The focus of traders today is the publication at 13:30 (GMT) of fresh inflation data in the United States. Economists expect the consumer price index to fall to 6.5% in December (from 7.1% in November) and the core CPI to 5.7% (from 6.0% in November), which confirms the market's expectations of a further decline in U.S. inflation. If the data proves to be true or is even softer, a further drop in the dollar appears to be unavoidable.

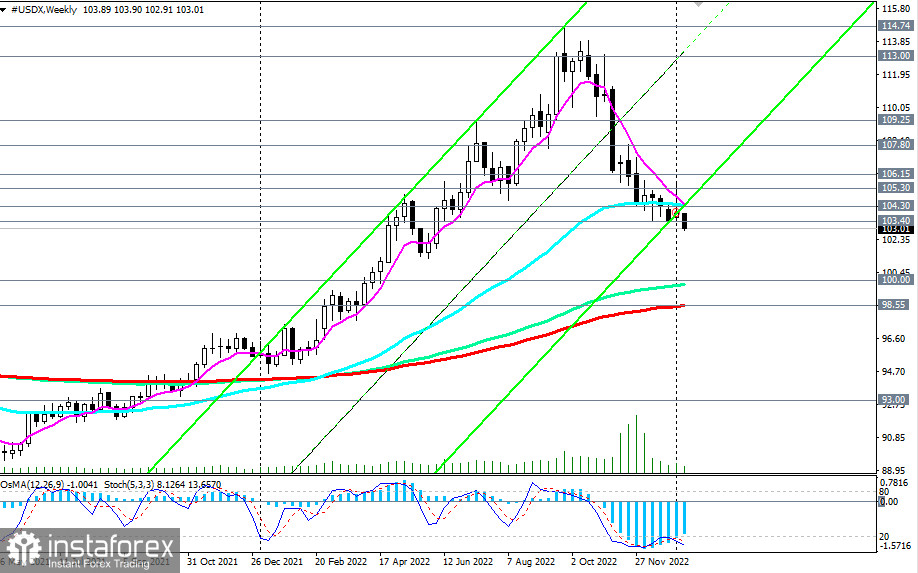

While market participants expect a further slowdown in the Fed's monetary policy tightening, the dollar remains under pressure, trading in the medium-term bear market zone, below the key resistance levels 104.30 (50 EMA on the weekly chart), 105.30 (200 EMA on the daily chart).

Repeatedly testing the 103.40 support level earlier, today DXY (CFD #USDX in the MT4 trading terminal) nevertheless broke through it, reaching 103.00 as of this writing.

Possibly, today's publication of U.S. inflation data, if they again point to a slowdown in inflation, will become an additional negative factor for the dollar and its DXY index. In this case, the key support levels at 100.00, 98.55 (200 EMA on the weekly chart) will become the targets for the decline. The breakdown of the 93.00 support level (200 EMA on the monthly chart) will indicate the breaking of the global DXY bullish trend.

In the alternative scenario, the DXY will resume growth, returning to the bull market zone above the 105.30 resistance level. The first signal of the implementation of this scenario will be a breakdown of the resistance levels 103.40, 103.75 (200 EMA on the 1-hour chart). The breakdown of the 106.15 resistance level (144 EMA on the daily chart) will confirm the scenario of the resumption of growth in DXY.

Support levels: 103.00, 102.00, 101.00, 100.00, 98.55, 93.00

Resistance levels: 103.40, 103.75, 104.00, 104.30, 104.91, 105.00, 105.30, 106.00, 106.15, 107.80, 109.25

Alternative Scenarios

Dollar Index CFD #USDX: Sell Stop 102.90. Stop Loss 103.50. Take-Profit 102.00, 101.00, 100.00, 98.55, 93.00

Buy Stop 103.50. Stop-Loss 102.90. Take-Profit 103.75, 104.00, 104.30, 104.91, 105.00, 105.30, 106.00, 106.15, 107.80, 109.25