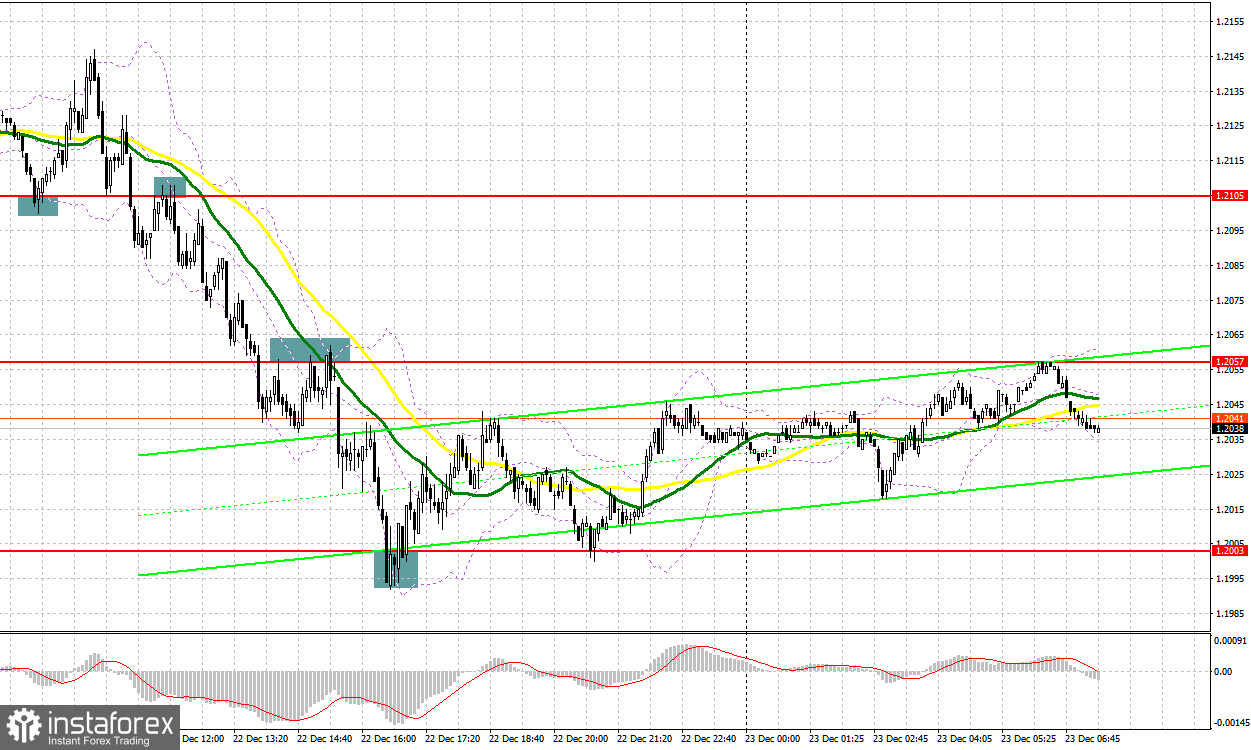

Yesterday, the pound/dollar pair formed a number of excellent entry signals. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2105 and recommended entering the market from there. A decline to this level and its false breakout following the release of the UK data formed a sell signal which pushed the price up by 40 pips. However, the pair failed to continue the uptrend. Then, the pound settled below the 1.2105 level. An upward retest of this range and a buy signal sent the price lower to 1.2057, generating a profit of more than 50 pips. In the second half of the day, the pair broke through the 1.2057 level and retested it. As a result, the price dropped by 50 pips to the 1.2003 area where bulls increased their activity. A false breakout at 1.2003 formed a buy signal which caused an upside correction of 30 pips.

For long positions on GBP/USD:

