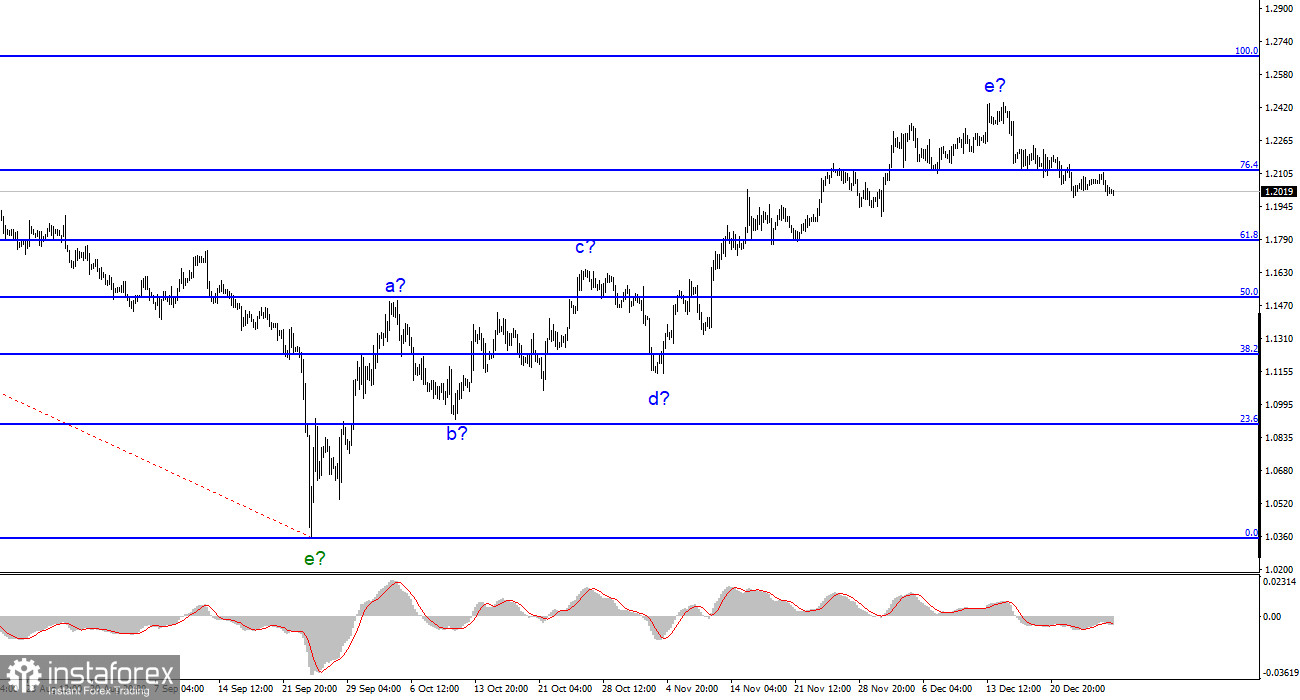

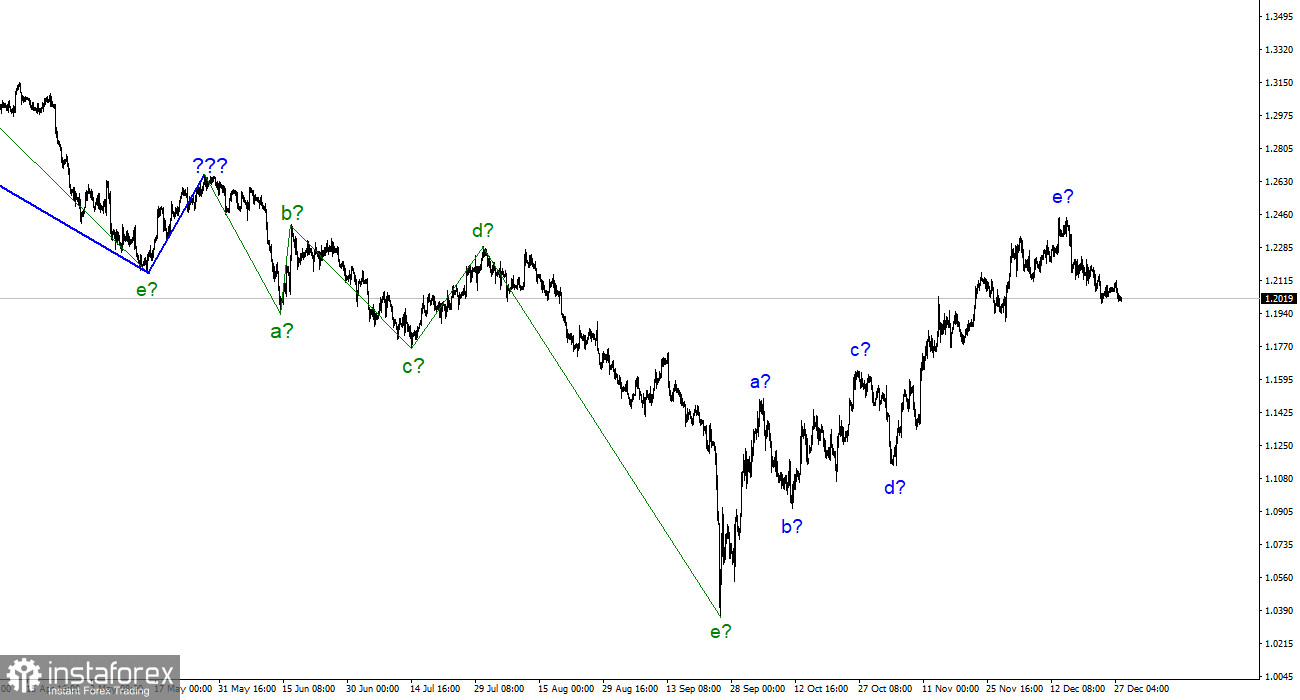

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still does not call for any clarifications. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. Because the quotes for the British continue to move quite actively away from previously reached peaks, the likelihood of the upward section of the trend being completed is much higher in this case. A European cannot, however, remain frozen in place indefinitely. I believe that it will eventually begin to deteriorate as well. It is challenging to sum up the recent British news background in a single word because it has been both robust and diverse. The British pound had sufficient justifications at this point to rise and fall. As you can see, it primarily chose the first course of action, but things have since turned around. Market demand for the pound has peaked, and as a result, the news background (or lack thereof) already contributes more to a decline in market demand. Trading with this tool is now much more effective because the wave marking on the pound has been improved.

The holidays are still going on, but fewer people are looking for British people.

On Tuesday, the pound/dollar exchange rate decreased by 40 basis points. Although this may not seem like much, the overall distance between quotes and the highs reached in December is already 450 points. Since such a decline can be regarded as a separate wave, the upward portion of the trend can be said to have ended. Of course, it can take a more complex shape, as we frequently witnessed when building a downward trend section. There were only corrective waves at that time; corrective ascending structures were essentially nonexistent. I continue to strive to build upon conventional wave structures, though.

The reasons for the decline in demand for the pound are probably the same as the reasons for the decline in the euro: a slowdown in the Bank of England's pace of tightening its monetary policy. The only distinction is that while the euro has not yet started to decline, the pound has. The euro and the pound should now correlate even more with one another when there are no news stories, so I continue to believe that this is just an accident. There are numerous other economic factors at play in the UK in addition to the slowing rate of the interest rate increase. Recent articles in the media and by numerous analysts predict that Britain will experience a protracted recession before it fully recovers. In contrast, it is anticipated that both the European Union and the United States will experience a mild and brief recession. Thus, among his main rivals, the British pound currently holds the least favorable position. I fully anticipate that the wave correction structure will end up being extended and that quotes about its construction will fall between 10 and 15 figures.

Conclusions in general

The construction of a new downward trend segment is still predicted by the wave pattern of the pound/dollar instrument. I can currently recommend sales with targets around the level of 1.1508, which corresponds to a 50.0% Fibonacci ratio. The upward portion of the trend is probably over, though it might still take a longer shape than it does right now.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished (or has already been completed). If this is the case, a downward section will likely be built for at least three waves, with the possibility of a decline in the region of figure 15.