According to the most recent data, the amount of cryptocurrency trading in India has significantly decreased following the subsequent collapse of FTX, one of the industry's top players. Investor sentiment toward crypto tokens has been weakened by news over the past six months, and local crypto experts do not anticipate a recovery in activity any time soon, unless, of course, something dramatic or unusual occurs.

Since April of this year, the Indian cryptocurrency market has been in a "dead" state. Cryptocurrency trading volumes on India's major exchanges have decreased significantly. The major exchanges in India lost between 34% and 50% of trading volumes following the demise of the FTX cryptocurrency exchange. Moneycontrol reports this, citing information from research firm Crebaco. It is important to remember that the decline started much earlier than the FTX's demise. Since the start of the year, Wazirx, one of the biggest cryptocurrency trading platforms in India, has lost 97.99% of its trading volume.

According to Sidharth Sogani, CEO of Crebaco, "I do not anticipate any active actions or recovery of the cryptocurrency industry in India in the next six months." According to Rajagopal Menon, Vice President of Marketing at Wazirx, everything comes down to eliminating TDS (tax on capital gains). No one trades on Indian exchanges as a result.

A 30 percent income tax on virtual digital assets, such as cryptocurrencies and non-interchangeable tokens (NFT), as well as a 1 percent TDS on all transactions costing at least 10,000 rupees (121 US dollars), were both introduced by the Indian government in the budget for 2022. As a result, the government has accomplished its objectives and virtually eliminated cryptocurrency activity nationwide. A stable recovery in trading volumes in India won't happen anytime soon if there are no changes made to the budget this year.

Except for how it made them feel, FTX had little of an impact on Indian users. According to experts, Indian investors switched to Binance after TDS, not FTX, because Binance supported peer-to-peer (P2P) transactions, whereas FTX did not, and the negative sentiment associated with FTX has been exaggerated.

The Reserve Bank of India (RBI) continues to insist on outlawing all cryptocurrencies such as bitcoin and ether. RBI Governor Shaktikanta Das recently stated that the next financial crisis will result in the outlawing of all cryptocurrencies. However, the Finance Minister stated earlier that the government plans to discuss the rules of cryptocurrency turnover with the G20 countries.

.

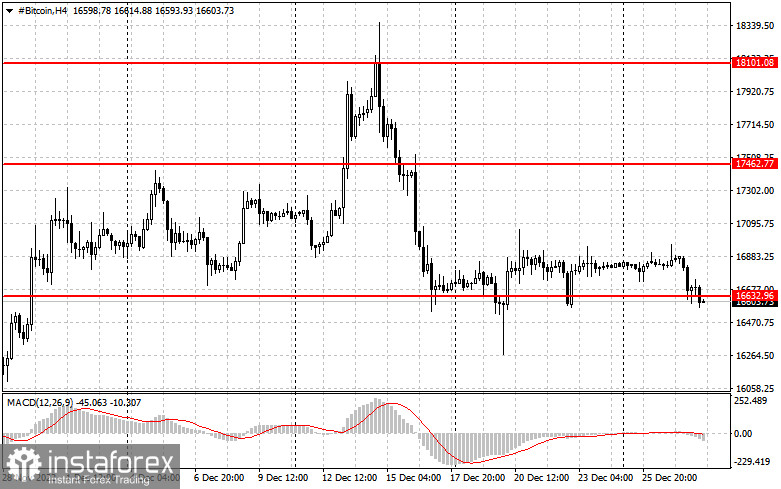

Regarding the technical picture of bitcoin today, everything came to a complete stop after it bounced off the crucial level of $16,600. The resistance of $17,400 restricts growth. However, in the event of renewed pressure, attention will be directed toward preserving exactly $16,600, as its breach by the sellers would deal the asset a fairly significant blow. The pressure on bitcoin will increase as a result, creating a direct route to $15,560 and $14,650. The world's first cryptocurrency will "drop" between $14,370 and $13,950 when these levels break. Once bitcoin has been released above $ 17,460, only then can the discussion turn to bringing the situation back to equilibrium and ending the "panic" mode. Breaking through this region will cause it to retrace to a significant resistance at $18,101 and provide an opening for a test of $18,720.

The breakdown of the nearest resistance at $1,344 is what ether buyers are concentrating on. This will be sufficient to cause substantial market changes and halt a fresh bearish wave. Fixing above $1,344 will diffuse the situation and put the remaining funds back into the ether with the possibility of a correction in the hope of raising the maximum to $1,466. The more distant target will be the $1,571 region. The $1,073 level, which was recently formed, will come into play when the pressure on the trading instrument resumes and the $1,198 level of support breaks. His innovation will raise the trading instrument's price to at least $999. For those who own cryptocurrencies, it will be very painful below $934 and $876