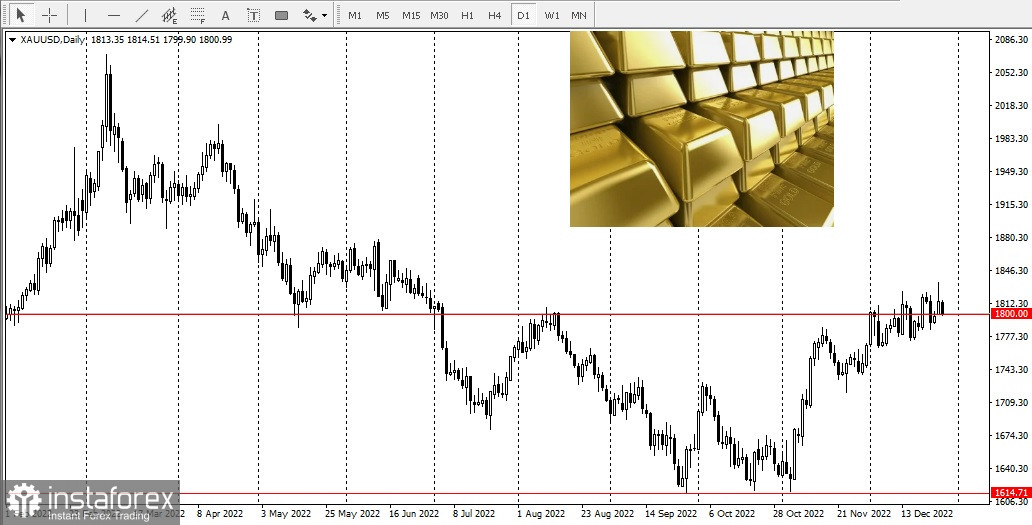

According to U.S. Global Investors CEO and Chief Investment Officer Frank Holmes, investors were underweight gold in 2022.

From what he says: they are about to take stock of 2022.

Inflation has reached its highest level since the 1980s, forcing the Federal Reserve to raise interest rates at the fastest pace in more than 40 years. The U.S. central bank raised interest rates by 425 basis points.

It was a tough year for most investors as the traditional 60/40 portfolio allocation suffered its biggest losses since the 1930s. The Fed's aggressive monetary policy caused bond yields to reach their highest level in more than a decade and the U.S. dollar saw a 20-year high this past year.

The global economy balances on the brink of recession as food and energy prices remain high. With so much uncertainty, investors are left wondering how they should build a portfolio for the new year.

Frank Holmes believes that when it comes to investing, regardless of the year, it always comes down to a person's age. For example, if you're 50 years old, you should have 50% of your portfolio in equities and 50% in short-term income. Let's say you're 70 years old, then 70% of your portfolio should be in income and 30% should be in equities. "Now, I also always advocate for the equity portion of your portfolio, 10% of that should be in gold (5% in bullion and 5% in high-quality gold stocks or ETFs)" he said.

According to Frank Holmes: The impending recession will affect everyone's investment decisions heading into 2023. The real question here is not whether there will be a recession, because it looks like there surely will be, but whether it will be a hard or a soft landing.

When asked, what are your top 3 investments for 2023 and why? He answered, "Personally, my top three investment areas for the new year focus on 1) global resources – a higher percentage here, 2) the global shipping industry and finally 3) the luxury goods market, which also has incredible pricing power, globally."

When asked - What investments would you avoid in the new year and why? - He gave a clear answer: "I personally believe that tax rates could go up next year, so moving into 2023 I would avoid government bonds. I would rather put my money in something that is tax free."

What's your final word on 2022?

"In 2022, I think investors underweighted gold in their portfolios, and perhaps this will change in the new year. In addition, in 2022 central banks consumed more gold than we have seen in living memory. Essentially, central banks are trying to hedge against their very policies."