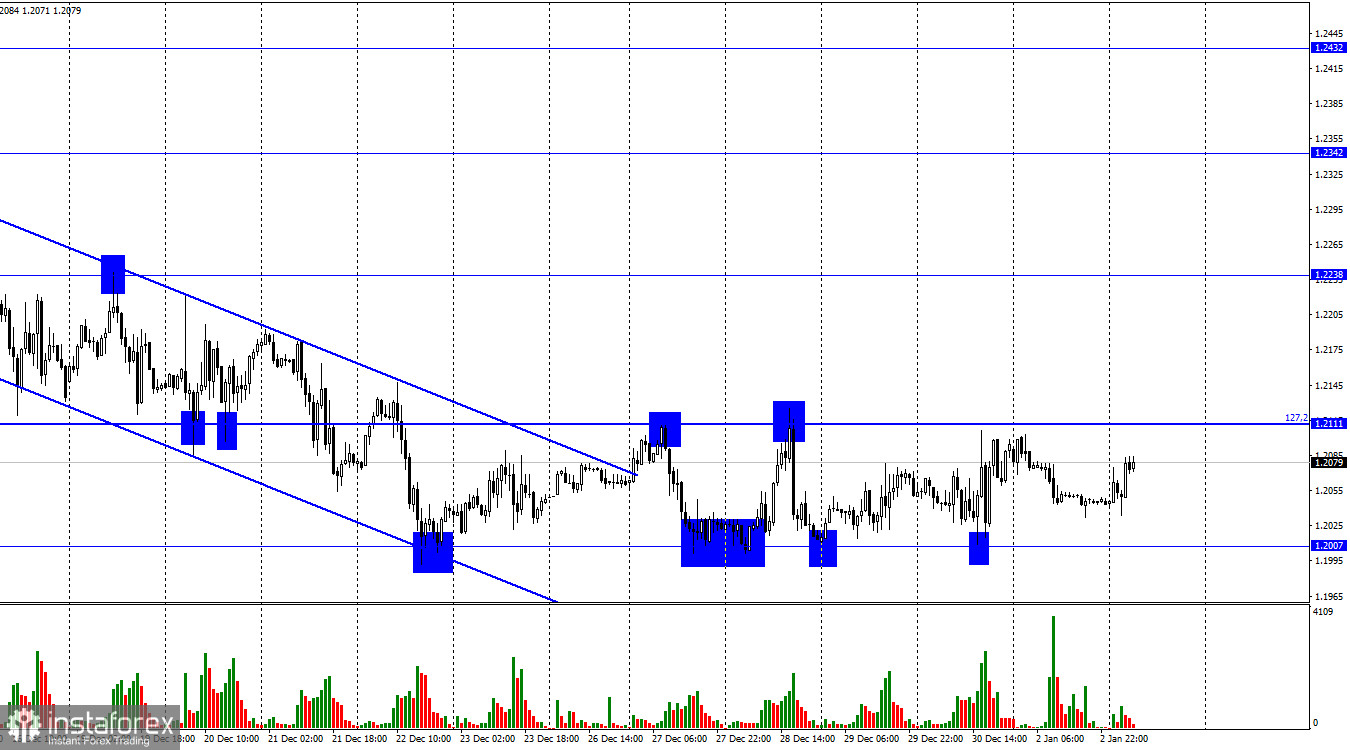

On Monday, the GBP/USD pair continued to trade between 1.2007 and 1.2111 on the hourly chart within a sideways channel. It has been hovering within this channel for almost two weeks, and so far it hasn't shown any signs of leaving it. The closing of the quotations below 1.2007 may work in favor of the continuation of the British pound fall towards the next level 1.1883.

Meanwhile, economists and analysts continue to expect the British pound to fall. As a basis for this prediction, they say that the British economy may shrink greatly in 2023. Much stronger than the economies of the European Union, the US, or the G-7 countries. The Financial Times cited comments by some economists who argue that the effects of the pandemic and the military conflict in Ukraine will have a longer and more crushing effect on Britain's economy. This will cause the Bank of England's high interest rates to remain so for longer, and the government will have to implement tighter fiscal policy. Taxes in Britain will rise in 2023, and the regulator may continue to raise the interest rate, leading to more serious GDP contraction from quarter to quarter.

