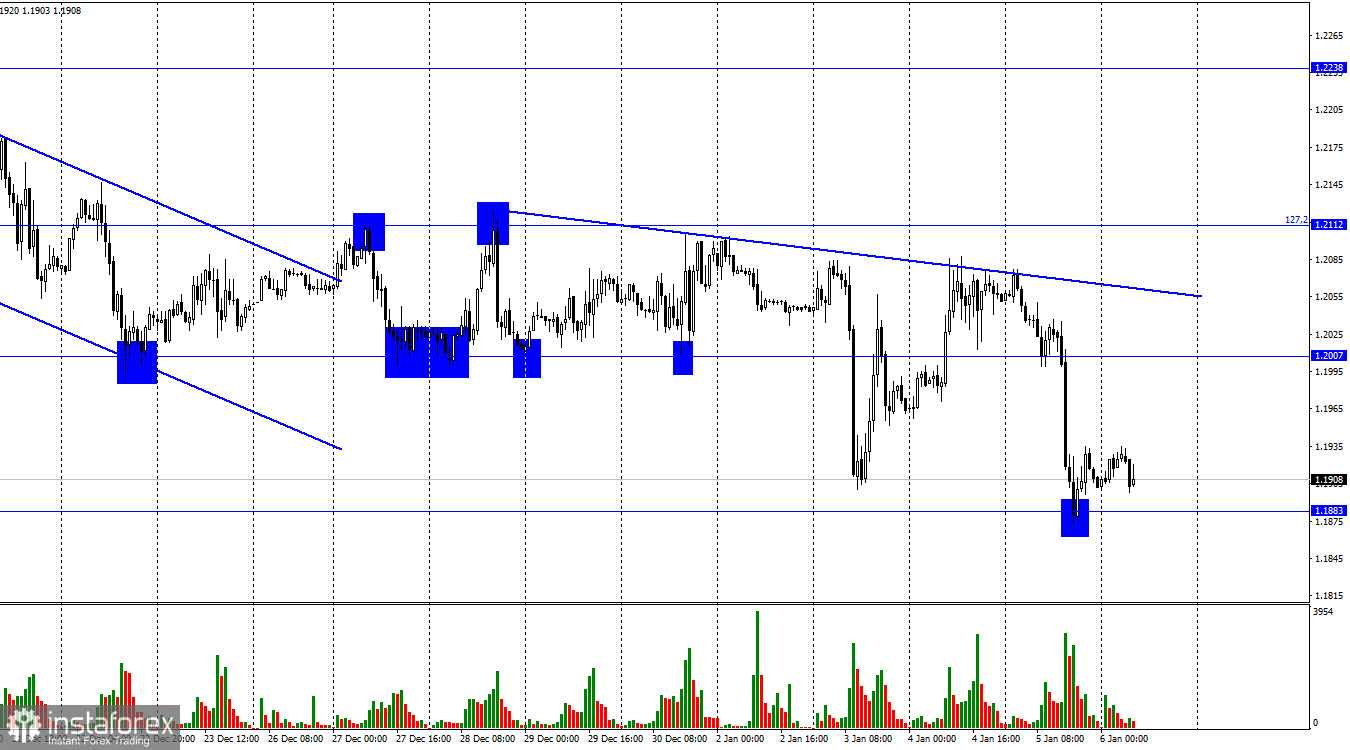

The GBP/USD pair reversed in favor of the US dollar on Thursday, dropping to a level of 1.1883 according to the hourly chart. Additionally, I created a descending trend line that indicates a "bearish" sentiment among traders and has already struck the price four or five times. The British pound will benefit from the pair's rate recovery from the level of 1.1883 and the start of growth toward the level of 1.2007. Fixing quotes at 1.1883 will raise the likelihood that the decline will continue toward the following level of correction, which is 100.0% (1.1737).

Today is crucial for the future of the US dollar. Traders receive crucial information regarding the state of the US labor market and unemployment on the first Friday of the month. Together with inflation figures, these data are currently the most crucial since they demonstrate if a recession is likely to occur. In recent months, the Fed's board of directors has frequently stated that the American economy is only anticipating a mild recession, not a full-blown downturn. They emphasized that the labor market is in outstanding form and that a recession cannot occur in the absence of layoffs, an increase in unemployment, or a decline in the supply of available jobs. Some analysts do not trust the Fed because they think a recession is unavoidable, yet so far, economic data points to the FOMC members being correct.

