They miscalculated inflation in 2022, which resulted in the worst year for bonds since the 1970s and an $18 trillion loss in world equity capitalization. Investors are currently predicting that consumer prices will slow to 3-4% by the end of the year. But what if they end up being mistaken? Even though the future of the US currency currently appears blatantly "bearish," the dollar will eventually have the chance to rise from the ashes.

What is the cause of the euro's decline over the first three quarters of 2022? Due to the energy crisis brought on by the war in Ukraine, which is taking place close to the EU, the eurozone is currently in a recession. Because of this, the ECB is powerless to effectively combat inflation. Lockdowns in China also limit the currency bloc's ability to export goods and impede economic recovery.

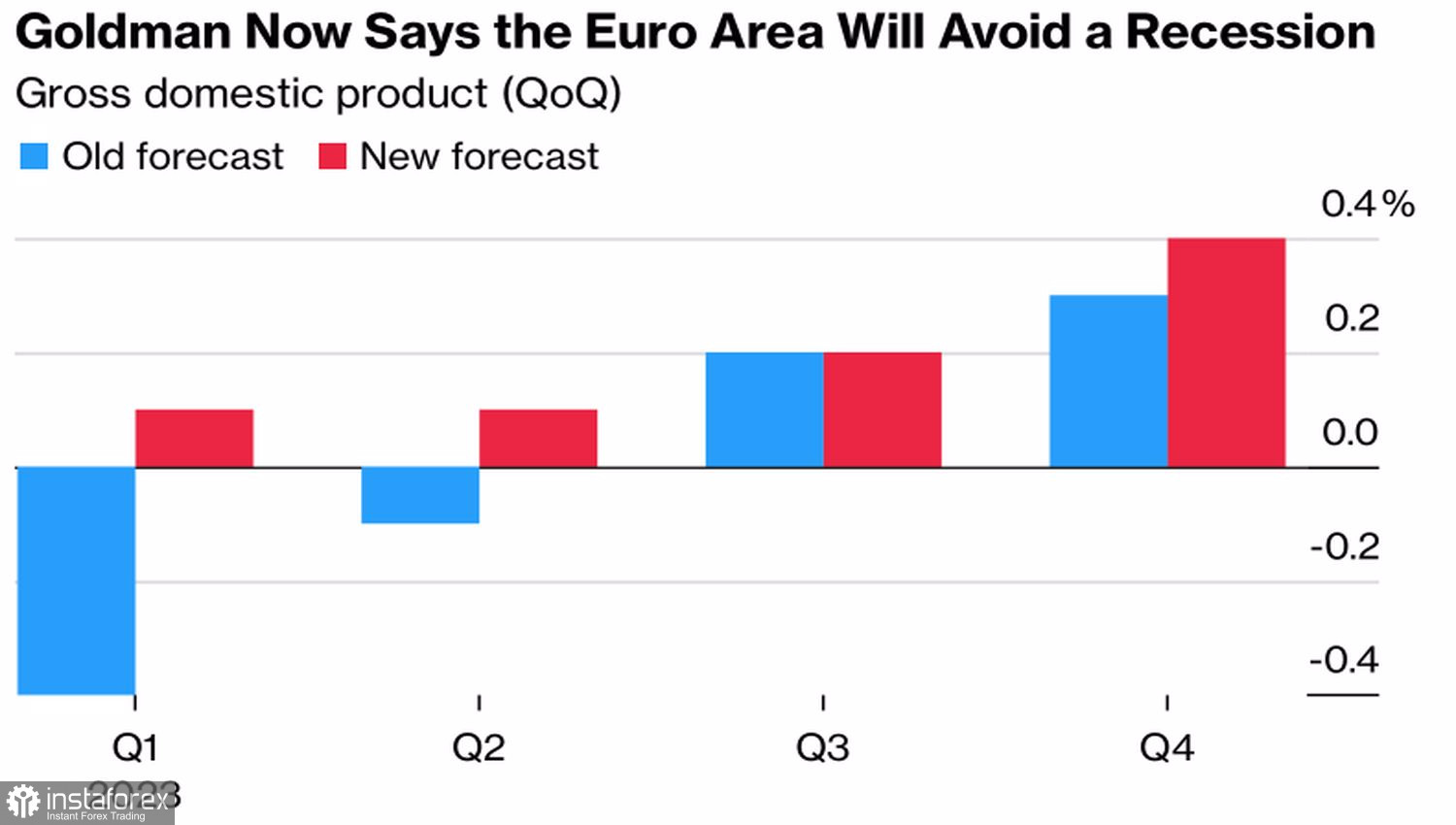

These are the standards. What took place? A shallow and transient recession is suggested by a 75% decline in gas prices in Europe as a result of mild weather, reduced demand, and increased storage capacity. According to Goldman Sachs, there won't even be a recession. He revised his estimate of the eurozone's GDP growth for 2023 from -0.1% to +0.6% in light of the region's economy's greater stability than anticipated and China's earlier opening. The bank predicts that the deposit rate will remain constant and that inflation will decrease to 3.25 percent by the end of the year. It will also increase by 50 bps at each of the Governing Council's first two meetings in 2023.

