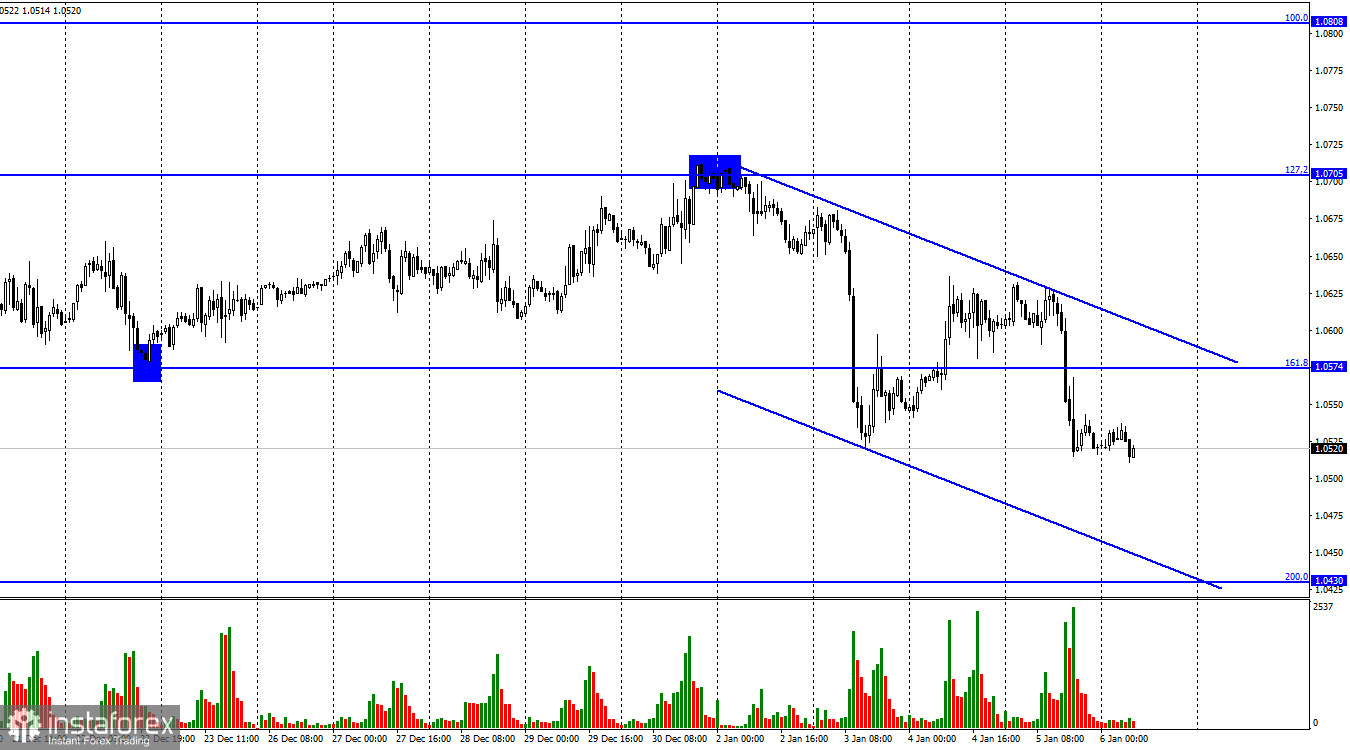

On Thursday, the EUR/USD pair reversed in favor of the US dollar and started a new declining process with a closure beneath the corrective level of 161.8% (1.0574). Therefore, the euro may decline to the Fibo level of 200.0% (1.0432). The downward trend corridor describes traders' attitudes as being "bearish."

The first statements by FOMC members in 2023 as well as economic updates were also presented yesterday, which was quite fascinating. I want to focus traders' attention on one of them and how they have performed. The Kansas City Fed's Esther George stated on Thursday that the Fed will maintain high rates for a considerable period after the increase is complete. She claims that such a strategy is necessary to further lower inflation. Demand is influenced by the Fed's monetary policies, and while a recession can be avoided this year and next, there is still a chance that it will happen. George also mentioned that the regulator can progressively relieve pressure on the economy because the most recent inflation statistics are favorable. However, it is crucial to avoid the "strict" PEPP being rejected too soon, and the Fed's balance sheet should be further shrunk.

George's remarks, in my opinion, can only be described as "hawkish." I should also point out that the ADP report, which represents the status of the US labor market, showed a 235,000 rise in employment rather than the 150 that traders had anticipated. As a result, there were numerous reasons to purchase the US dollar yesterday. We observed that traders reacted fairly logically. The activity of traders is unlikely to drop today due to the abundance of significant stories and events, but the direction of the pair will depend on statistics.