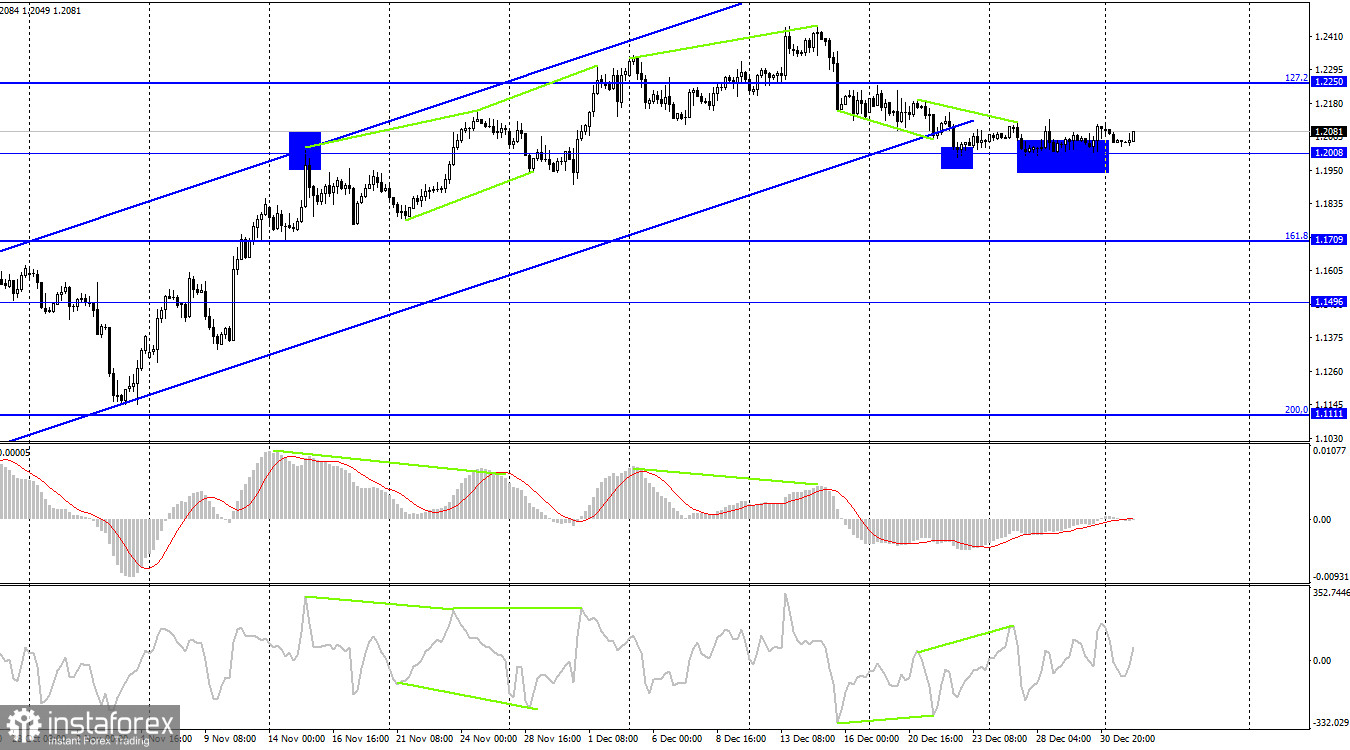

On the 4-hour chart, the pair closed below the ascending channel and fell to the level of 1.2008. The quotes may settle below the channel and this may be important as now the traders' sentiment is changing to the bearish one. The rebound from the level of 1.2008 is likely to cancel the decline. Meanwhile, the growth towards 1.2250 is limited. Anyway, if the price fixes below 1.2008, the fall may continue.