Who is correct will be revealed by today's report. Traders currently anticipate a 200–220,000 increase in the number of jobs in non-agricultural industries. The real value, in my opinion, might be lower because recent projections have consistently been exceeded. The Fed has been raising interest rates from meeting to meeting, which cannot in any way have an impact on the indices of unemployment and the labor market, so this cannot always be the case. Today's US figures are expected to be weak, which could lead to a decline in the value of the US dollar.

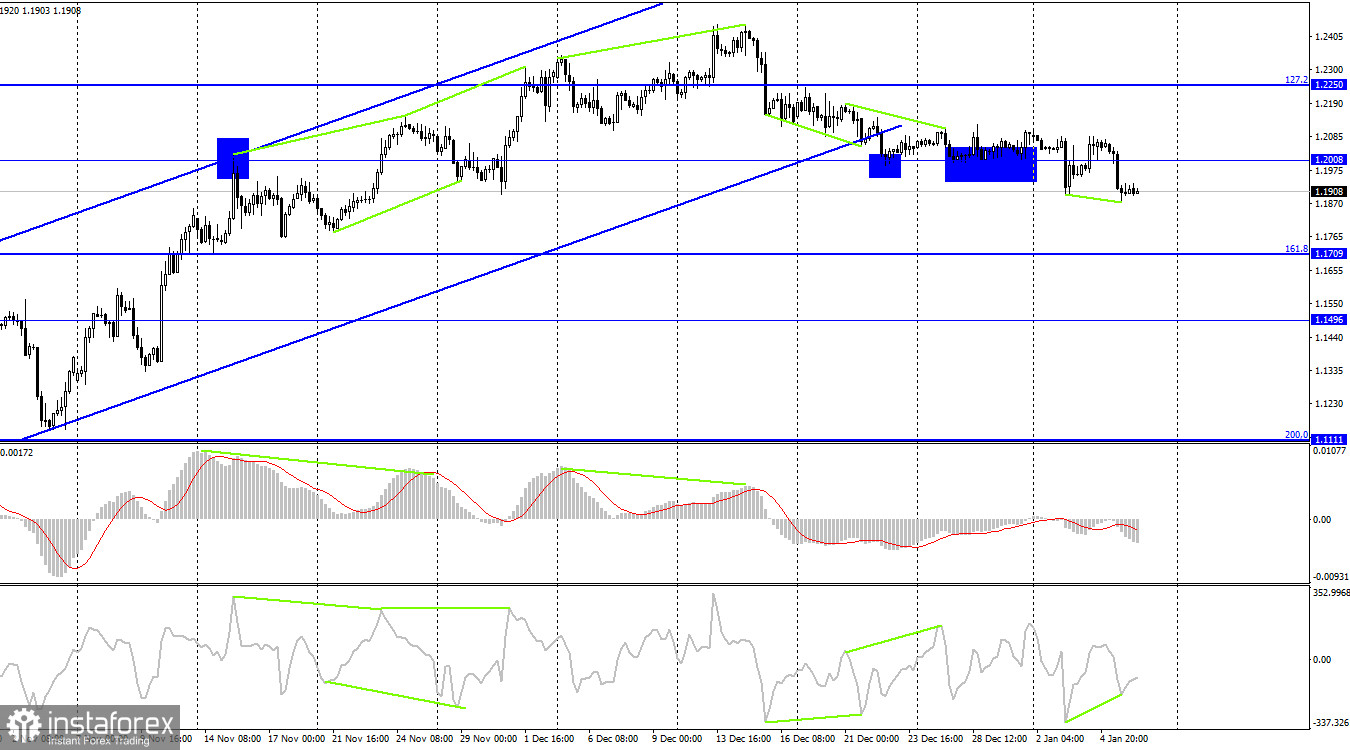

The pair finished within an ascending trend corridor on the 4-hour chart, which I believe to be the most significant development given that traders' sentiment is currently shifting to "bearish." The Fibo level of 161.8% (1.1709) is where the quotes may continue to fall, but yesterday the CCI indicator produced a "bullish" divergence, allowing us to expect some expansion of the pair.

