Against the backdrop of positive news from China and the weakness of the U.S. dollar, the AUD/USD pair has grown significantly in the last two trading days. Recently, the Chinese authorities decided to remove some of the restrictions on the import of Australian coal into the country. China has also significantly eased anti-COVID restrictions, which should positively impact the recovery of the Chinese economy, which actively uses Australian raw materials, in particular, in addition to coal, liquefied gas, iron ore and agricultural products.

Recently, new reports have come from China of easing on anti-COVID restrictions, in particular, the mandatory PCR test for entering the country is canceled, and citizens of the country will no longer be required to comply with centralized isolation.

Commodity currencies, particularly the Australian dollar, also strengthened recently amid increased investor optimism and expectations of softer decisions from the Fed regarding its monetary policy parameters, which, in turn, led to increased propensity to buy stock market assets.

Market participants still continue to evaluate the U.S. macro statistics published last week. Unfortunately, the positive report from the Department of Labor was largely ignored by market participants, who focused on the weak ISM report and the PMI indices in the services sector of the U.S. economy, also released on Friday.

As is known from the report of the Labor Department, U.S. employment increased by 223,000 in December, exceeding the forecast of 200,000, while unemployment fell to 3.5%, also being better than the forecast and the previous value.

However, the ISM Services Employment Index for December came out at 49.8, worse than estimate of 51.5, and the Purchasing Managers' Index at 49.6, below the forecast of 55.0 and the previous value of 56.5. At the same time, the index of new orders decreased from 56.0 to 45.2 (against the expectations of 58.5).

Buyers of the AUD/USD pair even ignored the weak macro statistics from Australia. Thus, the index of business activity PMI in the services sector of Australia fell again in December, to 47.3 (against 47.6 last month and the forecast of 46.9 points). The value of the indicator has been declining for the 6th month in a row.

Yesterday's preliminary November data on the number of building permits in Australia also turned out to be weak. The indicator decreased by -9.0% (after falling by -5.6% in the previous month, while a decline of -1.0% was forecast). The housing market (and hence the construction sector of the economy) may have begun to feel pressure from the Reserve Bank of Australia's interest rate hike, which is already negatively affecting the entire Australian economy.

Tomorrow at 00:30 (GMT), important macro statistics on Australia will be published, which may give a new reason for either concern about the state of the Australian economy, or for optimism, which will be reflected in AUD quotes accordingly. Their volatility will rise again in an hour, when Chinese consumer price indices are published. China is known to be Australia's largest trade and economic partner. Therefore, the publication of important macro statistics from this country is also reflected in the AUD quotes.

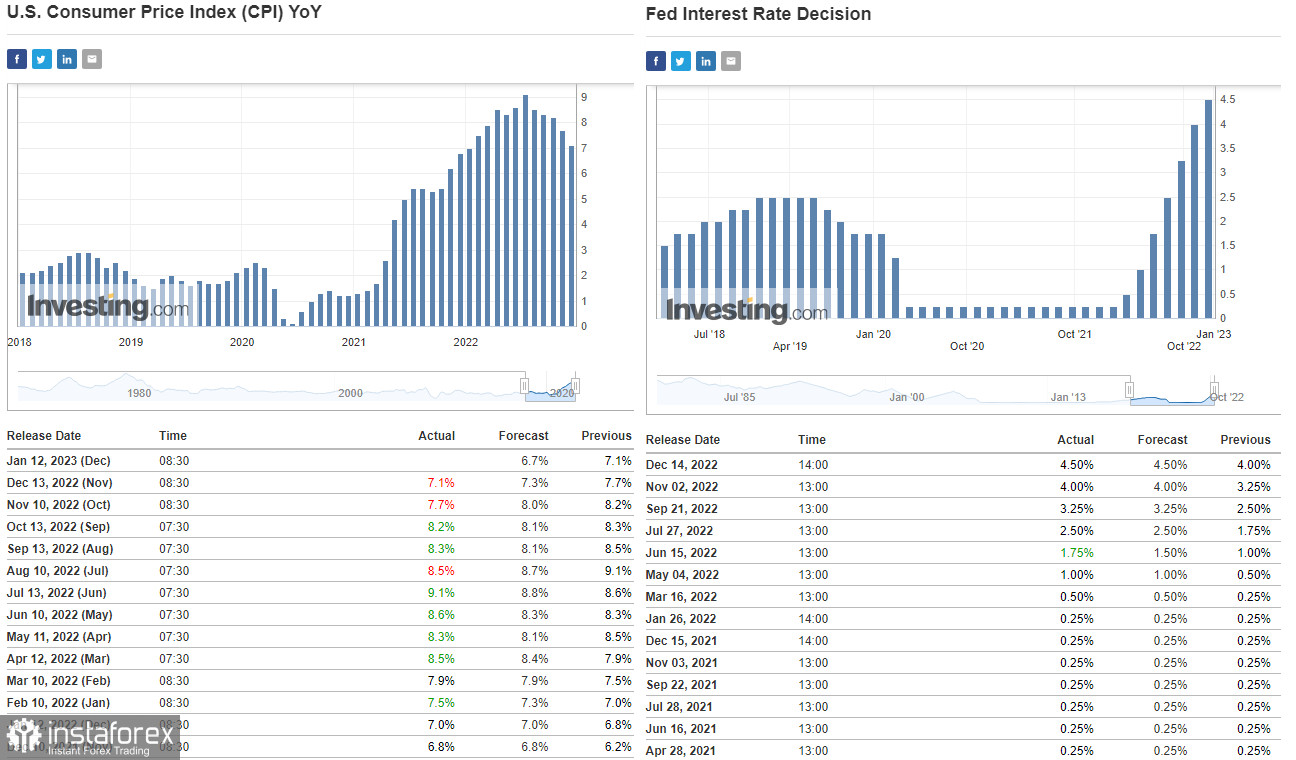

And today, market participants will follow the speech (at 14:00) of Fed Chairman Jerome Powell at the international symposium on central bank independence, organized by the Swedis central bank. According to the CME Group, market participants are pricing in almost 80% of the probability of a 25 basis point Fed rate hike on February 1. Nevertheless, Fed officials are pushing for a continuation of the tight monetary policy cycle through 2024. This, in particular, was stated yesterday by Federal Reserve Bank of Atlanta President Raphael Bostic.

Now it is important for market participants to hear Powell's opinion on this matter. If he also takes a tough stance on this issue, the dollar will have a chance to regain its recently lost ground.

The publication of consumer inflation statistics for December on Thursday will also be of importance for investors. The dollar will also strengthen its position if the data indicate a resumption of inflation growth. If not, the dollar may fall under a new wave of sales.