Important information about Japan's inflation growth was released on Friday. The report's components were all released either at the level predicted or in the green zone, reflecting the main indicators' continued growth. Despite the USD/JPY pair ignoring the article, it is not worth discounting Japanese inflation, especially given the results of the December Bank of Japan meeting.

Notably, the yen ignored all previous inflation reports similarly because the Japanese regulator, despite the rise in the CPI, kept its accommodative stance while using the appropriate rhetoric. According to Haruhiko Kuroda, the rise in the consumer price index growth rate this year is "due to single factors, such as the rise in energy prices."

In these circumstances, Japanese inflation reports had no bearing on predicting the USD/JPY pair's direction of movement.

However, as you are aware, things took a dramatic turn in December when the Bank of Japan began to tighten monetary policy guidelines. Given that the Central Bank has only increased the target yield of ten-year bonds' fluctuation range (now it is from plus to minus 0.5%, whereas previously the corridor was within plus or minus 0.25%), this statement initially seems quite bold. On the other hand, the Japanese regulator has consistently implemented ultra-soft monetary policy over a long period, ignoring the "general trends" of the central banks of the top industrialized nations tightening the DCP's parameters. The idea that the Japanese regulator will maintain an ultra-soft policy at least until the spring of 2023 has been repeatedly put forth by many experts. They only connected potential adjustments to the fact that Haruhiko Kuroda will undoubtedly leave his position in April of next year (his second term in office expires).

Therefore, the market responded seriously to even a slight "hawkish shift." This is one small step for the Bank of Japan, but a giant leap for the yen, as the press succinctly put it in a paraphrase of Neil Armstrong's famous adage.

Indeed, many analysts revised their predictions regarding the next steps taken by the Japanese Central Bank after the results of the December meeting were made public. Nearly half of the economists surveyed in the most recent Reuters poll think that the Bank of Japan may abandon its ultra-accommodative monetary policy in the first two to three quarters of 2019. Furthermore, the currency strategists at Goldman Sachs predict that the Japanese regulator will take more drastic action in the future. The Central Bank may decide, in particular, to stop entirely manipulating the yield curve. The likelihood of ending the negative interest rate policy is also rising.

It is noteworthy that Bank of Japan officials link the pertinent decisions to the dynamics of inflationary growth and do not rule out hawkish scenarios (including Kuroda's). Particularly noteworthy in light of today's release are two recent statements made by Asahi Noguchi, a member of the board of the Japanese Central Bank. He stated that the incoming data will determine when the Bank of Japan will reduce the stimulus. Second, and this is crucial, Noguchi did not completely rule out the possibility that the Bank of Japan might actively reduce stimulus measures if inflation turns out to be higher than anticipated.

His coworker, Naoki Tamura, expressed a similar viewpoint. He made it abundantly clear that incoming data, particularly in the area of inflation, still determines the Central Bank's exit strategy from the current ultra-soft policy.

This is why the inflation data from yesterday should be interpreted in light of the aforementioned claims. Members of the Japanese regulator will discuss "hawkish scenarios," among other things, as de facto inflation in Japan continues to rise.

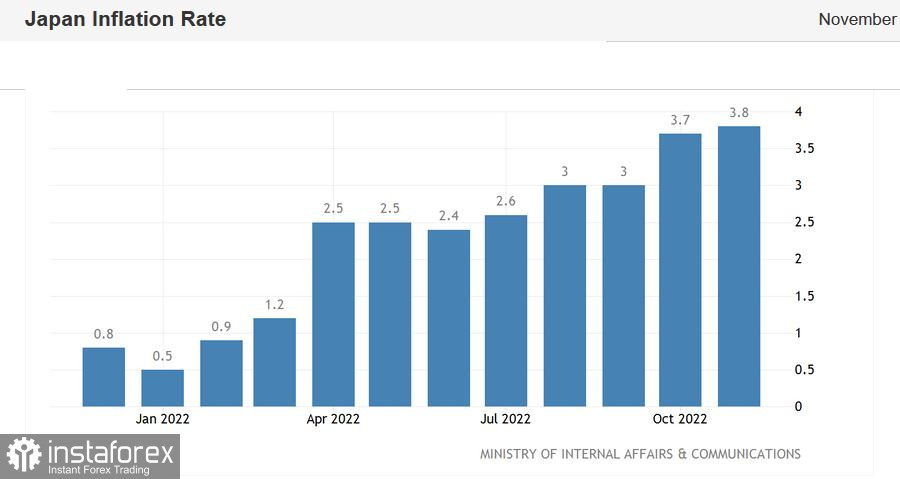

The situation is as follows. The consumer price index as a whole increased by 3.8% in November, marking the indicator's fastest rate of growth since 1981. The 40-year record was also updated by the core CPI, which does not include fresh food but does include energy prices (petroleum products). Excluding food and energy costs, the consumer price index increased 2.8% year over year in October. Nearly every aspect of the aforementioned report performed better than expected in the green zone. In light of the stagnant wage growth, it is important to note that inflation has been above the Bank of Japan's two percent target for eight months.

On the eve of the Japanese Central Bank meeting in January, in my opinion, this release will still occur at the beginning of the following year. As a result of the nation's inflation continuing to rise, it is likely that the regulator's members will continue to use more strident language. The yen will benefit from rising hawkish expectations regardless of whether the Central Bank actually decides to take additional steps toward tightening the PREP or only engages in verbal pumping.

Therefore, it is advised to use corrective pullbacks to open short positions on the USD/JPY pair as it has most likely not yet reached its southern potential. The levels of 131.60 (the lower line of the Bollinger Bands indicator on the daily chart) and 130.60 are the two southern targets in the distance (the semi-annual price minimum was reached last week).