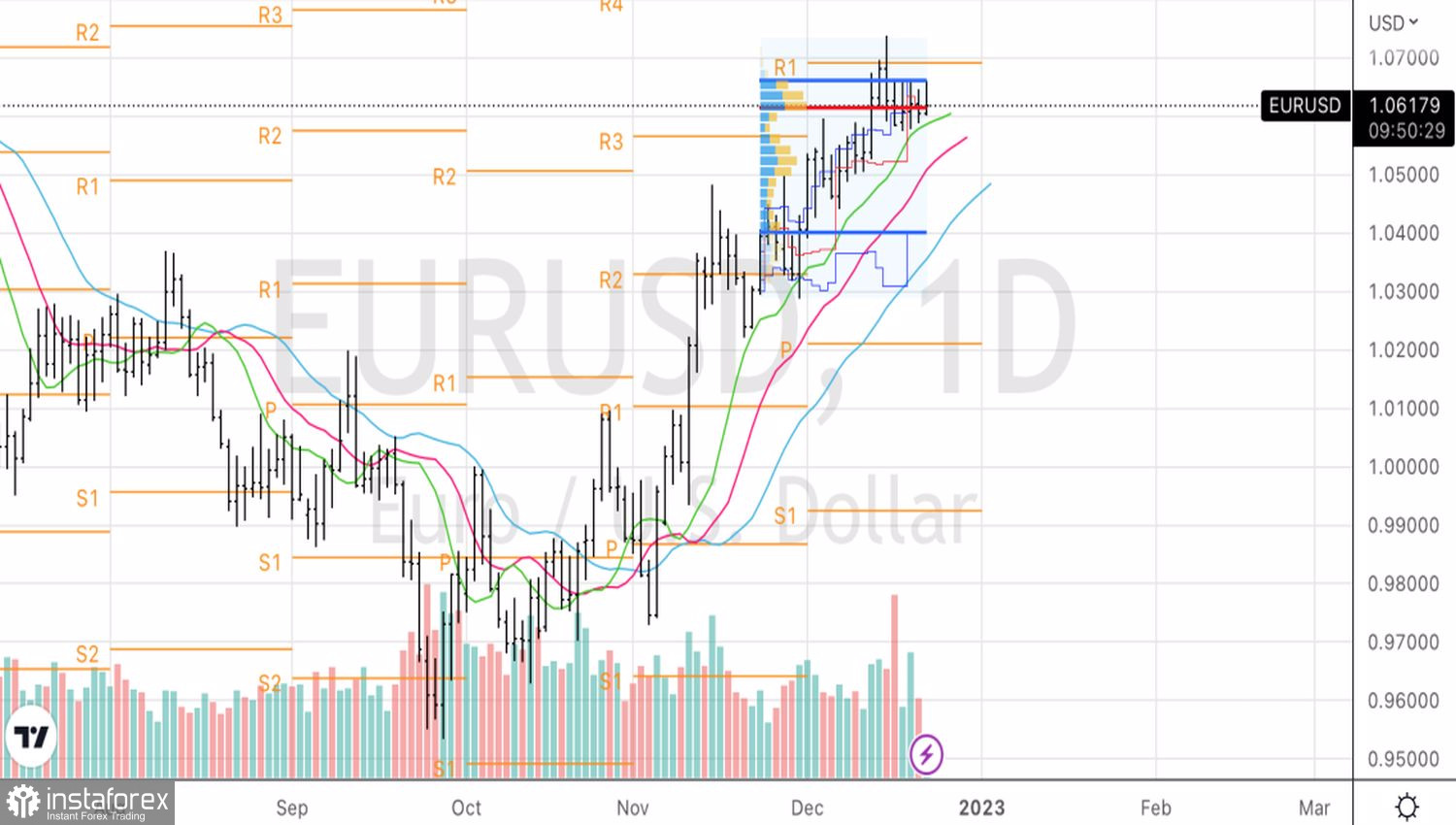

Technically, the short-term consolidation in the range of 1.0575-1.0665 is still ongoing on the daily EURUSD chart. The risks of continuing the northern campaign will increase with an exit from the trading range, or it may, on the other hand, lay the groundwork for a correction. Setting pending orders to buy the euro at $1.0665 and sell it at $1.0575 makes sense in this context.