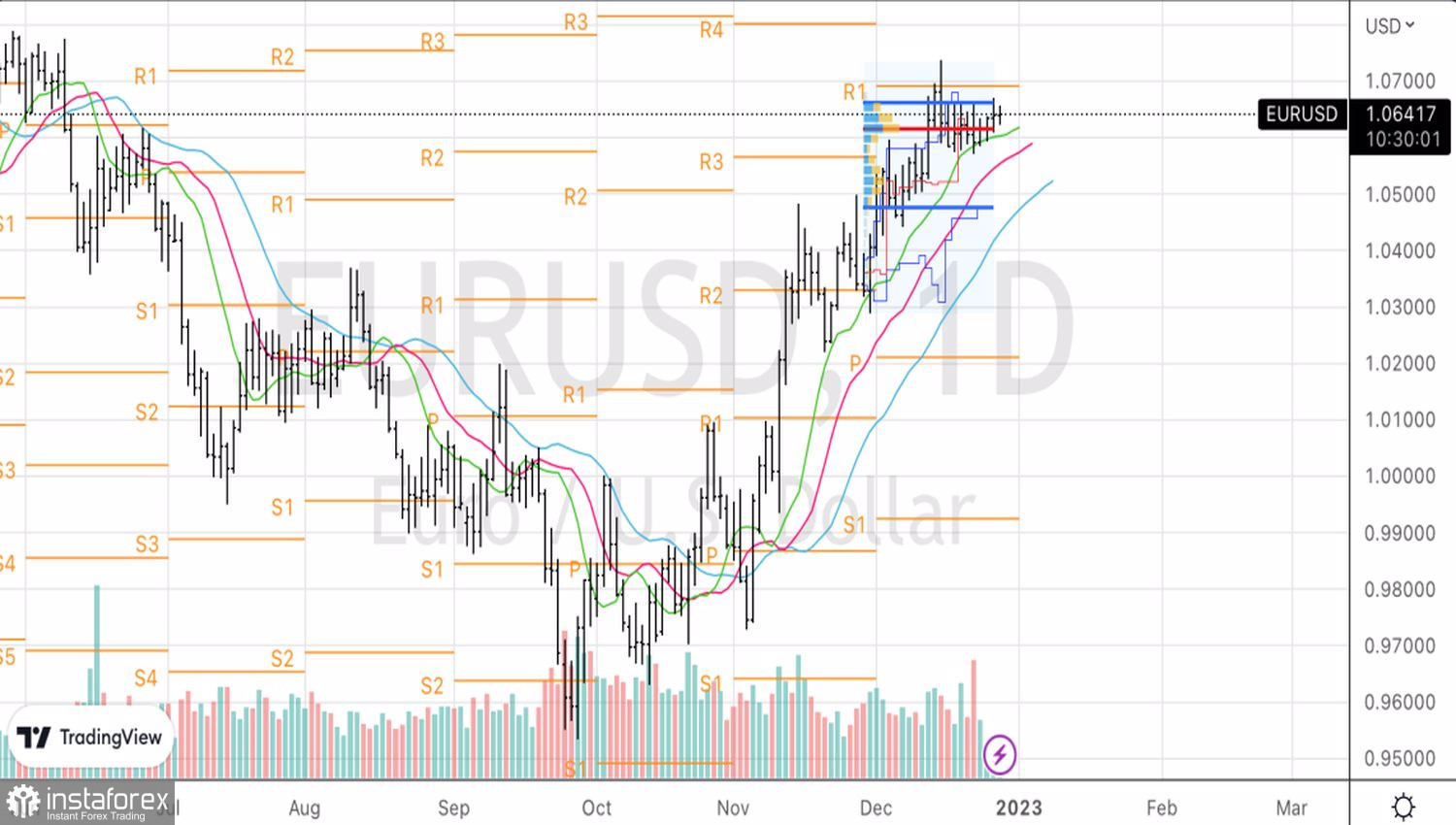

Despite being unable to rise above $1.0655, the euro ends 2022 on an optimistic note. After falling 16% from the beginning of the year to the September bottom, the EURUSD pair rose by 11% due to the Federal Reserve's intention to slow down the process of tightening monetary policy, a milder recession in the eurozone than initially expected, and a hawkish European Central Bank. Officials of the Governing Council hint that the forecast of the futures market on the ceiling of the deposit rate of 3.4% is underestimated, which indicates the readiness of the ECB to increase the pace of monetary tightening and paints a bright future for EURUSD.

Back at the end of the third quarter, the euro was trading below parity with the US dollar due to concerns that the ECB faces a more difficult task than the Fed. Inflation was rising both in the US and in the eurozone, but investors had the impression that the ECB's hands were tied. The increase in rates threatened serious shocks in the eurozone debt market due to its fragmentation. Peripheral economies appeared to be more sensitive to monetary tightening, and the widening of Italian and German bond yield spreads was seen as a deterrent for ECB President Christine Lagarde and her colleagues.

