The beginning of the new year has caused the market to gradually begin to fill with a news background. Both instruments started to decline in the first week of this year, which perfectly matches the present wave pattern. As a result, we can only be glad that the predictions are coming true, which implies that you can work on the tools and get paid for them. The US will release data on unemployment, wages, the labor market, and business activity in the service sector tomorrow. The market has already learned this week about indices of business activity in the US, the EU, and the UK, as well as the ADP report. However, the most interesting information is still to come. These are, in my opinion, the most significant reports from this week and possibly the entire month.

But let's not jump to conclusions just yet. You should first consider the facts you've previously been given and try to determine whether they're the cause of the rising demand for US cash. The FOMC protocol was one of the most important, but also one of the most formal, events of the week. It was released last night, and the market showed no sign of it. The protocol's "hawkish" aspect was highlighted by many analysts. Since the Fed has been telling us that the rate will continue to grow but at a somewhat slower rate throughout December, I think that it could not have been any other way. The fact that the majority of FOMC members are not prepared to vote in favor of a rate cut in 2023 was also made public. This element, in my opinion, might help the US dollar today, on Thursday. The US market was about to close last night, and today, right at the start, the US dollar started to rise sharply. However, I am unable to fully connect this to American news because the market typically pays little heed to it.

I'd like to remind you that today saw the announcement of the trade balance and the ADP data. The euro increased by 60 basis points, while the pound increased by 110, as both turned out to be stronger than market estimates. But for some reason, it seems that the rise in demand for the dollar was not primarily caused by these reports. At the same time, I would caution my readers against drawing generalizations about 2023 from the protocol. The language of ECB and Fed members has changed so frequently over the past year that you already approach each new speech or announcement with a healthy dose of skepticism. The only thing to keep in mind is that Jerome Powell and Christine Lagarde both mentioned raising the rate to a maximum of 3.5% at the beginning of the year. As we can see, the truth was a little bit different. Based on this, I think that despite statements made at the end of 2022, inflation will drop to 2% and the Fed will start loosening monetary policy even in 2023. The Fed will respond following the circumstances, allowing its members' rhetoric to freely shift every two to three months.

