Following the pause seen since December 17, ether and bitcoin both experienced a small decline. We won't concentrate on this because, from a technical standpoint, it had no special effects. The news that the US Securities and Exchange Commission has accused Sam Bankman-Fried, the founder of FTX, of orchestrating a fraud scheme with investor money is much more intriguing.

The data revealed that in March of this year, the cryptocurrency company invested $100 million in Dave Inc. through its FTX Ventures division. This fintech business only went public two months prior, and it claimed that its goal was to cooperate to develop the ecosystem of digital assets. The SEC also mentioned a $100 million investment round made in the Web3 company Mysten Labs in September. Mysten's value then increased to $2 billion.

The most important thing at this time is that the money was not Sam Bankman-Fried's funds; rather, it was the funds of the clients of the company who were trading and investing on the FTX platform. The Ministry of Justice is also looking into how, following the announcement of FTX's demise, the business was abruptly hacked and $372 million was taken from its accounts.

Mysten Labs and Dave investments were the only ones that were made public, according to PitchBook research. FTX Ventures carried out dozens of transactions concurrently, investing billions of dollars in unidentified locations. In its press release, FTX Ventures was described as a venture fund with a $2 billion annual revenue.

Bankman-Fried, 30, is now charged with widespread fraud. His business, FTX, in which private investors had invested $32 billion, failed. The accusation's main focus is on how Bankman-Fried transferred money from FTX to his hedge fund, Alameda Research, which used it for risky loans and transactions. FTX Ventures was probably involved in this scheme.

FTX investments are already planned to be repaid with interest by 2026, according to the CEO of Dave Inc. Wilk. FTX invested $100 million through the acquisition of bonds, a short-term loan, and cash. Mysten Labs has not yet offered any comments on the matter.

It is important to note that the Bankman-Fried tale is only getting more interesting. Sam has cool customers despite these serious accusations. As I mentioned in my most recent review, the FTX founder, Bankman Fried, was recently released from prison after promising a whopping $ 250 million in bail. According to Assistant US Attorney Nicholas Roos, it is the largest pre-trial bail in court. As it turned out, however, not a single real cent was contained in these 250 million, meaning Fried was released from prison without making a single payment.

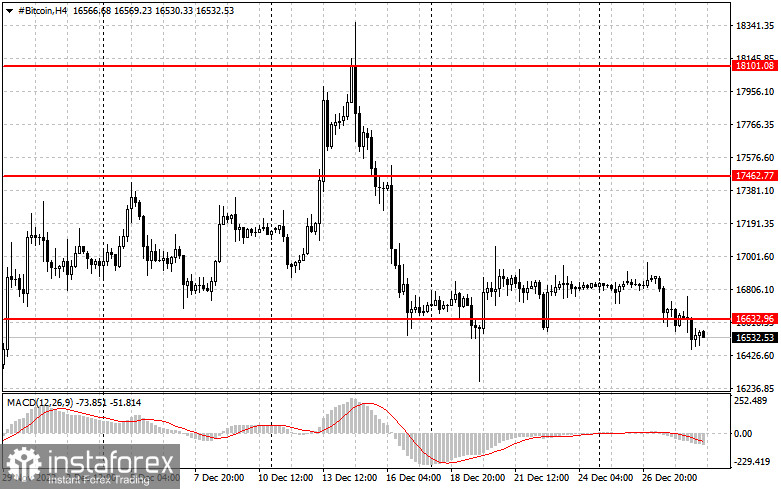

Regarding the technical picture of bitcoin today, everything came to a complete stop after it bounced off the crucial level of $16,600. The resistance of $17,400 restricts growth. However, in the event of renewed pressure, the focus will be on safeguarding exactly $16,600, as a breach by the sellers would deal the asset a relatively serious blow. By putting more pressure on bitcoin, a direct path to $15,560 and $14,650 will become available. The first cryptocurrency in the world will fall below these levels and settle somewhere between $14,370 and $13,950. Once bitcoin has been released above $ 17,460, only then can the discussion turn to bringing the situation back to equilibrium and ending the "panic" mode. Breaking through this region will cause it to retrace to a significant resistance at $18,101 and provide an opening for a test of $18,720.

The breakdown of the nearest resistance at $1,344 is what ether buyers are concentrating on. This will be sufficient to cause substantial market changes and halt a fresh bearish wave. Fixing the rate above $1,344 will diffuse the situation and put the remaining funds back into the ether with the possibility of a correction in the hope of raising the maximum to $1,466. The more distant target will be the $1,571 region. The $1,073 level, which was recently formed, will come into play when the pressure on the trading instrument resumes and the $1,198 level of support breaks. His innovation will raise the trading instrument's price to at least $999. For those who own cryptocurrencies, it will be very painful below $934 and $876.