Two weeks ago, the euro-dollar pair approached the limits of the 7th figure, within the framework of the multi-week uptrend. The pair had been climbing up since late October, when amid the weak dollar, the EUR bulls managed to cross the parity level and the main thing was to keep the price above the 1.0000 mark.

The price was actively rising throughout November, easily conquering one figure after another. The fundamental background contributed to the upward movement. The US inflation rate showed evident signs of slowing down, the Federal Reserve started to talk about slowing down monetary tightening, while the European Central Bank, on the contrary, retained a hawkish stance. Other fundamental factors also contributed to the bullish dynamics. In particular, Brussels managed to partially solve the energy crisis by filling gas storage facilities for the winter, after which the cost of blue fuel started to fall (since early September, the cost of gas in Europe has tripled and currently stands at $900 per thousand cubic meters). In addition, China provided support for the bulls when it eased quarantine restrictions in October-November.

In other words, things worked out well for the euro in autumn, due to which EUR/USD renewed its semi-annual high, reaching the limits of the 7th figure at the beginning of December.

But the bulls ran out of steam in this area. Take a look at the weekly chart: during the last two weeks, the pair traded in the range of 1.0510-1.0700, which narrowed this week to the limits of 1.0550-1.0660. This week's low volatility is explained by the half-empty economic calendar. However, last week was marked by key events, which, however, could not change the situation for the pair - neither in favor of the bulls or the bears. The Fed and the European Central Bank did not become allies of their currencies, making widely expected decisions and voicing a balanced stance.

In particular, Fed members expectedly slowed the pace of monetary policy tightening to 50 points, but revised the final point of the current monetary tightening cycle upward to 5.1%, from the previous value of 4.6%. The Fed's accompanying stance was contradictory. For example, Fed Chairman Jerome Powell made it clear that the current cycle ceiling could be reconsidered (now downward) if inflation showed consistent signs of slowing. Moreover, the Fed chief hinted that there is no predetermined trajectory of rate hikes - the relevant decisions will be made by the Fed members from meeting to meeting.

In other words, Powell's stance was rather dovish, although he left "all doors open": both in the context of a possible pause and in the context of reaching the final point at 5.1%.

But his colleague John Williams, head of the Federal Reserve Bank of New York, was more categorical in an interview with Bloomberg. He commented on the results of the December meeting, and his statements were very hawkish. Specifically, he called the U.S. consumer price growth rate "stubbornly high," assuring reporters that the Fed would raise the benchmark rate "as high as necessary to get inflation under control." According to Williams (who, by the way, has a permanent vote on the Committee), inflation in the United States has begun to subside, but a much more significant slowdown is required so that the Fed can soften its position on the need to tighten policy.

This hawkish stance by one of the most influential members of the Fed is at odds with the overall outcome of the December meeting. That's why traders aren't risking most of their bets against the U.S. currency right now. Even the core PCE index, which was released on Friday, did not help the EUR/USD bears, although this crucial inflation indicator slowed to 4.6% y/y (a downtrend recorded for the second straight month).

In my opinion, Williams' hawkish comments are "keeping the US currency afloat", not allowing bulls to launch an attack. The pair was trading in the range of 1.0550-1.0660 during the entire week, and I believe that traders will finish 2022 in the same range.

Other fundamental factors also supported the greenback last week. For example, new home sales in the U.S. increased 5.8% while the forecast was -4.7%.

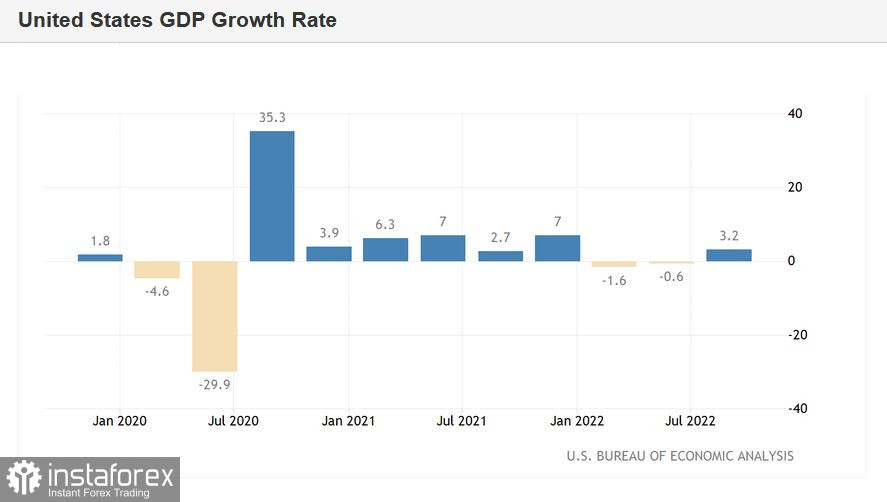

U.S. home sales on the primary market in November unexpectedly increased by 5.8% while the forecast was for a 4.7% reduction. The University of Michigan Consumer Sentiment Index also pleased dollar bulls (rise to 59.7 points with a forecasted decline to 57 points). Moreover, the final data on the US GDP growth in the third quarter was released this week. This important indicator was revised upward, and quite significantly (from 2.9% to 3.2%).

All these factors did not let the bulls leave the range of 1.0550-1.0660 to test the limits of the 7th figure.

Moreover, at the end of the trading week there was some disappointing news from China. To be more precise, Bloomberg news agency published the information about a large-scale outbreak of coronavirus in China, citing its sources and estimates from China's top health authority. According to the report, nearly 37 million people were infected with COVID-19 in just a day - last Friday. And all in all, nearly 250 million Chinese were infected in December after quarantine restrictions were loosened. Official Chinese statistics report several thousand cases per day, but insider information is more important for the market. Anti-risk sentiment has grown and the dollar is in high demand again as a defensive instrument.

Thus, the contradictory fundamental background will probably force traders to be careful till the end of the holidays. It means that the pair will continue to trade in the range of 1.0550-1.0660, alternately pushing back against the limits of this range.