The week started optimistic as risk appetite surged, accompanied by a weakening of dollar. Clearly, investors continued to buy in expectation of a pause in interest rate hikes after another 0.25% increase on February. Latest data on average payrolls also showed lower values than expected as market players anticipate a noticeable decline in the December consumer price report.

One thing that cooled down the bulls on Monday was the speech of Atlanta Fed President Raphael Bostic. He said the central bank should raise interest rates above 5% at the beginning of the second quarter and then suspend it for "a long time". These words brought the markets back to the reality that the Fed is still considering the continuation of rate hikes regardless of anything, may it be a fall in inflation or the risk of a deep recession.

Fed Chairman Jerome Powell, who is due to speak today, is unlikely to ride the wave of negativity, especially ahead of the release of the US inflation data for December. But if he does say something similar to what Bostic reported, sell-offs will surge today. This will renew demand for dollar, as well as the yields of US treasuries.

Forecasts for today:

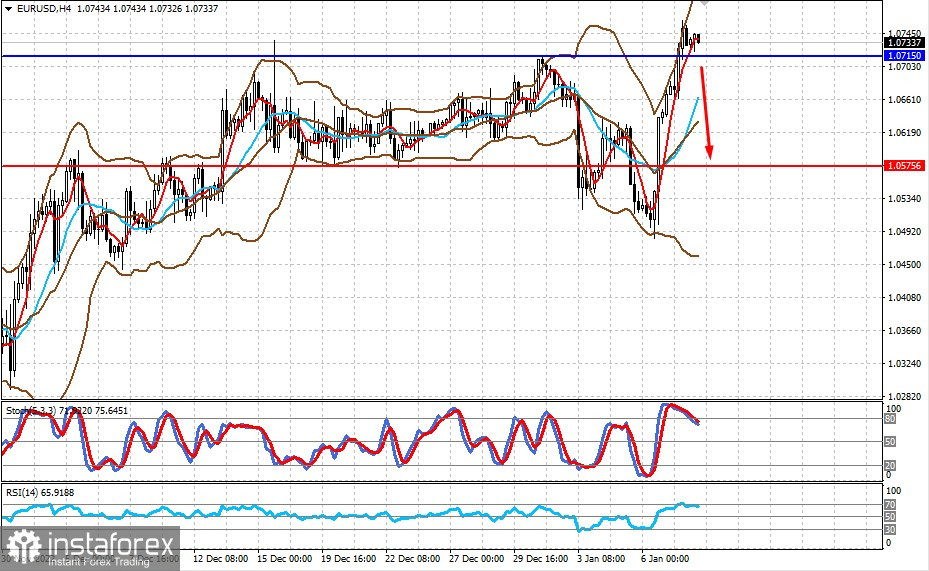

EUR/USD

The pair is trading above 1.0715. If negative sentiment prevails, it will drop to 1.0575.

AUD/USD

The pair is trading above 0.6900. A decline in risk appetite, accompanied by new concerns over further Fed rate hikes, may cause a price decrease to 0.6835.