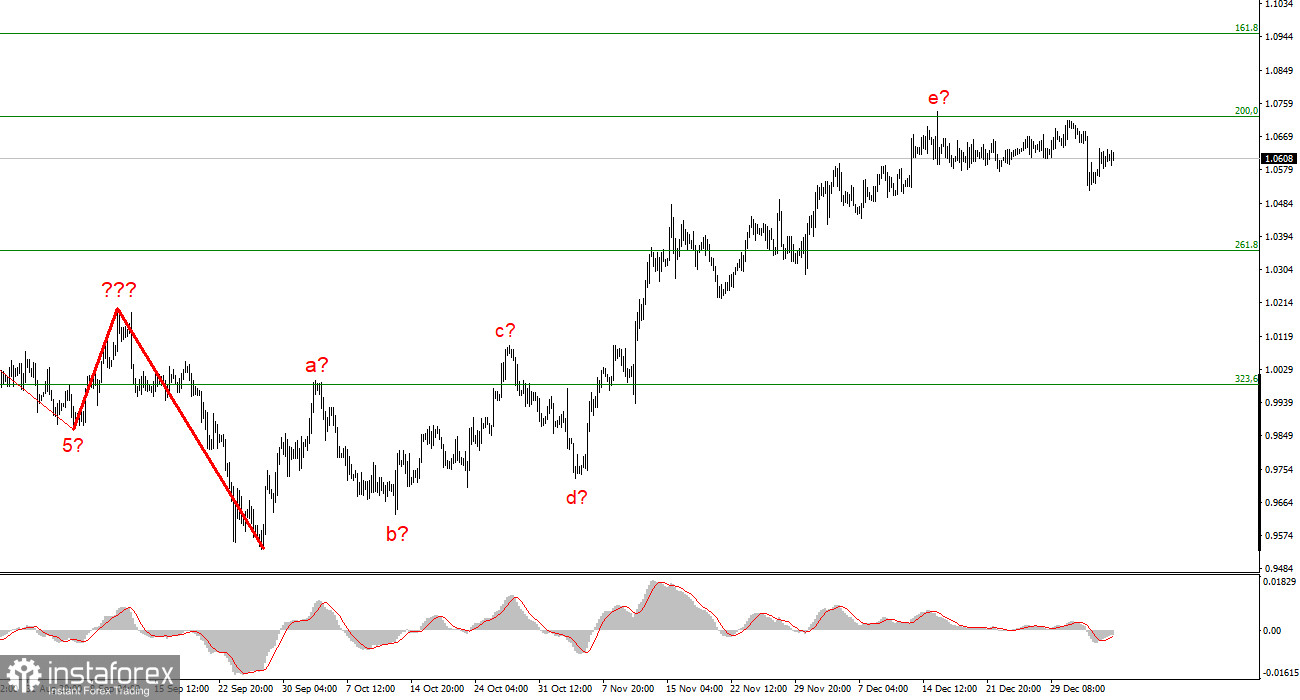

Based on the study, I conclude that the upward trend section's construction has grown more complex and is either finished or nearing completion. As a result, I suggest making sales with objectives close to the predicted 0.9994 level, or 323.6% Fibonacci. We have a signal for a drop and a departure of quotes from the recent highs, while there is a chance that the rising phase of the trend will become even more lengthy and complicated. The likelihood of this scenario is still pretty high.

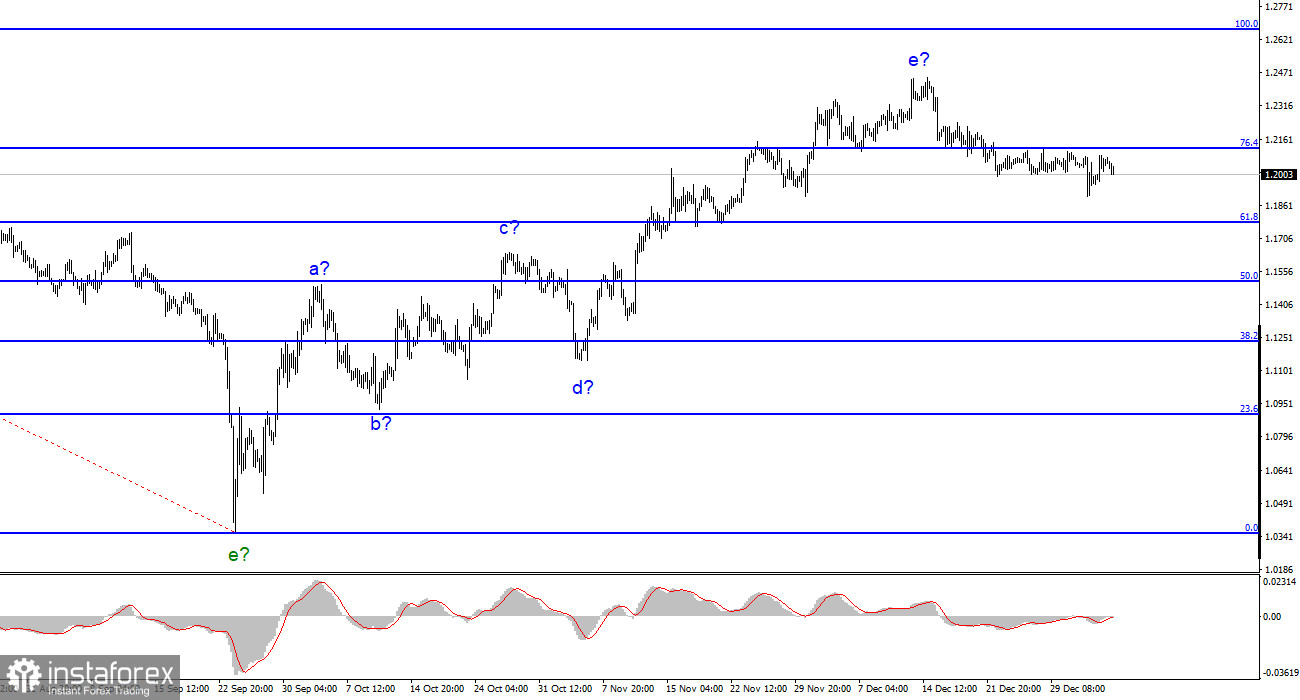

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. Right now, I still suggest sales with objectives near the level of 1.1508, which corresponds to a 50.0% Fibonacci. The upward portion of the trend is probably over; however, it might yet take a longer form than it does right now.