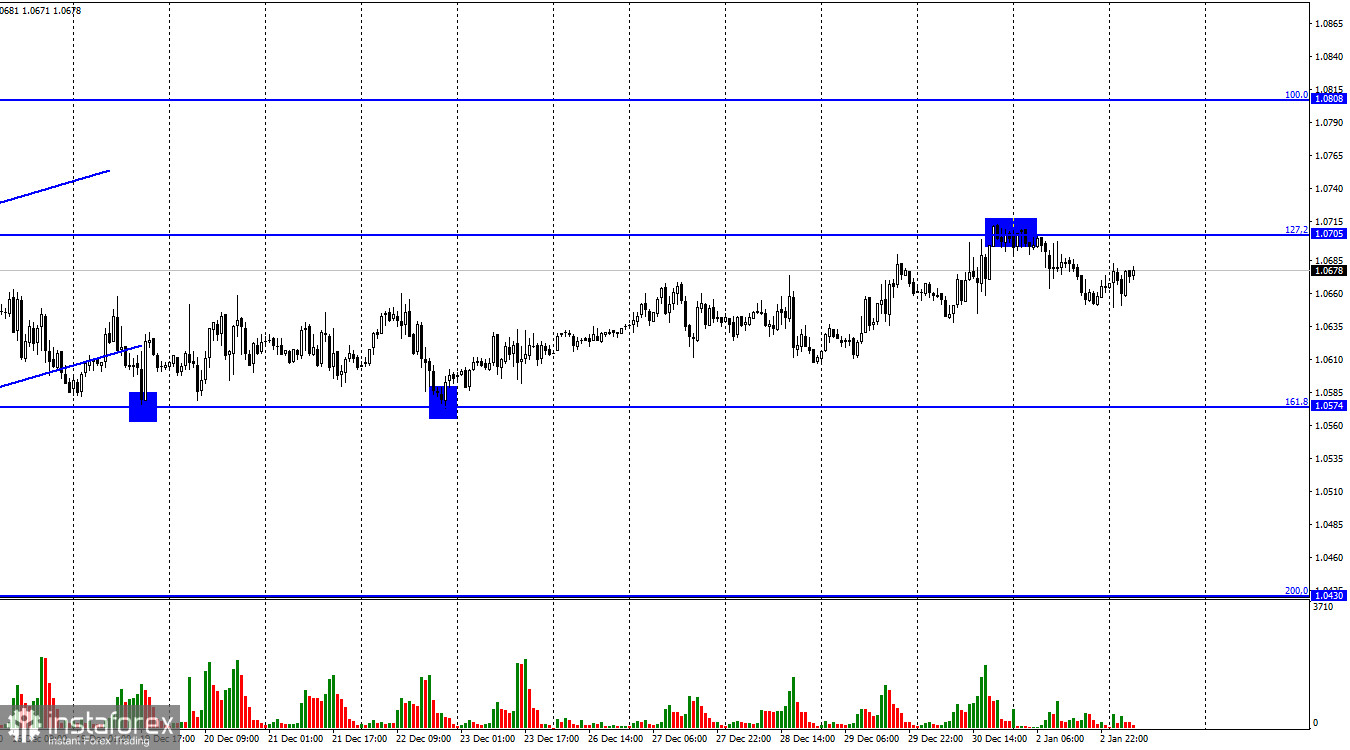

On Monday, EUR/USD stayed in the range between 1.0574 and 1.0705. A rebound from the 1.0705 level supported the US dollar and initiated a fall toward 1.0574. In the coming days, we may observe a slight decline in the quotes as trading activity is still very slow. Consolidation above 1.0705 will increase the possibility of a further uptrend toward the next Fibonacci retracement level of 100.0% - 1.0808.

The information background for the euro/dollar pair is absent today. On Monday, only the manufacturing PMI for December was published. The reading of 47.8 came in line with traders' expectations. This was the second PMI estimate for December. Therefore, this report could not cause any reaction in the market.

Meanwhile, TD Securities has presented its outlook for the Fed's rate in 2023. According to the forecast, the rate may approach the range of 5.25-5.50% by May. The Fed minutes that are due on Wednesday evening will shed more light on the FOMC monetary policy. In recent months, Jerome Powell and other FOMC members have repeatedly warned that the rate may be raised higher than was expected in the autumn. Although the rate-hiking cycle was slowed in December, this does not mean that the same will happen in the near future and the rate will slide to zero. The regulator will continue to tighten the monetary policy at least until inflation reaches the target level of 2%. Analysts at TD Securities also noted that the US labor market remains strong which may be confirmed by Friday's nonfarm payrolls. The positive results of the jobs report may allow the Fed to raise the rate for as long as possible. The robust labor market makes the Fed think that a recession will be minor or there won't be any recession at all.