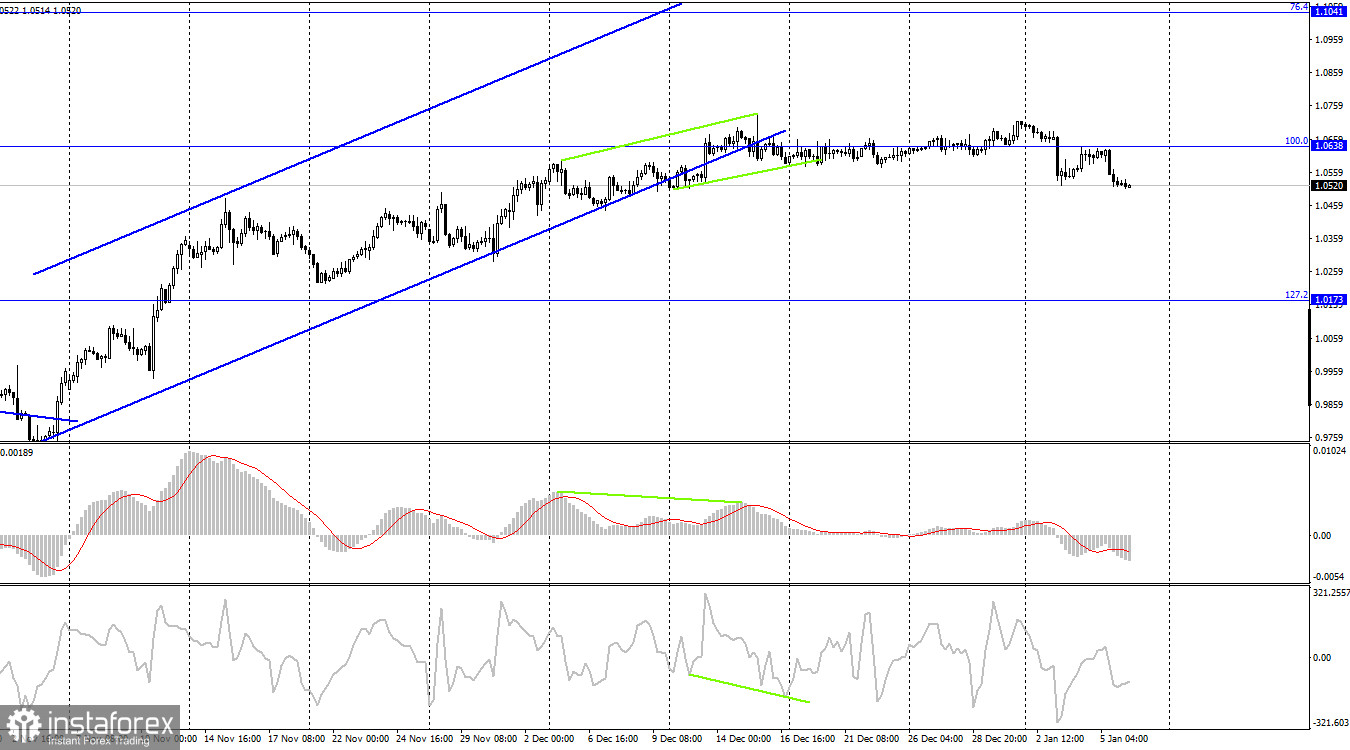

The pair reversed in favor of the US dollar on the 4-hour chart and anchored under the Fibo level of 100.0% (1.0638). The pair closed under a side corridor on the hourly chart, thus the downward process may continue in the direction of the following corrective level of 127.2% (1.0173). By itself, the consolidation beneath this level does not have the character of a signal.

