Both European indices and US stock index futures are up for the third day in a row. Traders were anticipating a positive report on US inflation that would indicate a decrease in prices in December, allowing the Federal Reserve to hike interest rates more gradually.

The Nasdaq 100 futures increased by more than 0.3%, and the S&P 500 futures increased by around 0.2%. Following news that the development of the electric vehicle manufacturer's factory in Shanghai had been delayed, shares of Tesla Inc. fell in the premarket.

On Thursday, the key European indicator increased 0.7%, supported by a second day of gains in real estate stocks amid expectations for a more favorable outlook on interest rates.

While the dollar index fell as investors tried to disregard the hawkish remarks made by Federal Reserve System officials, US treasuries stabilized after increasing on Wednesday.

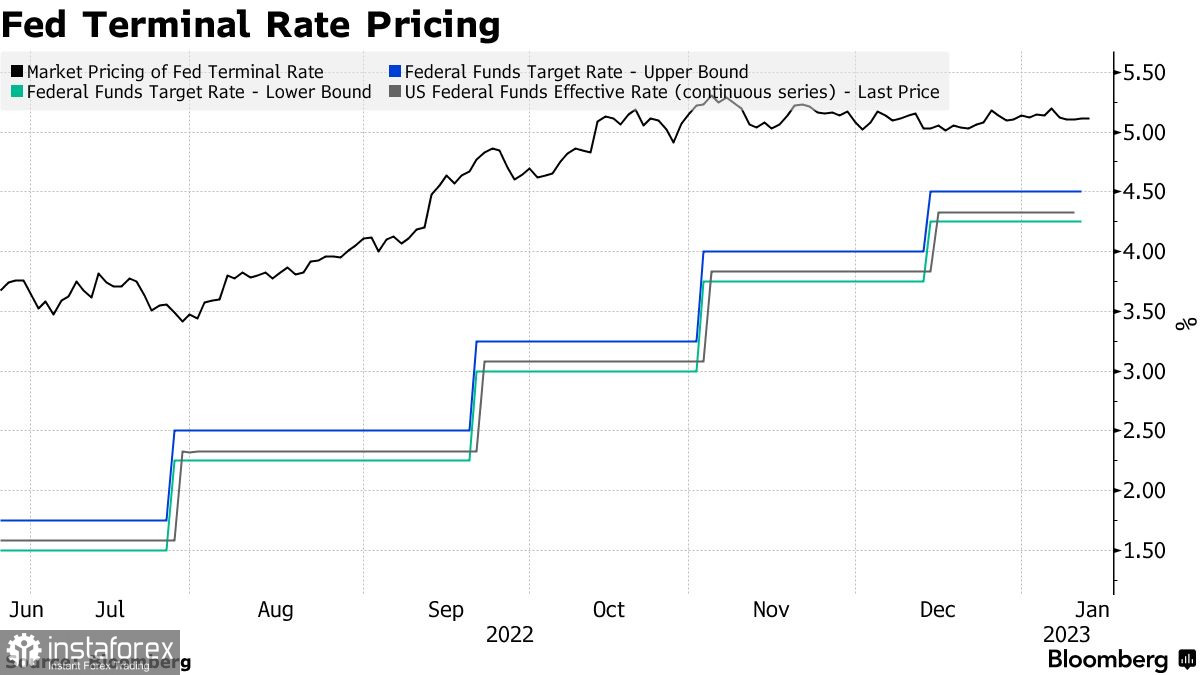

Rates are expected to peak at about 5.5% and stay there for a very long time, according to several esteemed economists who spoke yesterday at the Chicago Fed. This will prevent costs for everything from food to fuel from rising too quickly. Some people, however, think that the maximum interest rate won't go above 5.0%.

Data on the US consumer price index for December are anticipated to show a decrease of 6.5% year-over-year. Naturally, every detail of the consumer price index report will be carefully examined, since core inflation, which excludes the cost of gasoline and food, is also quite significant. Considering that the expected decline will only reach 5.7%, well above the Fed's target, the regulator will be able to keep interest rates high.

It is clear that despite the anticipated drop, inflation is still much higher than the goal level, allowing the Fed to fulfill its mandate and postpone taking drastic action. Given that the Fed delayed hiking rates in 2021, it is likely that the missed opportunity will be made up for in 2023.

In other markets, oil has increased for the sixth day in anticipation of a drop in US inflation. Before the Lunar New Year holidays, China is expected to buy more crude oil, maintaining the market for black gold. Traditional gold increased ahead of information that would reveal its two-month upswing.

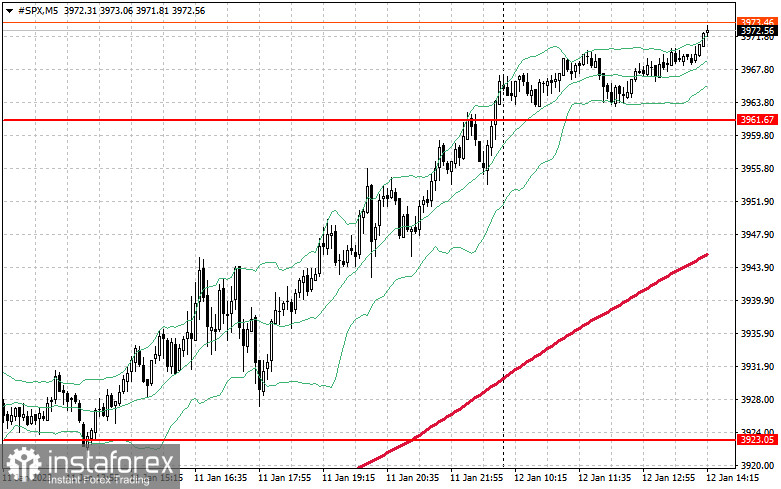

According to the S&P500's technical picture, the index might keep expanding. Protecting the $3,960 nearest level will be a priority for today to achieve this. The trading instrument is expected to strengthen to $3,983 just after that, at which point we can anticipate a more confident upward move. The $4,010 level is a little higher; it will be challenging to surpass it. Buyers are only required to declare themselves in the vicinity of $3,866 in the event of a downward trend and a lack of support at $3,960 and $3,920. The trading instrument's breakdown will swiftly push it to $3,839, and the $3,806 region will be the furthest goal.