Economic predictions for the Eurozone from Goldman Sachs

The Celestial Empire's future seems much brighter as well. According to Morgan Stanley, the yuan will be worth 2% more at the end of the year compared to the US dollar, and Chinese stock indices will increase by 16%, making them the best-performing asset class overall.

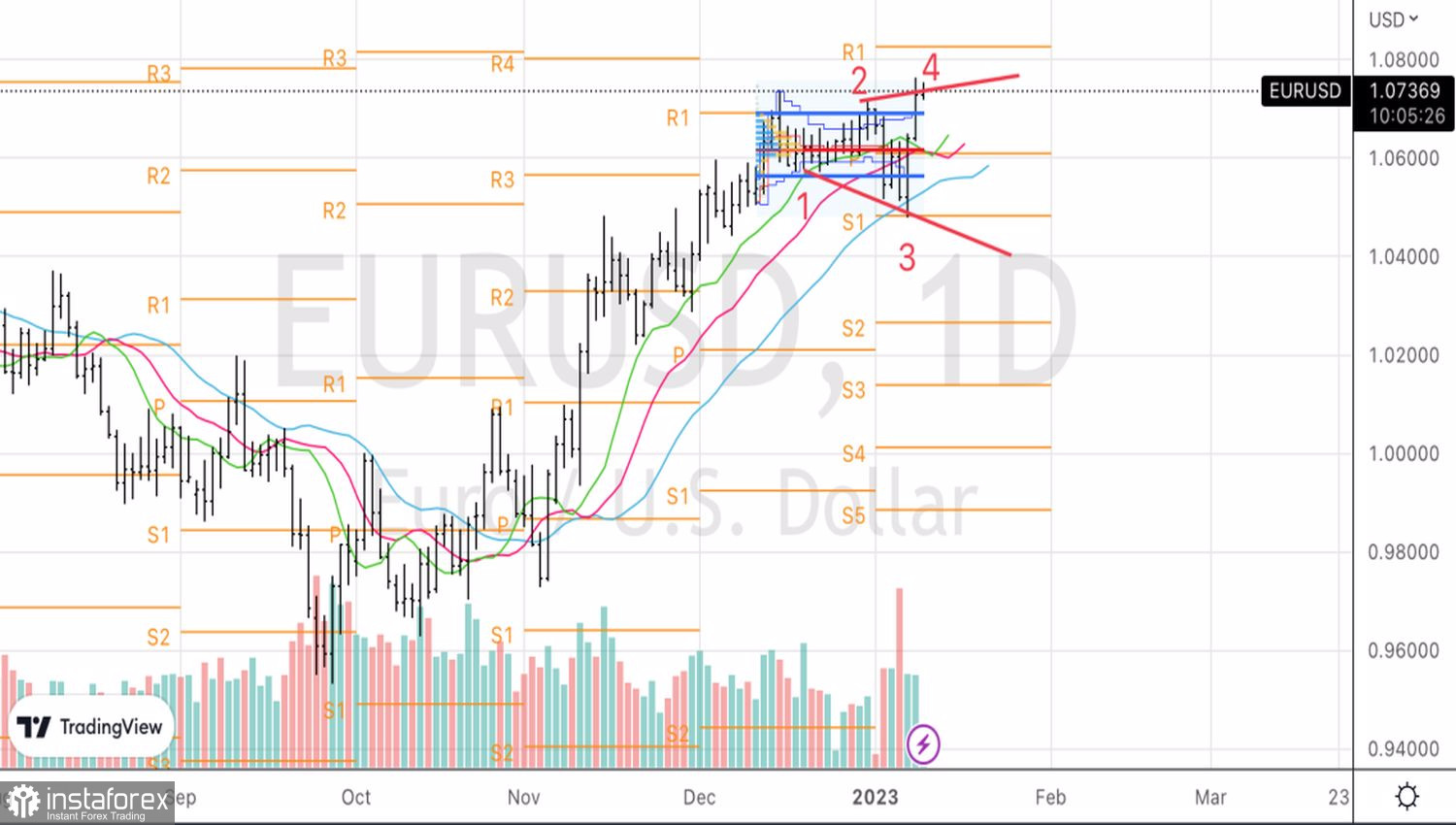

The medium- and long-term prospects for the EUR/USD currency pair are unmistakably "bullish" due to the higher stability of the European economy than previously believed, which frees the ECB's hands, and the recovery of China, which boosts demand for exports from the currency bloc. How the pair will act in the near future is another issue to consider.

Investors are assessing the likelihood of a federal funds rate increase of 25 or 50 basis points in February. Officials of the FOMC have doubts about the first result if the futures market is 78% confident in it. Jerome Powell may give a speech that is extremely hawkish due to the Fed's discontent with the eroding financial conditions, which make it tougher to combat inflation. Bulls on the major currency pair are terrified of this, and they will hold off on engaging in combat until they hear what the president of the Central Bank will say.

Technically, the risk of an expanding wedge reversal pattern developing will increase if the EUR/USD returns below the maximum at point 2 at 1.071 and below the upper bound of the fair value at 1.0685. On the other hand, the construction of longs will be supported by the rebound from current levels. I believe you should concentrate on closing prices and maintain both buying and selling as choices.