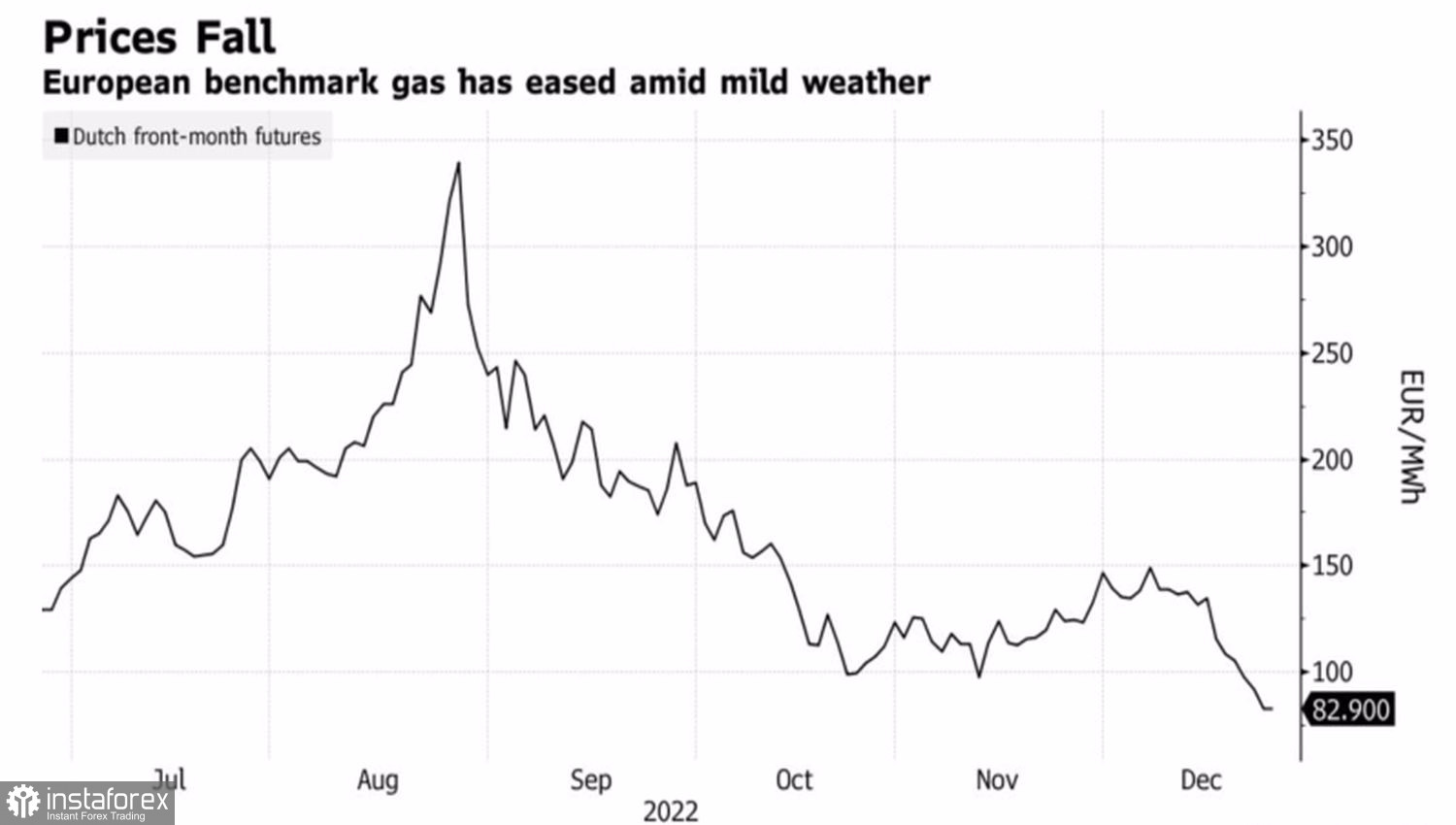

The energy crisis seemed to be the same deterrent. A 7-8-fold rise in gas prices compared to last year's levels while Russia cut off supplies threatened to drive the eurozone economy into a deep recession. In such conditions, an increase in the rate threatened to ruin it altogether. The reality turned out to be different. Due to the warm and windy weather, as well as the rapid growth of LNG imports from the United States, Qatar and other countries, European gas storage levels now amount to 83.1%, which is above average, and gas prices are still falling.

Dynamics of gas prices in Europe

The energy crisis is unlikely to plunge the eurozone into a deep recession. As a result, the euro was sold on rumors and bought on facts. At the same time, the ECB had its hands free. It no longer looks as cautious as before. On the contrary, the central bank has reignited the same determination that was characteristic of the Fed during the second-third quarter.

Even based on the futures market indications of a 90 bps deposit rate hike and only a 40 bps increase in the federal funds rate in 2023, it is clear that monetary policy divergence is in play for the EURUSD. Also add the expectation of an impending recession in the US and a stronger than expected eurozone economy. As a result, there is a clear understanding of the stability of the uptrend of the main currency pair.

Technically, on the daily chart, EUR/USD was unable to cross resistance at 1.0655. However, the bulls refuse to give up. If the second attack turns out to be a success, the pair may rise up to 1.07 and 1.075. It would be best to buy.