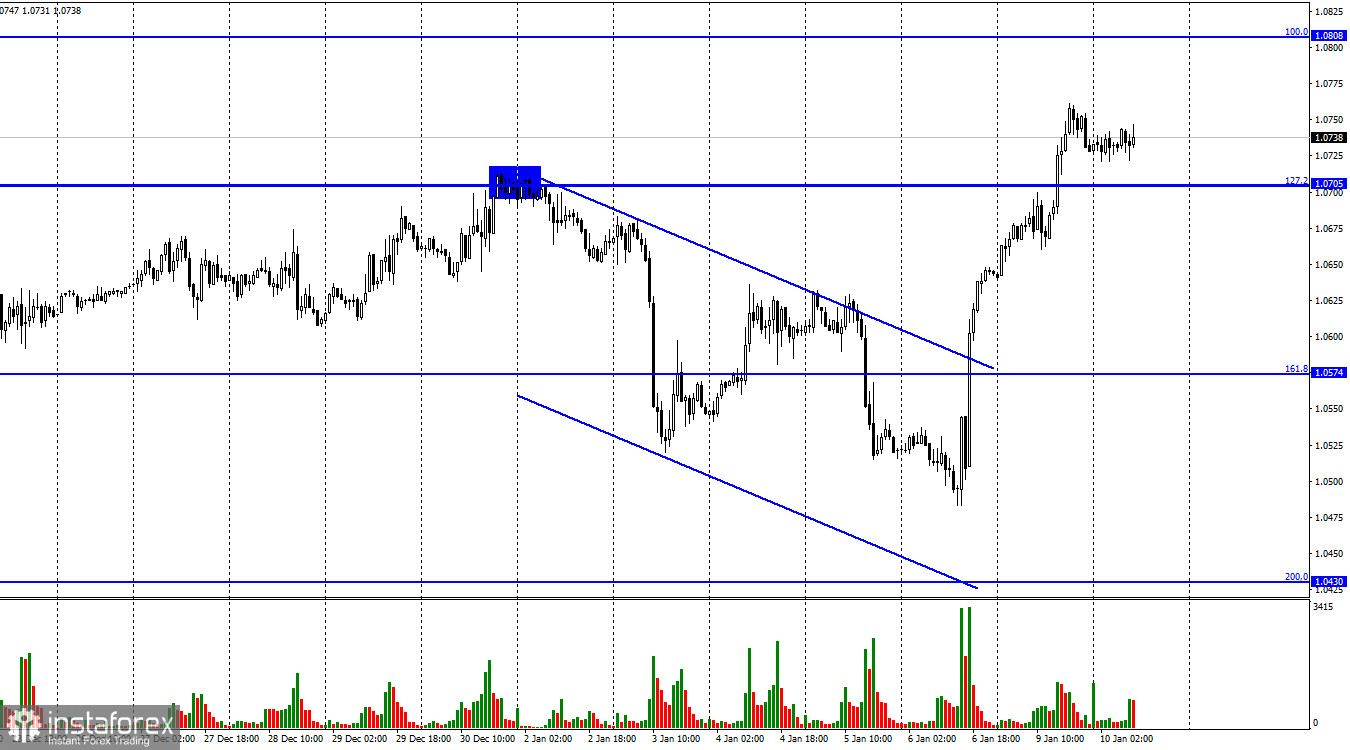

On Monday, the EUR/USD pair maintained its upward trend and secured above the corrective level of 127.2% (1.0705). The European currency can now continue to increase in value in the direction of the following Fibo level of 100.0% (1.0808). The US dollar will benefit if the exchange rate for the pair closes below 1.0705, and some of the falls will be in the direction of the corrective level of 161.8% (1.0574).

Although there was essentially no background information on Monday, traders continued to actively trade for another couple of days because the news and reports from Friday were sufficient. Let me remind you that Friday saw the release of significant nonfarm payrolls and unemployment statistics, which traders viewed as poor, although it was very difficult to do so. After all, the unemployment rate fell to 3.5%, and there were more payrolls than speculators had anticipated. Even though it is already Tuesday, the US dollar soon started to lose territory and is currently losing ground. I believe that traders anticipated seeing payrolls at a higher level than 223,000. At this point, determining who is correct and who is incorrect is difficult. I think traders' expectations were generally justified, and if they were hoping for an even higher price, it doesn't necessarily indicate that the US economy is deteriorating, a recession is about to start, or any other such thing. America can easily avoid a recession as long as the labor market continues to expand and the unemployment rate stays at its lowest level in 50 years. Therefore, I find it difficult to see how these reports could have been written in passive American currency.