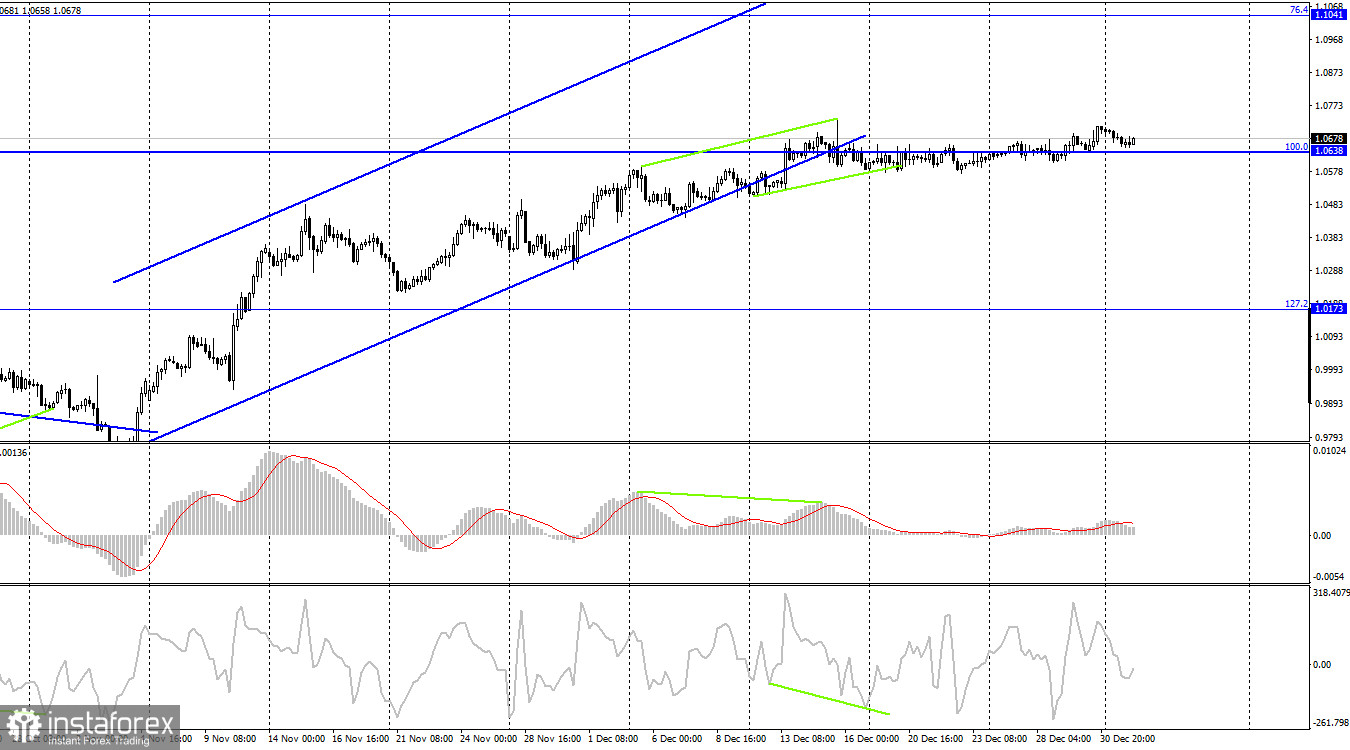

On the 4-hour chart, the pair is trading flat. Therefore, a close above or below the retracement level of 100.0% - 1.0638 should not be considered a signal. Divergences that occur here or there from time to time are also of no importance to us. All the focus is on the sideways channel on the 1-hour chart.