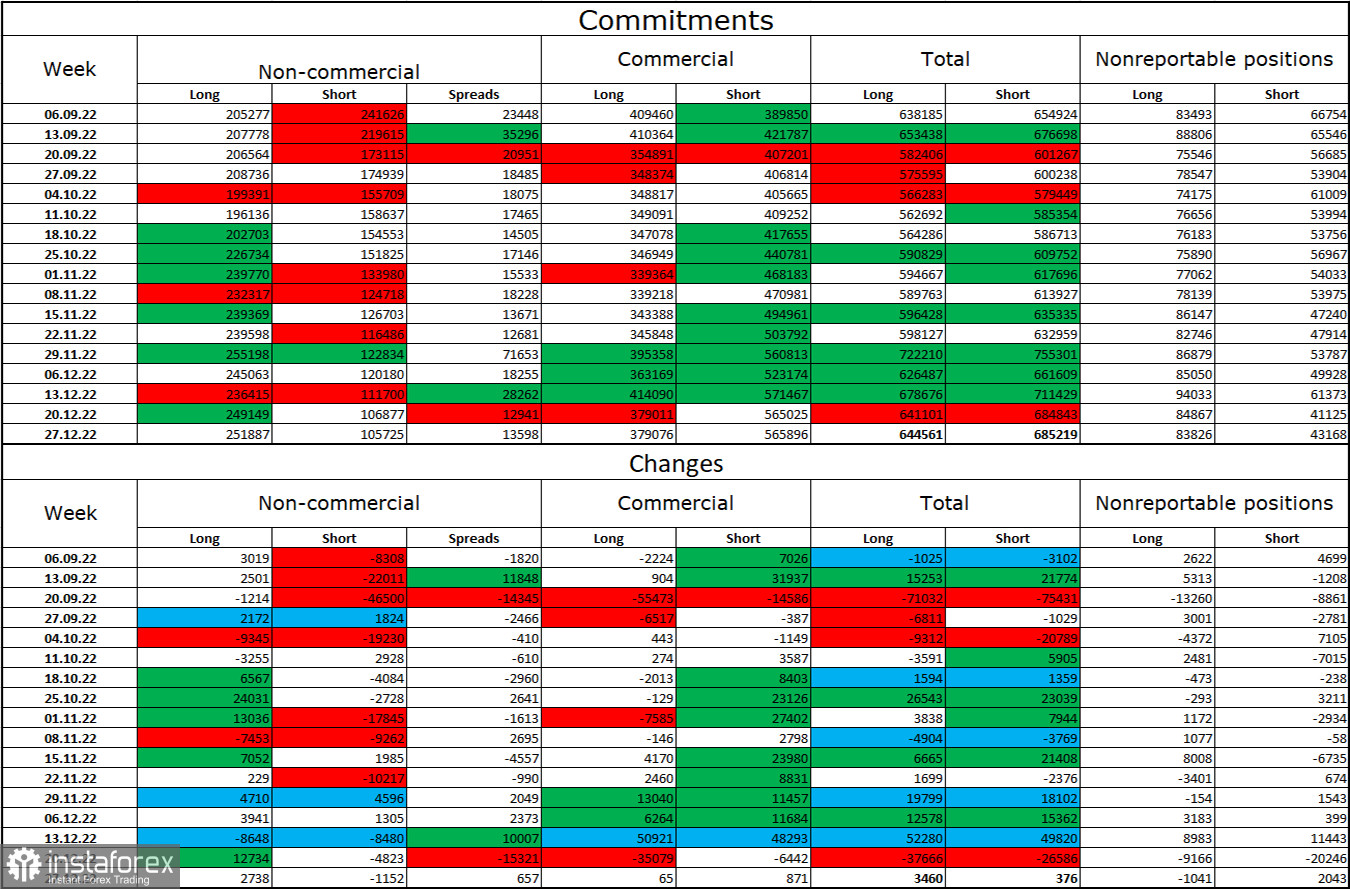

Report on Commitments of Traders (COT):

Speculators opened 2,738 long contracts and closed 1,152 short contracts over the previous reporting week. The positive sentiment among large traders is still present and getting stronger. Speculators now have 252 thousand of long contracts, while just 106 thousand short contracts are concentrated in their hands. According to COT statistics, the euro is currently rising, but I also notice that the number of long positions is already 2.5 times higher than the number of short positions. The likelihood of the euro currency increasing has been steadily increasing over the past few weeks, but now I'm wondering if it has increased too quickly. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. On the hourly and 4-hour charts, however, breaking through the ascending corridors may indicate a strengthening of "bearish" positions in the short term.

News calendar for the USA and the European Union:

EU - Consumer price index (CPI) (10:00 UTC).

EU - Retail sales volume (10:00 UTC).

US – Average hourly wage (13:30 UTC).

US – Change in the number of people employed in the non-agricultural sector (13:30 UTC).

US - Unemployment rate (13:30 UTC).

US - ISM purchasing managers' index for the non-manufacturing sector of the USA (15:00 UTC).

The calendars of economic activities in the European Union and the United States are jam-packed with significant records on January 6. The information background will have a significant impact on the traders' attitudes today.

Forecast for EUR/USD and trading suggestions:

I advised selling the pair with a target of 1.0430 when it anchored under the 1.0574 mark. These agreements can now be kept. With a target price of 1.0705 or when the euro price closes above a descending trend corridor on the hourly chart, I advise purchasing the currency when it recovers from the 1.0430 level.