Temperatures above average in Europe not only failed the energy gambit but also formed the basis of the EURUSD rally. The fall in gas prices below the levels that existed before the armed conflict in Ukraine made it possible to talk about a shallow and short-lived recession in the eurozone economy and untied the hands of the ECB. Goldman Sachs even believes that the currency bloc will avoid GDP contraction. If the worst is over, why shouldn't the euro keep growing?

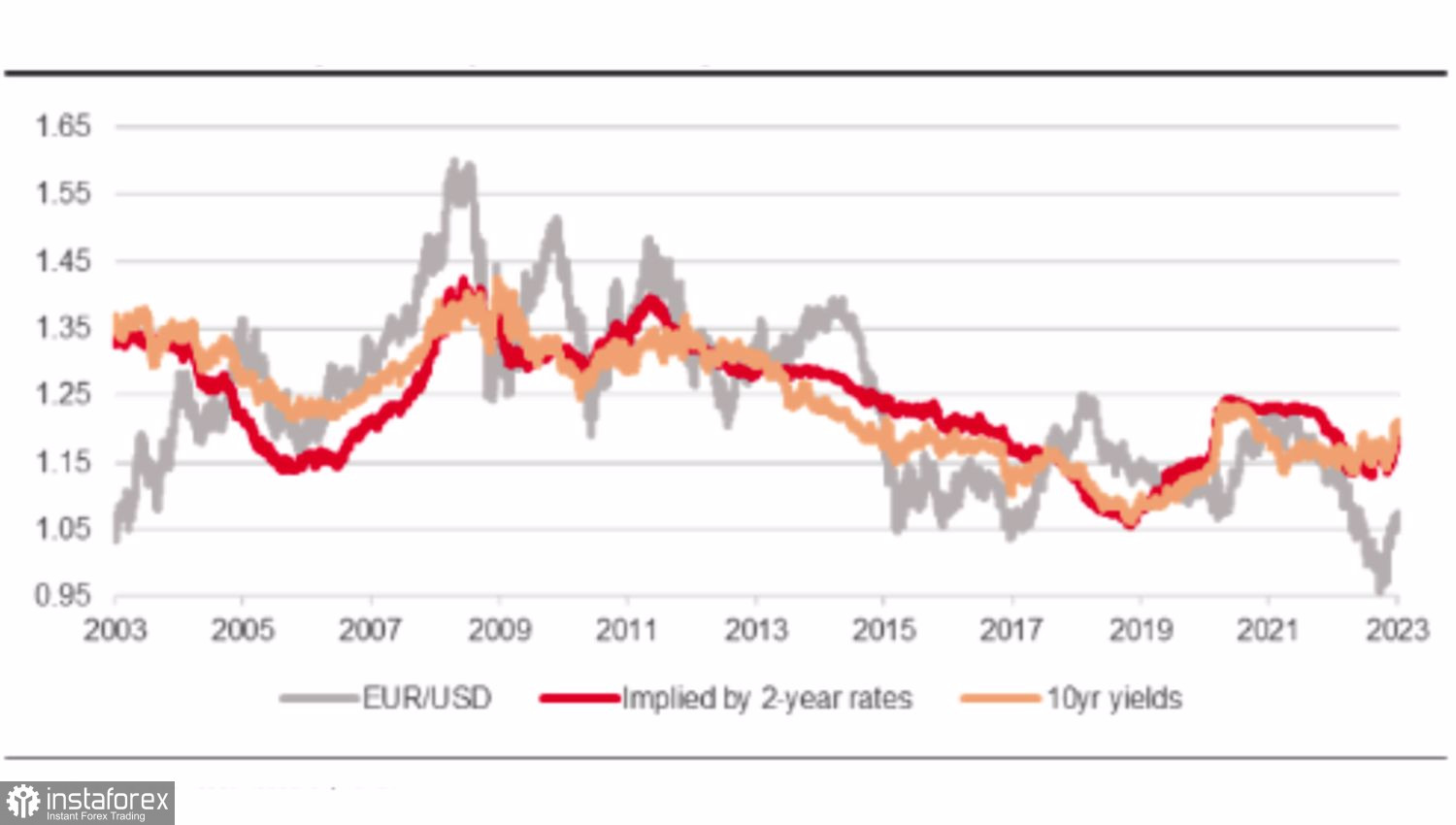

The consensus of Wall Street experts is shifting in favor of a continued rally of the major currency pair. Deutsche Bank and Morgan Stanley predict that EURUSD could rise to 1.15 this year. Nomura is betting at 1.1 by the end of January, while Societe Generale says that if it were not for the armed conflict in Ukraine and the associated energy crisis and the need for the ECB to find a compromise between inflation and economic growth, the euro would trade at $1.2. The company draws such conclusions based on the yield spreads of U.S. and German bonds.

Dynamics of EURUSD and U.S. and German bond yield differentials

According to TD Securities, fine weather is a kind of safety cushion to help the eurozone overcome the recession. Nothing lasts forever under the moon, and meteorologists' forecasts of a cold snap in the North-West of Europe may spoil the mood of euro fans. Luckily for them, temperatures will continue to be above normal in the rest of the eurozone.