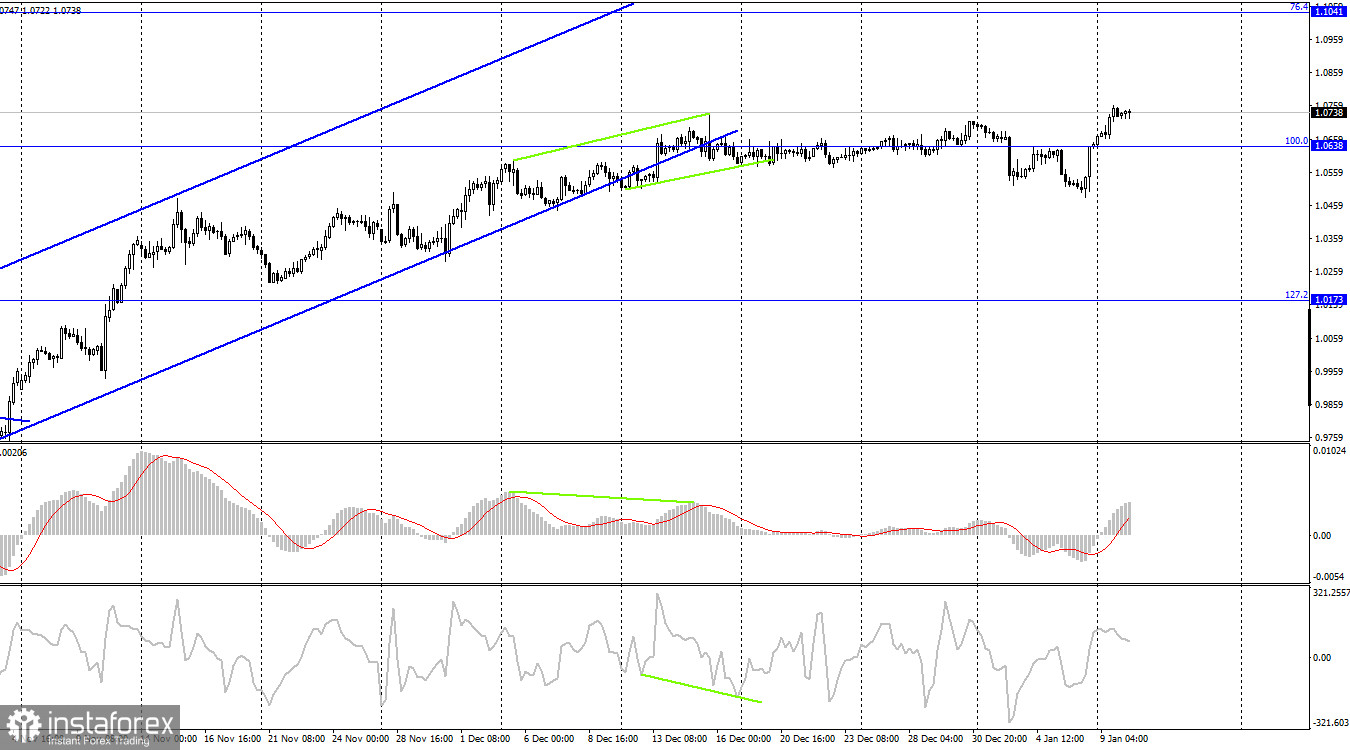

However, the consolidation of prices above the corridor of the downward trend beautifully shows that bull traders have resumed their onslaught and that market sentiment is "bearish." As a result, it is perfectly reasonable to anticipate the continued rise of the euro.