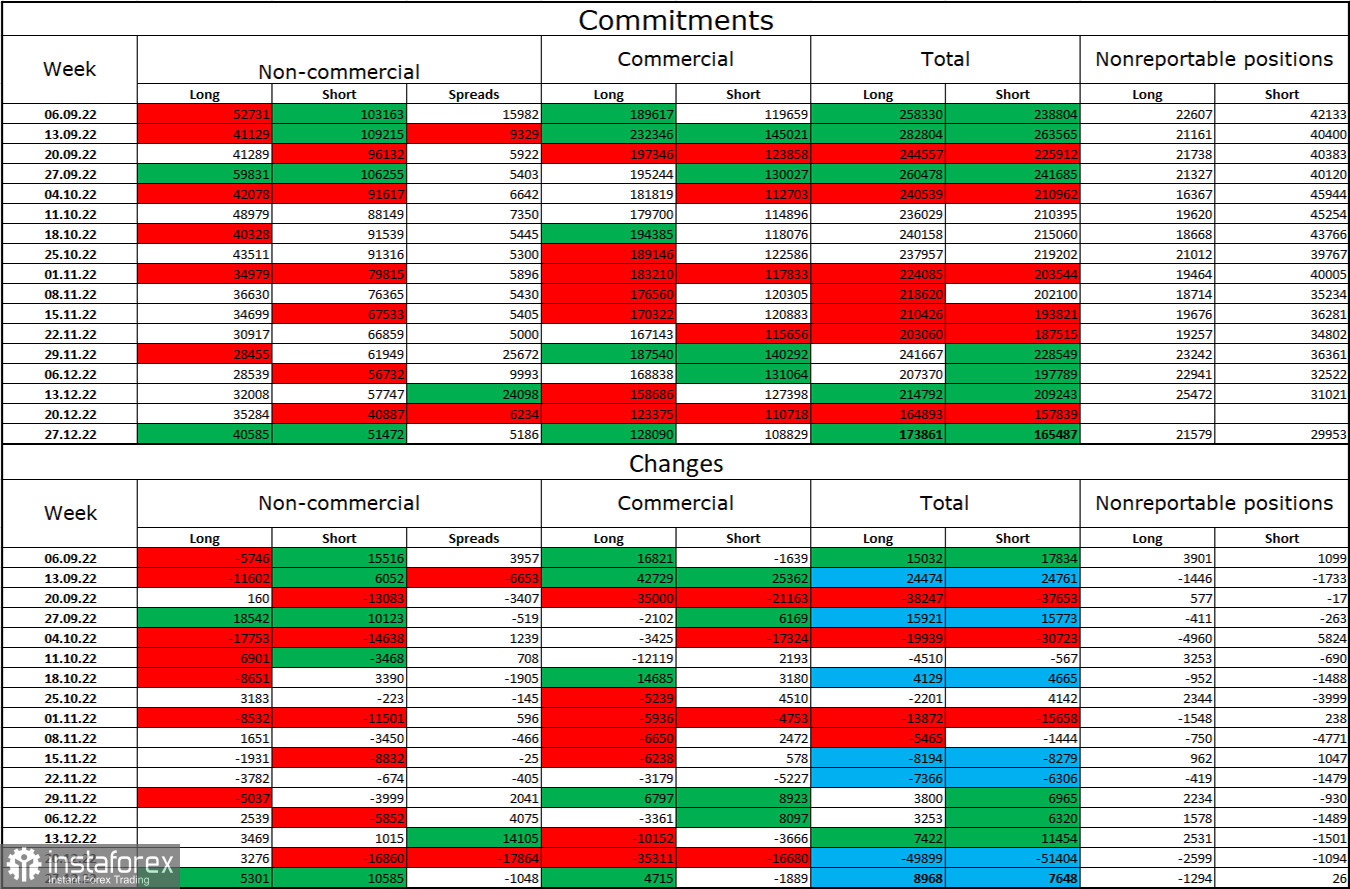

Report on Commitments of Traders (COT):

The sentiment among traders in the "Non-commercial" category over the last week has shifted more "bearish" than it did the week before. The number of short contracts increased by 10,585 units, while the number of long contracts held by investors increased by 5,301 units. However, the major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. However, during the past few months, a significant change has taken place, and presently there is not a significant disparity between the amount of long and short positions held by speculators. There was a threefold change a few months ago. As a result, the pound's chances have greatly improved recently. However, given that the 4-hour chart crossed above the three-month ascending corridor, the British pound may soon continue to decline.

The following is the UK and US news calendar:

UK – Index of business activity in the construction sector (09:30 UTC).

US – Average hourly wage (13:30 UTC).

US – Change in the number of people employed in the non-agricultural sector (13:30 UTC).

US - Unemployment rate (13:30 UTC).

US - ISM purchasing managers' index for the non-manufacturing sector of the USA (15:00 UTC).

The US has a packed calendar of economic events, but the UK will only report one business activity indicator on Friday. The information background can have a significant impact on how traders are feeling right now.

GBP/USD prediction and trading suggestions:

With a goal of 1.1883, I advised selling the British pound if it closed below 1.2007. This objective has been completed. With a target of 1.1737, new sales should close at a level below 1.1883. On the hourly chart, I suggest buying a British pound when it recovers from 1.1883 with a target of 1.2007.