Futures on US stock indices rose as well as on European ones amid expectations of a slowdown in inflation. The report will be revealed tomorrow. If so, it will fuel hopes for smaller rate hikes by the Fed and other world central banks.

The Stoxx Europe 600 index climbed thanks to growing shares of mining companies. They have been the biggest gainers amid expectations that China's economic recovery will boost demand for metals.

Futures on the S&P 500 index grew by 0.3%, while futures on the NASDAQ gained more than 0.4%. US government bond yields declined compared to the previous session. 10-year government bonds are now trading just below 3.6% as investors are largely focused on the inflation report for December 2022. The US dollar index is hovering at a seven-month low.

Yesterday, Fed Chairman Jerome Powell made a speech. He avoided commenting on the future plans for monetary policy. He preferred talking about inflation data. It might signal that the Fed could move to smaller rate hikes despite the hawkish comments of some Fed policymakers. They keep saying that it is too early to discuss a policy reversal as there is no steady decline in inflation.

"Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time," Mr. Powell said. "Bringing inflation down when it is high can require measures that are not popular in the short term as we raise interest rates to slow the economy. The absence of direct political control over our decisions allows us to take these necessary measures without considering short-term political factors," he pointed out.

Investors who are trying to figure out the Fed's further steps should pay attention to the bond market, not to the Fed's comments. After the latest data, recession fears in the US and the eurozone have subdued. Besides, China is fully reopening. As a result, risk appetite is growing. This is why the likelihood of less aggressive tightening is rather high even despite the hawkish statements that could be made during the February meeting. Yesterday, Jerome Powell did not make any hints about monetary policy, which fueled a bullish momentum.

As I have mentioned above, shares of mining companies are rising amid expectations of a spike in demand for metals in China. Copper leapt above $9,000 a tonne for the first time since June, boosted by hopes of increased consumption by the world's largest consumer of metals. Oil also recouped its losses. Speculators are expecting an increase in demand from China amid reports of a rise in crude oil inventories in the United States.

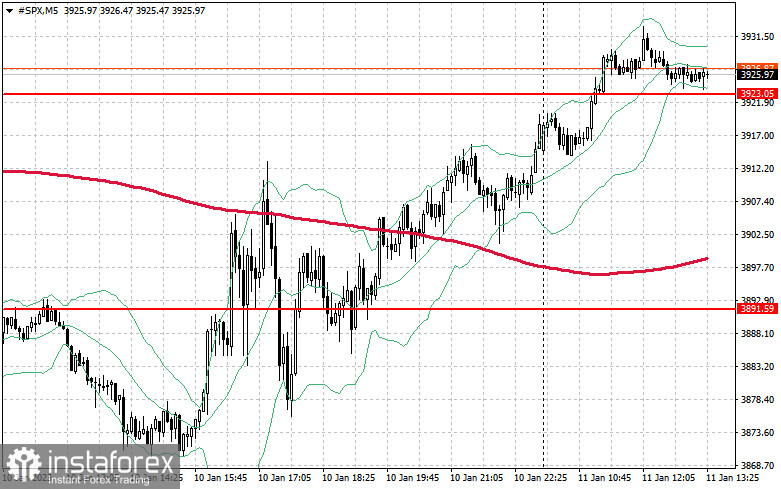

As for the technical outlook of the S&P500, the index may continue to grow. Bulls need to protect the level of $3,920, which will be their main task today. Only after that, there could be a jump to $3,961. The level of $3,983 is located a little higher. It will be quite difficult to push the pair above it. If the price drops below the support level of $3,920, buyers will have to defend $3,866. If the index breaks below this level, it is likely to decline to $3,839 and to $3,806.