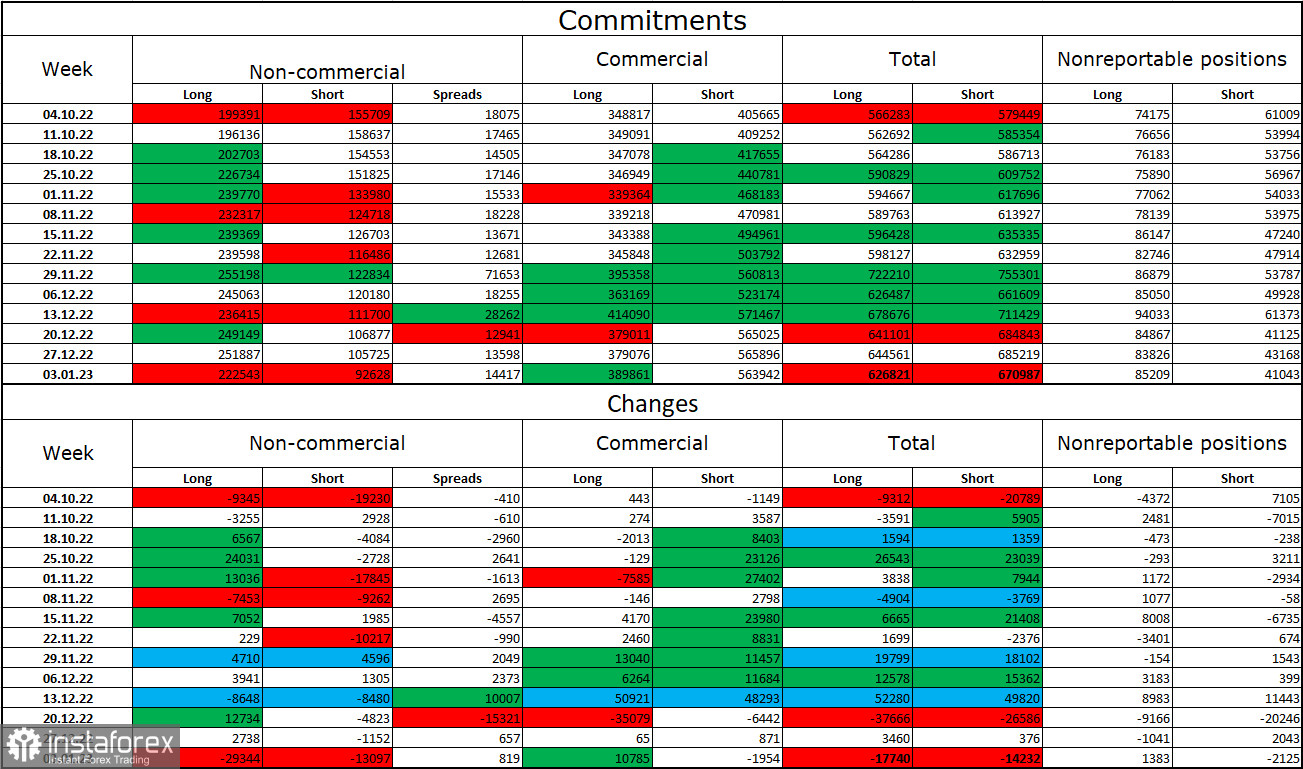

Report on Commitments of Traders (COT):

Speculators closed 29,344 long contracts and 13,097 short contracts during the previous reporting week. Major traders' optimism is still positive, but it has waned over the past two weeks. Currently, 222 thousand long futures and 92 thousand of short contracts are all concentrated in the hands of traders. According to COT statistics, the value of the euro is now increasing, but I'm also conscious of the fact that there are 2.5 times more long positions than short positions. The likelihood of the euro currency's expansion has been increasing over the past few weeks, much like the euro itself, but the information background does not always support it. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. Going beyond the ascending corridor on the 4-hour chart, however, would signal a strengthening of "bearish" positions soon.

The United States and the European Union's news calendar:

United States - Mr. Powell, the Fed's chairman, speaks

On January 10, there is a significant entry for both the European Union and the United States on the calendar of economic events. However, Powell's speech is a significant event, so the impact of the background information on the traders' attitudes today may be little.

Forecast for EUR/USD and trading suggestions:

On the hourly chart, I advise selling the pair at closing if it is below the level of 1.0705 with a target price of 1.0574. Alternatively, if the price moves up from the level of 1.0808 with a goal of 1.0705. I advise purchasing the euro when it rises above 1.0705, with a goal of 1.0808.