If investors mainly expect a slowdown in the monetary policy tightening cycle from the Fed, then from the Bank of England—a further increase in the interest rate by 1.0% and up to 4.50% by the summer (now the BoE's interest rate is at 3.50%).

In this sense, today, market participants will follow the speech of Federal Reserve Chairman Jerome Powell at the Swedish central bank's International Symposium on Central Bank Independence starting at 14:00 (GMT). It is important for market participants to hear Powell's opinion on this matter. If he also takes a tough stance on this issue, the dollar will have a chance to regain its recently lost ground.

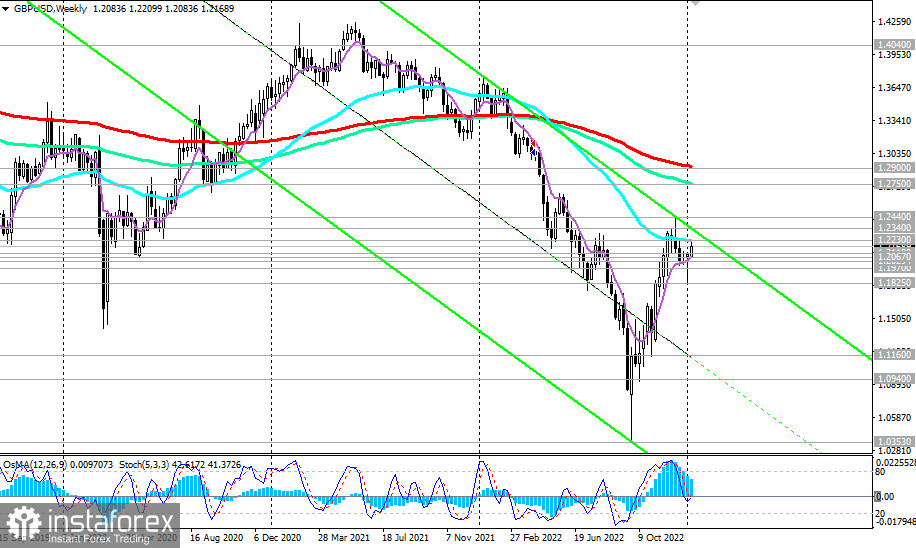

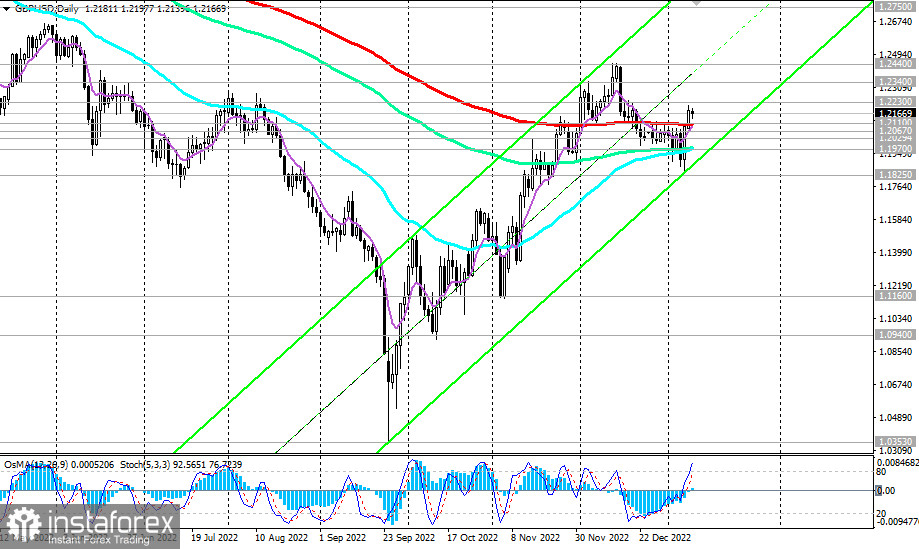

The GBP/USD pair is declining today after rising significantly in the past two trading days. Yesterday, the pair came close to the long-term resistance level 1.2230 (50 EMA on the weekly chart). The breakdown of which would open the way for the pair towards the key resistance levels 1.2750 (144 EMA on the weekly chart), 1.2900 (200 EMA on the weekly chart), separating the long-term bullish trend of the pair from the bearish one.

The scenario for a resumption of decline and a return to the long-term bear market zone will be associated with a breakdown of the 1.2110 key support level (200 EMA on the daily chart). A breakdown of the 1.1970 support level (144 EMA, 50 EMA on the daily chart) will confirm our assumption and return to a long-term bearish trend.

In the meantime, long positions remain preferable above the 1.2110 support level.

Support levels: 1.2110, 1.2100, 1.2067, 1.2030, 1.2000, 1.1970, 1.1900, 1.1825, 1.1800

Resistance levels: 1.2230, 1.2300, 1.2340, 1.2400, 1.2440, 1.2500, 1.2750, 1.2800, 1.2900

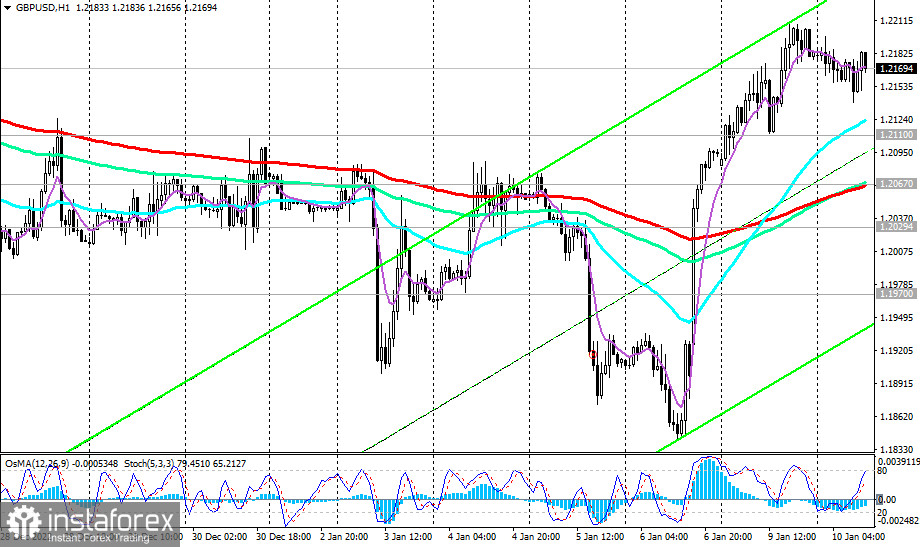

Trading tips

Sell Stop 1.2130. Stop-Loss 1.2210. Take-Profit 1.2100, 1.2067, 1.2030, 1.2000, 1.1970, 1.1900, 1.1825, 1.1800, 1.1575, 1.1500, 1.1400, 1.1300, 1.1200, 1.1160, 1.0940

Buy Stop 1.2210.Stop-Loss 1.2130. Take-Profit 1.2230, 1.2300, 1.2340, 1.2400, 1.2440, 1.2500, 1.2750, 1.2800, 1.2900