Analysis of transactions and trading advice for the euro

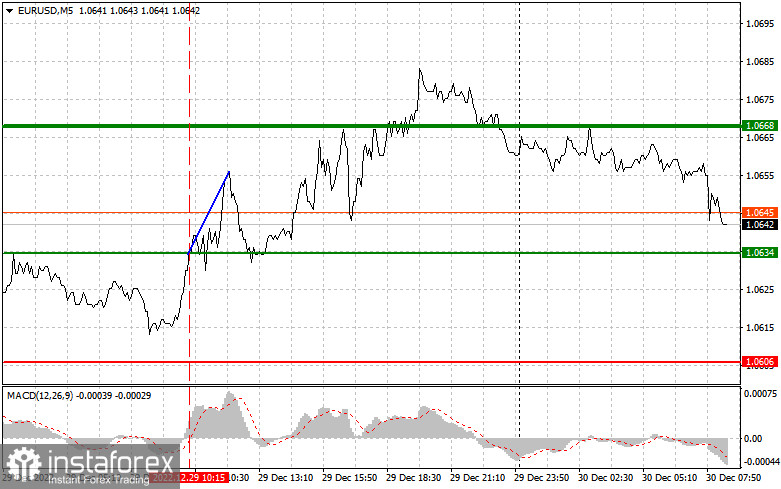

The first half of the day's price test at 1.0634 occurred as the MACD indicator was just beginning to rise from zero, confirming the best moment to purchase euros. The increase was around 20 points. Other signals were not produced.

Reports on the volume of lending to the private sector and the M3 aggregate of the money supply surprised traders since the data showed a considerable decline, which restrained the pair's gain in the morning. The United States' initial jobless benefit application data perfectly matched economists' expectations, allowing the euro to reach weekly highs, but then the pressure on the pair resumed. There are no statistics on the eurozone today, but I predict that the pair will close the year in a narrow side channel. A report on the PMI business activity index in Chicago is released in the afternoon; a strong reading could result in a strengthening of the dollar, which would also limit the pair's upside potential after the week.

Buy Signal

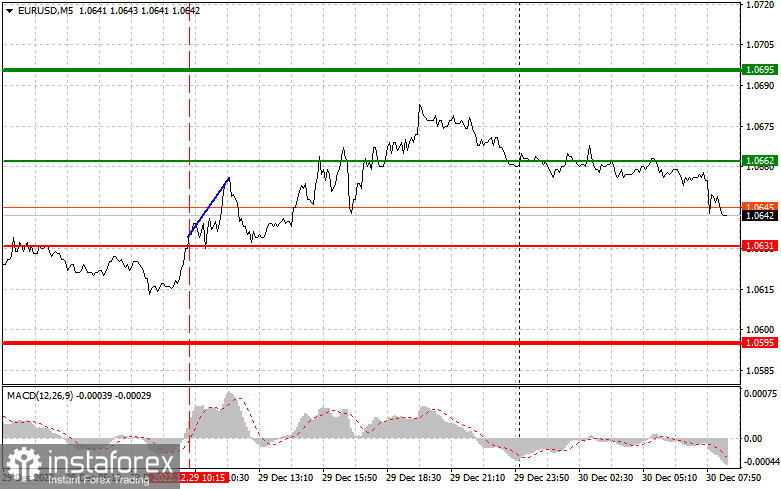

Scenario #1: Today, you can purchase euros when the price reaches 1.0662 (the green line on the chart) to increase to the level of 1.0695. I advise selling euros in the other direction at the price of 1.0695 and departing the market, anticipating a movement of 30 to 35 points from the entrance point. Although the pair's rise is currently predictable, it is doubtful that it will continue for very long. Make sure the MACD indicator is above zero and just starting to increase from it before making a purchase.

Scenario #2: If the price reaches 1.0631 today, it is also viable to purchase euros. However, at this time, the MACD indicator should be in the oversold region, limiting the pair's potential for further decline and causing the market to reverse upward. Growth to the opposing levels of 1.0662 and 1.0695 is to be anticipated.

Sell signal

The euro can be sold after it reaches a level of 1.0631 in scenario one. The 1.0595 level will be the target, and at that moment I advise exiting the market and purchasing euros right away in the opposite direction. In the event of positive US data, the pressure on the pair will increase again. Make sure the MACD indicator is below zero and just starting its descent from it before you decide to sell.

Scenario #2: Selling the euro today is also an option if the price reaches 1.0662, but at this point, the MACD indicator should be overbought, which will stifle the pair's ability for further gains and result in a downward market reversal. A decrease to the levels opposite of 1.0631 and 1.0595 is to be anticipated.

Listed on the chart:

The price at which you can purchase a trading instrument is shown by the thin green line. Since further growth is improbable beyond this level, the thick green line represents the predicted price at which you can place a take-profit order or set your profit levels.

The price at which a trading instrument may be sold is shown by the thin red line.

Given that an additional decrease is unlikely below this level, the thick red line is the predicted price at which you can place a take-profit order or fix your gains.

The MACD signal. It's vital to follow overbought and oversold zones while entering the market.

Important. When deciding to enter the forex market, novice traders must be extremely cautious. To avoid being subjected to sudden variations in the exchange rate, it is recommended to avoid the market before the release of significant fundamental reports. Always use stop orders to limit losses if you choose to trade during the news announcement. Without stop orders, you run the risk of losing your entire deposit very rapidly, especially if you trade frequently but do not employ money management.

And keep in mind that a clear trading plan, such as the one I provided above, is essential for effective trading. An intraday trader's spontaneous trading selections based on the state of the market are initially a losing technique.