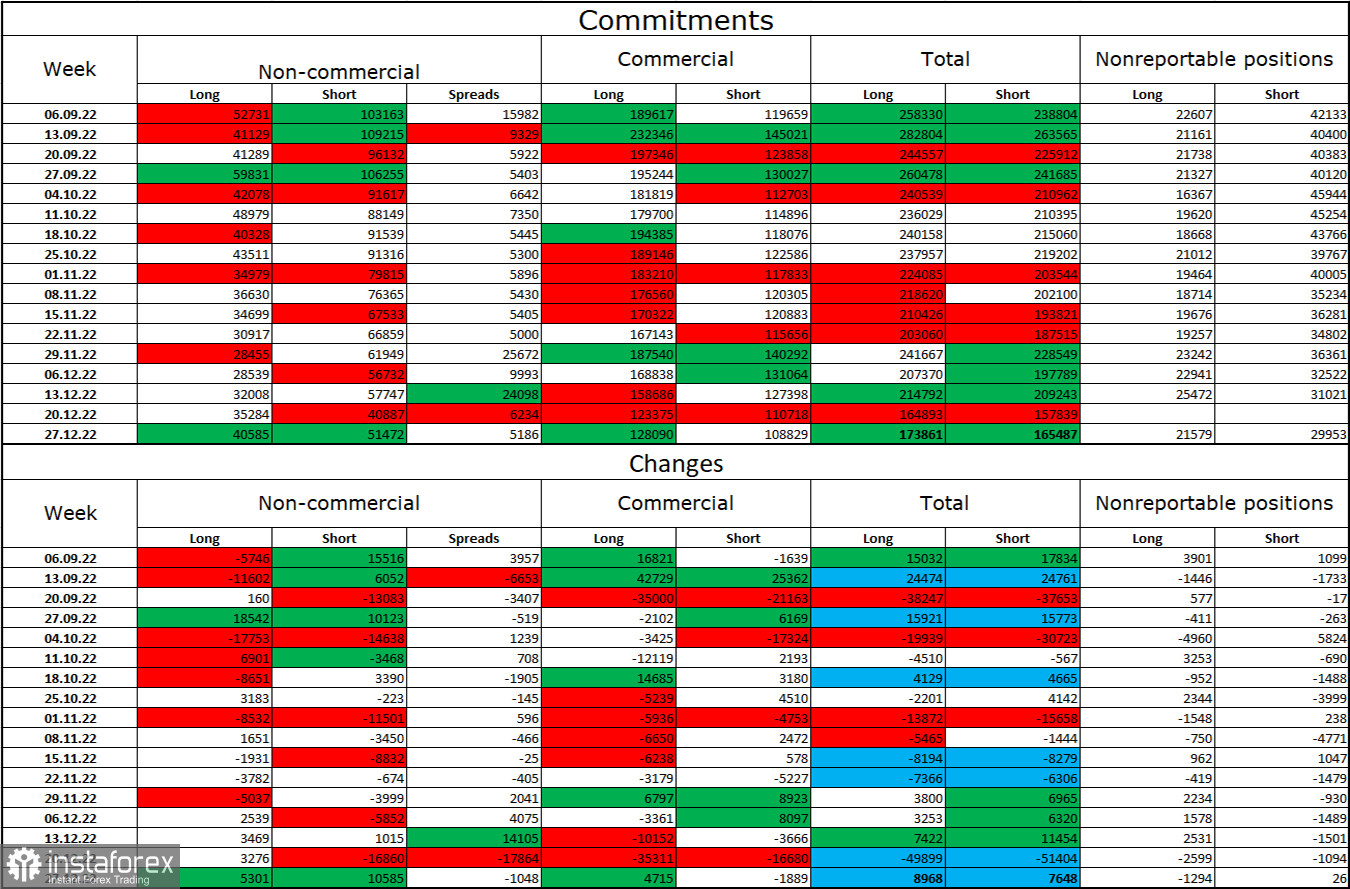

COT report:

Last week, the sentiment of non-commercial traders became more bearish than the week before. The number of long contracts in the hands of speculators increased by 5,301, and the number of short contracts increased by 1,055. The general mood of big players remains bearish, and the number of short contracts still exceeds the number of long contracts. However, over the last few months, the situation has changed dramatically, and now the difference between the number of longs and shorts in the hands of speculators is not too high. Only a couple of months ago the difference was threefold. Therefore, the prospects for GBP have improved a lot lately. However, in the near future, the British pound might continue falling as the price has moved below the three-month ascending channel on the 4-hour chart.

US and UK economic calendars:

UK - Manufacturing PMI (09-30 UTC).

US - Manufacturing PMI (14-45 UTC).

On Tuesday, the US and UK economic calendars contain one event each, which is not so important. The influence of the information background on the market will be low today.

GBP/USD forecast and recommendations for traders:

It is better to sell the British pound on a rebound from 1.2111 on the hourly chart with the target of 1.2007. You may sell GBP if the quotes close below 1.2008 on the 4-hour chart. It will be possible to buy GBP on a rebound from 1.2007 on the hourly chart with the target of 1.2111 or after the closing above 1.2111.