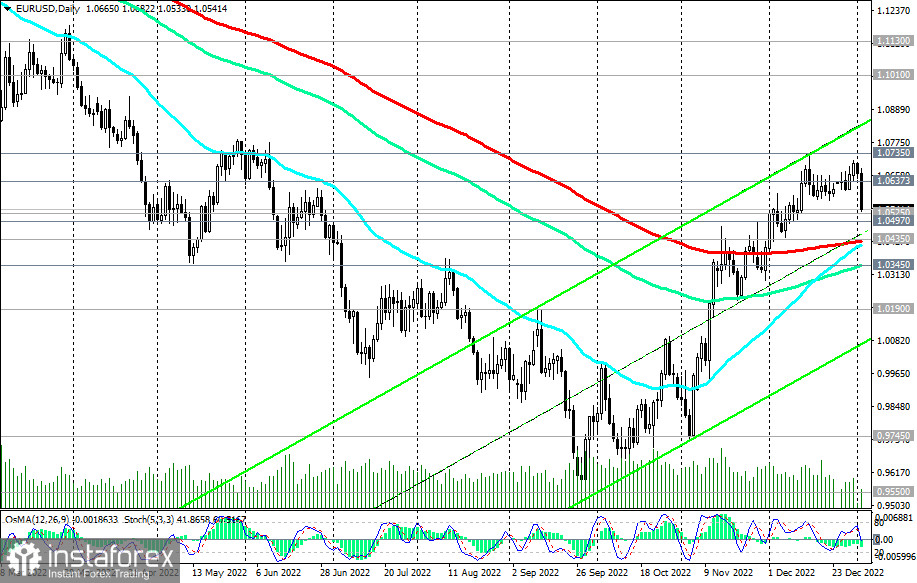

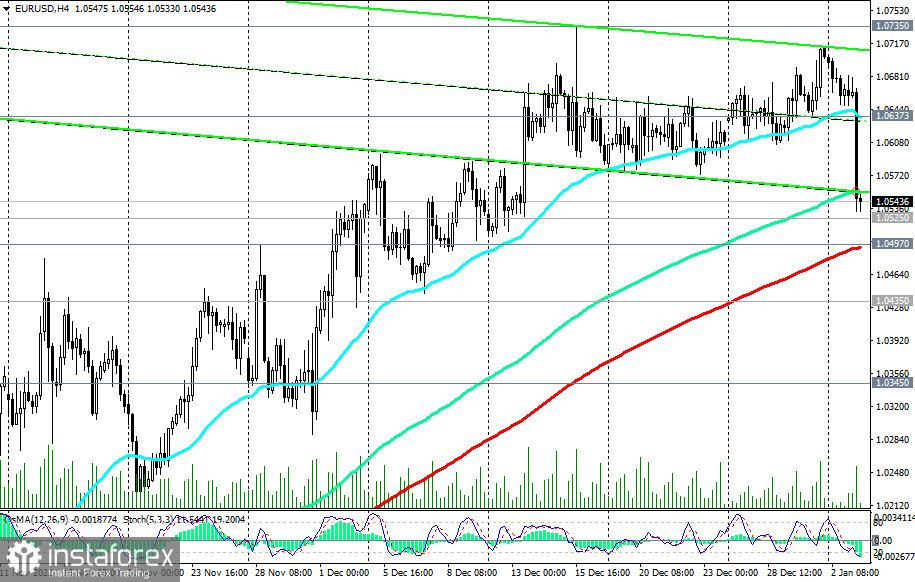

EUR/USD lost 1.2% in the first hours of today's European session, down 130 pips from today's opening price. As of writing, the pair was trading near 1.0544, near the strong support at 1.0525 (50 EMA on the weekly chart). Considering such a sharp fall and reaching a zone of strong support, we assumed a consolidation near the current levels and the support at 1.0525 and then a pullback, considering the general upward trend of the pair.

A rise above the zone of the 1.0555 resistance level (144 EMA on the H4 chart) will be a confirmation signal of our assumption. If the decline continues, we will also place a buy order near the 1.0497 support level (200 EMA on the H4 chart).

In an alternative scenario, EUR/USD will reach the 1.0435 key support level (200 EMA on the daily chart). But this is likely a story for 2–3 days. On Friday (at 10:00 GMT), Eurostat will publish data on retail sales and consumer inflation in the Eurozone, and (at 13:30 GMT) the U.S. Department of Labor will publish a monthly report with key data on the U.S. labor market for December.

Is it worth mentioning how strong the movement in EUR/USD is expected to be this Friday? The level of 1.0435 will be a kind of watershed breaking off the pair's long-term bullish trend from the bearish one.

Support levels: 1.0525, 1.0497, 1.0435, 1.0345, 1.0300, 1.0190, 1.0000, 0.9745, 0.9700, 0.9600, 0.9550, 0.9500

Resistance levels: 1.0557, 1.0600, 1.0637, 0.0700, 1.0735

Trading Tips

Sell Stop 1.0490. Stop-Loss 1.0565. Take-Profit 1.0435, 1.0345, 1.0300, 1.0190, 1.0000, 0.9745, 0.9700, 0.9600, 0.9550, 0.9500

Buy Stop 1.0565. Stop-Loss 1.0490. Take-Profit 1.0600, 1.0637, 0.0700, 1.0735, 1.0750, 1.1035, 1.1100, 1.1150