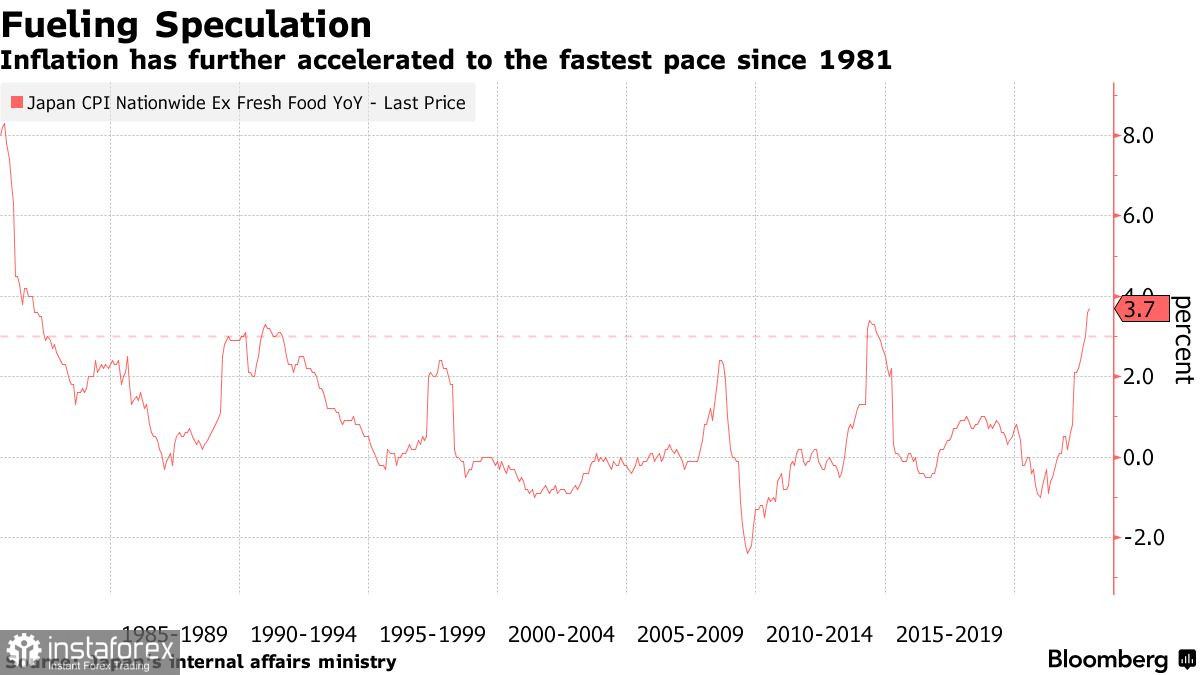

The Central Bank of Japan's recent actions appears to have been intended as a warning. As of today, the primary measure of inflation in Japan has increased even further and reached its highest level since 1981, which will undoubtedly increase market speculation that the Bank of Japan will shock the markets once more by altering its monetary policy in 2023.

The Ministry of Internal Affairs reports that consumer prices in Japan increased by 3.7% in November compared to the same month last year. The Bank of Japan's primary index's results and the economists' evaluation were in agreement. The growth of the index was primarily driven by higher food prices, which even outpaced the growth of energy prices. It is clear that a variety of government initiatives, such as funding travel, contributed to keeping prices below 4%, but the battle against high inflation is far from over.

Those who trade Japanese bonds barely responded to these data: Benchmark 10-year bonds and five-year securities both saw modest increases, which caused yields to drop by one basis point to 0.205%. The foreign exchange market hasn't undergone many notable changes either.

Notably, core inflation has gone above the Bank of Japan's 2% target for eight straight months. The main trend is strengthening, as evidenced by the current level of inflation, which is 2.8% when fresh food and energy are excluded.

Now, speculation that the central bank is on the verge of a policy reversal will continue to be supported by recent actions of Bank of Japan Governor Haruhiko Kuroda and recent data. Let me remind you that Kuroda shocked the markets at the beginning of the week when he announced that he would now permit the yield on 10-year Japanese bonds to rise to about 0.5%, which is twice the prior cap of 0.25%. All of this is a tactical maneuver to buy time before determining the future yield curve, which will change after the Central Bank's policy is altered next year when it is anticipated that interest rates will be raised.

Many economists now anticipate that after the new governor assumes office, a policy change could occur as soon as next spring. Regarding the outlook for monetary policy, many analysts now predict that core inflation in Japan will reach 4% in December of this year before dipping to 2.7% in the first quarter of 2023 as a result of new government subsidies. Furthermore, data for January won't be available until after the Bank of Japan meeting in January, although economists anticipate that these subsidies will start to have a significant impact on inflation in that month.

Regarding the USDJPY pair's technical picture, it is clear that the area around 130.20 serves as strong support over the long term. After the most recent news, the level of 121.10 will be the furthest goal. Its breakdown will trigger another significant sell-off in the vicinity of 126.20. It is not necessary to mention that the demand for the yen will decline in some circumstances right now.

Regarding the EURUSD's technical picture, the demand for the currency is still quite weak, but there is still a chance that it will reach its December highs. To achieve this, a break above 1.0660 is required, which will cause the trading instrument to surge toward the new December high of 1.0700. You can easily climb to 1.0740 above this point. Only the failure of support at 1.0580 will put more pressure on the pair and drive EURUSD to 1.0540 with the possibility of falling to a minimum of 1.0490 if the trading instrument declines.