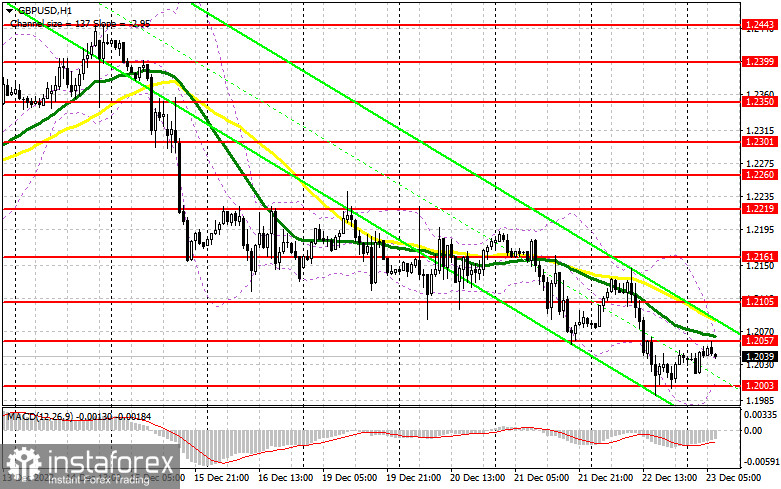

The pound eased under pressure from weak GDP data in the UK and strong US data that was upwardly revised. Actually, the pound is in low demand this week. I doubt that the bulls will have enough drive to bring the pair back to December highs until the end of the year. Therefore, I wouldn't bet on a rise in the pair. Yet, the buyers may assert their strength on Friday if they manage to hold near the level of 1.2003. The best moment to go long on the pair will be a false breakout of this range. This will allow the pair to return to the resistance of 1.2057 that was formed a few days ago. This is where moving averages support the bearish trend. A breakout of this range and consolidation above it may push the price upwards to the level of 1.2105 provided that there is no important data coming from the UK. At this point, the pound bears may return to the market. If the quote moves above 1.2105 and retests it, it may then head for the higher target of 1.2161 where I recommend profit taking. If bulls fail to bring the price above 1.2003, I wouldn't recommend going long. In this case, it is better to open long positions after a decline and a false breakout of the weekly low at 1.1955. You can buy GBP/USD right after a rebound from 1.1904, keeping in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Bears are still in control of the market and play aggressively when they have a chance, just as they did yesterday. The pair went through a slight correction in the Asian session. With this in mind, the best signal to open short positions will be a false breakout of the nearest resistance of 1.2057 where moving averages are located. If so, the pair may continue to decline toward the weekly low of 1.2003. A breakout of this range and its upward retest will generate an entry point into sell positions with a target at 1.1955. The level of 1.1904 will act as the lowest target where I recommend profit taking. If GBP/USD rises and bears are idle at 1.2057, the pressure on the pound will ease at the end of the week and bulls will have a great opportunity to develop a correction. In this case, only a false breakout at 1.2105 will create an entry point for going short. If bears show no activity there as well, I would recommend selling GBP/USD right from the high of 1.2161, bearing in mind a possible downward rebound of 30-35 pips during the day.

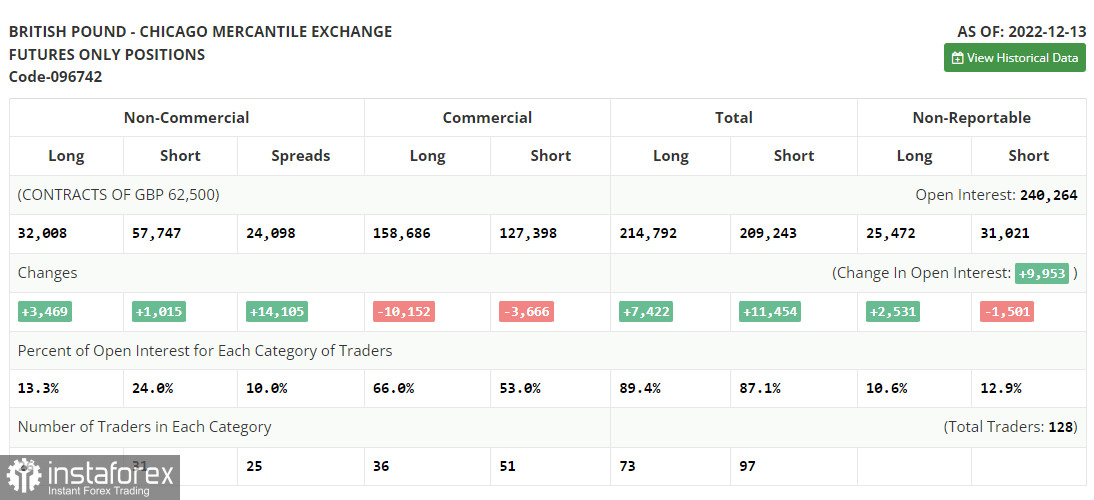

COT report

The Commitments of Traders report for December 13 recorded a rise in both long and short positions. Given that the number of long positions was much higher, we can conclude that traders are still willing to buy the pound at the current high prices. This could be explained by the fact that the Bank of England signaled last week it was going to maintain its aggressive stance on monetary policy. The regulator is determined to fight rapid inflation which slowed down a bit last month. At the same time, fears mount that such a tough approach may tip the UK economy into a recession. This will definitely limit the further upside potential of the pound. For this reason, it would be wise to wait until the pair enters a downward correction which is expected to be rather strong at the end of the year. According to the latest COT report, short positions of the non-commercial group of traders increased by 1,015 to 57,747, while long positions went up by 3,469 to 32,008. As a result, the negative value of the non-commercial net position decreased to -25,739 from -28,193 a week ago. The weekly closing price advanced to 1.2377 from 1.2149.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a downtrend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair advances, the upper band of the indicator at 1.2057 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.