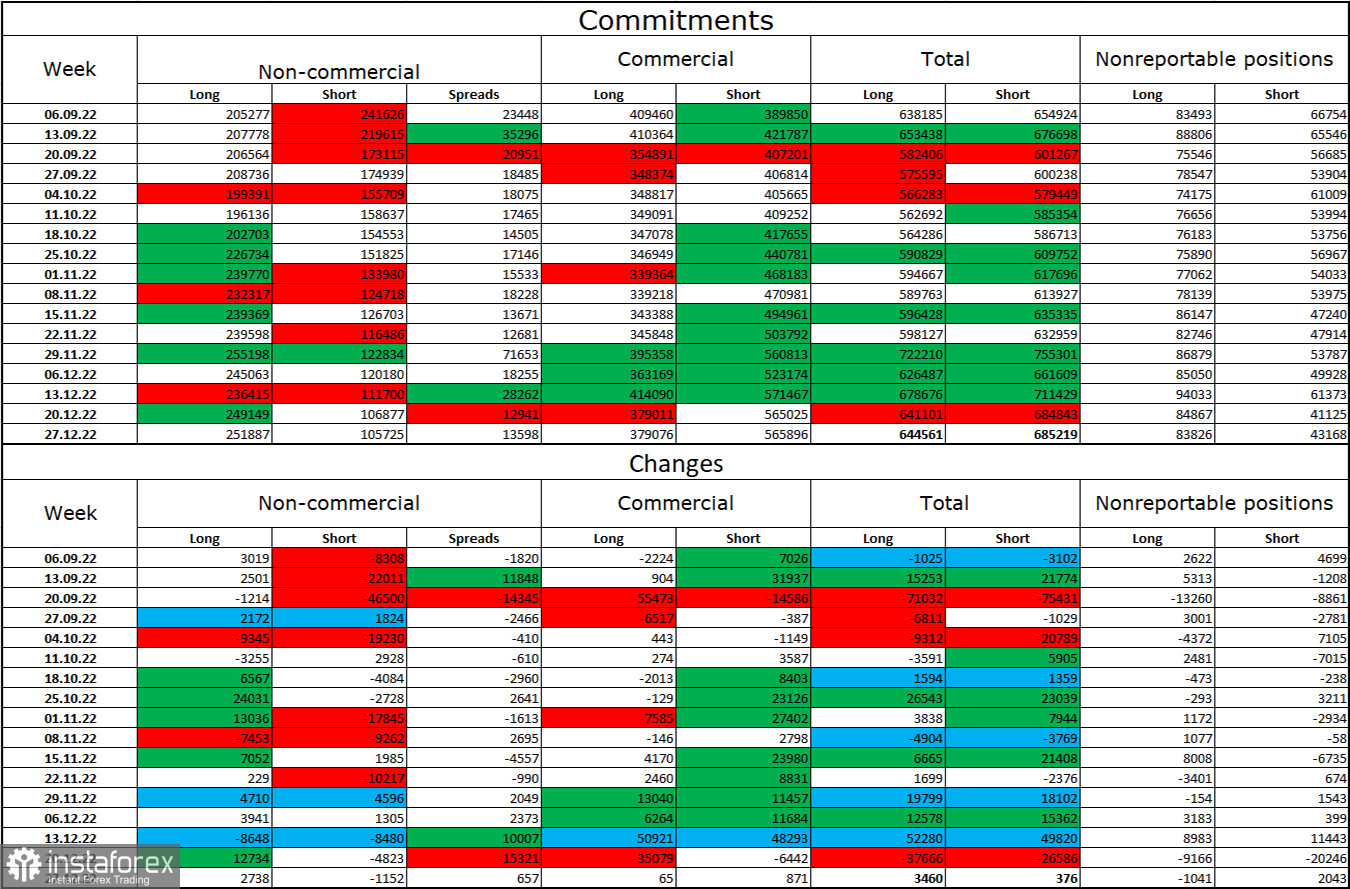

Commitments of Traders (COT) report

Last week, traders opened 2,738 long contracts and closed 1,152 short contracts. Large market players are getting more bullish on the pair. The total number of long positions opened by speculators is 252,000 while the number of short positions is 106,000. The euro is currently gaining ground which is in line with the COT report. At the same time, please note that the number of long contracts is two and a half times higher than that of the short ones. In recent weeks, the chances were getting higher for the euro to develop a proper uptrend. Now there is a risk that EUR has been largely overbought. After a prolonged decline, the euro has finally seen some improvement, and its prospects remain positive. However, a break below ascending channels on the 4-hour chart may indicate that the bearish bias may strengthen in the near term.

Economic calendar for US and EU:

US – Manufacturing PMI (14-45 UTC).

On January 3, the economic calendars for US and EU are almost empty. There will be only one report on manufacturing PMI in the US today. So, the influence of the information background on the market will be zero on Tuesday.

EUR/USD forecast and trading tips:

I recommend selling the pair when the price settles firmly below 1.0574 on the H1 chart with the target at 1.0430. You can also go short on the pair when it rebounds from 1.0705 with the target located at 1.0574. Buying the euro will be possible when the quote rebounds from 1.0574 on H1 with the target at 1.0705. In addition, you can open long positions when the price closes above 1.0705 with the next target at 1.0808.