Barclays Capital Inc. says 2023 will be one of the worst years for the global economy. Ned Davis Research estimates a 65% chance of a severe global economic downturn, while Fidelity International believes a hard landing is inevitable.

Obviously, many agree that as the Federal Reserve continues its most aggressive tightening campaign in decades, a recession will occur which, no matter how mild it is, will force the central bank to consider a dovish tilt in policy even if inflation is at its peak. However, this forecast may be wrong, just like what happened last year, when analysts failed to predict the 2022 cost-of-living crisis and double-digit market losses. Goldman Sachs, JP Morgan and UBS Asset Management, for their part, see the economy thriving as price growth slows, signaling big gains for investors if they get the market right.

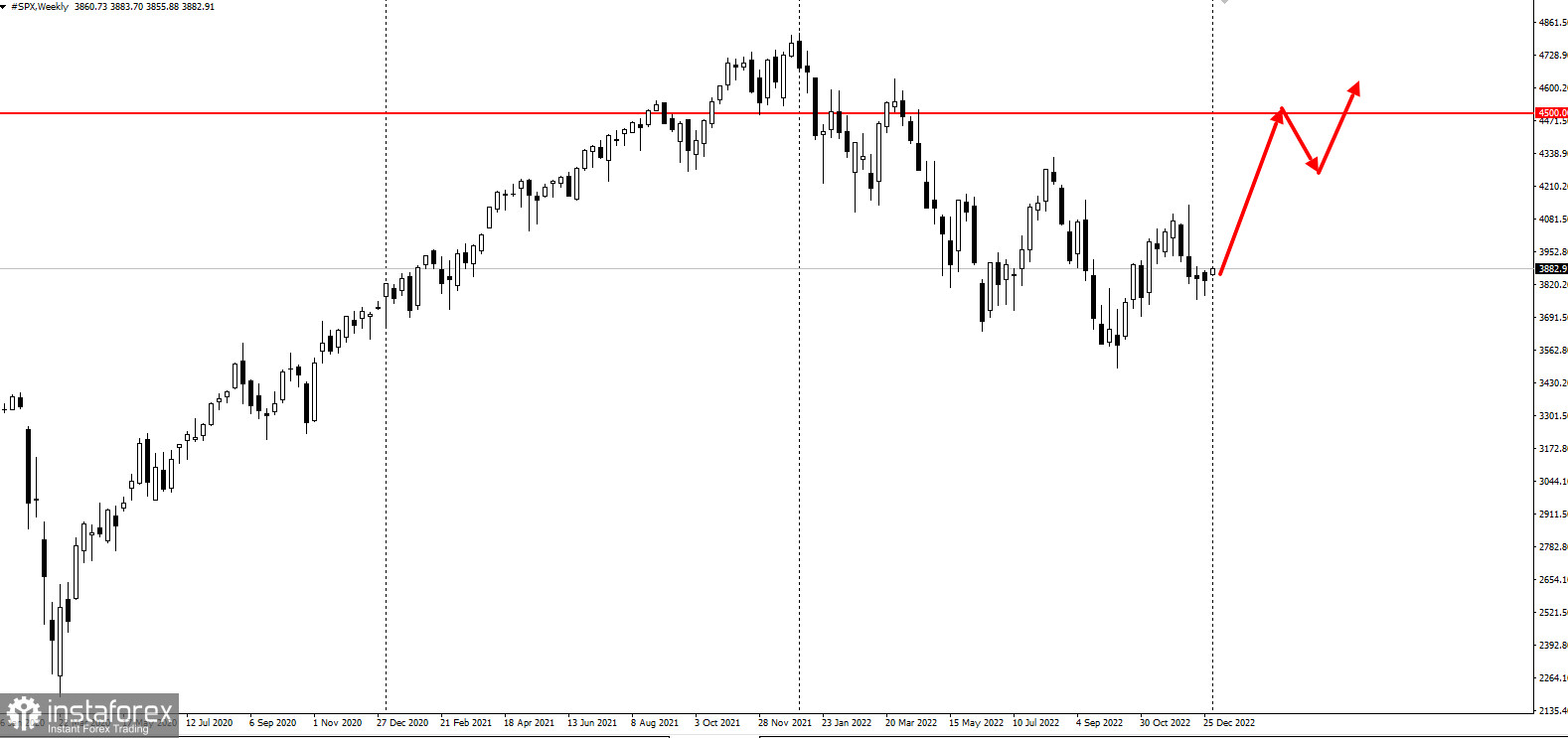

Deutsche Bank predicts that the S&P 500 index will rise to 4,500 in the first half of the year and then fall by 25% in the third quarter. It will return to 4,500 by the end of 2023 as investors look to rebound.

UBS Group expects 10-year bond yields in the US to fall to 2.65% by the end of the year due to renewed demand for safe-haven assets.

Meanwhile, investment firms are in no mood to discuss the crypto industry as they have spent the previous years spinning speculations. Now, references to it have all but disappeared in forecasts for 2023.