Along with a favorable climate, EURUSD is supported by a slowdown in U.S. inflation and the Fed's monetary tightening cycle, the opening of the Chinese economy, as well as a number of positive macroeconomic reports. Actual data is better than expected, which allows the European index of economic surprises to rise. In the U.S., on the contrary, it is declining, and the divergence in economic growth faithfully serves euro fans.

Dynamics of the index of economic surprises in the United States

Pessimism about the negative impact of the energy crisis on the eurozone economy has undervalued European stocks, and now, when all the bad things seem to be over, investors are buying them like hot cakes. Over the past three months, German and French stocks have been rising almost twice as fast as the S&P 500, which, against the background of the EURUSD rally, accelerates the flow of capital from North America to Europe.

Add to that the ECB's faster pace of monetary tightening compared to the Fed, as the former intends to raise rates by 50 bps in February, and the latter will be limited to 25 bps, the upward trend for the main currency pair starts to look natural.

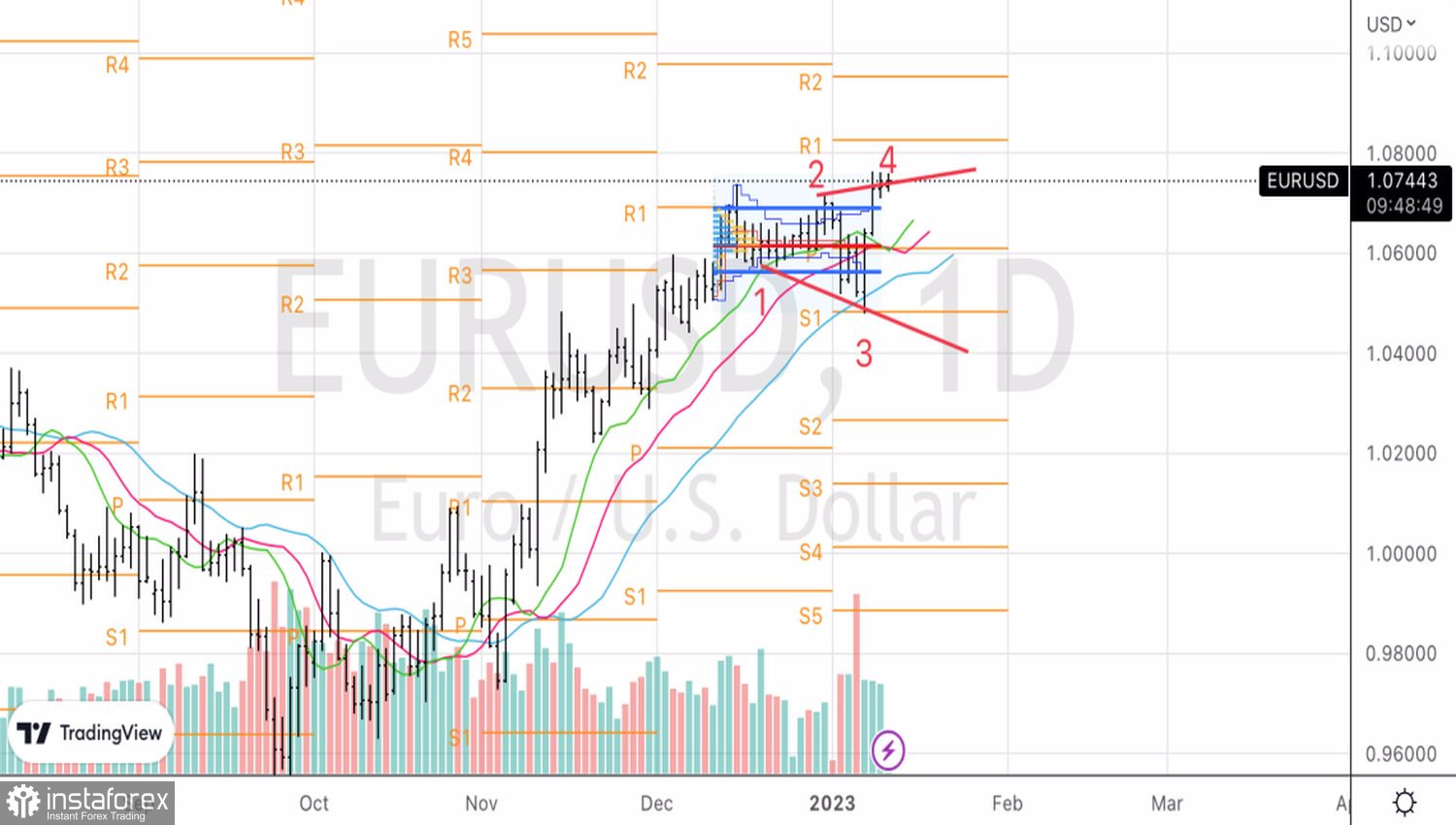

Technically, an inside bar has formed on the EURUSD daily chart. A break of its lower boundary at 1.071 will increase the risks of a pullback towards 1.068 and 1.061. On the contrary, a successful assault on the resistance at 1.076 may become the basis for the formation of long positions with targets at 1.08 and 1.0825.