Long positions on EUR/USD:

The market is focused on the US inflation data release. Consumer prices in the US may have continued to decline at the end of last year. If the data exceeds economists' expectations and if inflation declines more than expected, the euro is likely to grow so fast that the price may reach the resistance level near 1.0900. If the report disappoints and prices continue rising, the pressure on the euro is expected to return and traders will have to protect the support of 1.0728, which was formed yesterday. If the pair decreases and forms a false breakout at this level, it may give an entry signal, allowing bulls to push the price back to the weekly high of 1.0768. Notably, the price failed to break through this level in the first half of the day. A downward test of this level will be an extra entry point into go longs with the target at 1.0810, launching a bullish trend. Meanwhile, this level may be pierced only if we see strong data. The upward movement will trigger Stop Loss orders. Thus, an additional signal will be formed with the target located at 1.0853, where one may lock in profits. However, if the EUR/USD pair falls and bulls fail to protect 1.0728, as well as we see that US inflation remains high, the pressure on the pair will increase dramatically. Therefore, the price may plummet to the support of 1.0687, where only the formation of a false breakout may lead to a buy signal for the euro. It would be better to open long positions on a pullback at the low of 1.0653 or lower near 1.0618, allowing an upward intraday correction of 30-35 pips.

Short positions on EUR/USD:

Traders are sitting on the fence amid the lack of economic data before the US inflation report, which can reverse the market quickly. For this reason, there are few risk-takers. That became clear after the price went below 1.0755, bears fled the market, lacking support from other players. Now, bears need to hold the euro below 1.0768, and as long as the pair is trading below this level, the chance of a larger correction remains. If the EUR/USD pair increases during the North American session after the US data, it would be better to sell the euro after an unsuccessful consolidation above 1.0768. This would create a signal to open short positions and push the price down to the area of 1.0728, which was tested several times yesterday. If this area is pierced and tested, the short-term bullish outlook may be canceled, adding pressure on the euro and creating an additional sell signal with the target of 1.0687. Settling below this level would trigger a decline to 1.0653. Thus, the bear market may return. Traders may take profits there. If the EUR/USD pair soars during the North American session and bears show weak activity at 1.0768, which may occur after the US inflation declines, it would be better to open short positions only from 1.0810. In addition, you may wait for an unsuccessful consolidation and a false breakout at that level. One may sell the euro on a pullback from the high of 1.0853, allowing a downward correction of 30-35 pips.

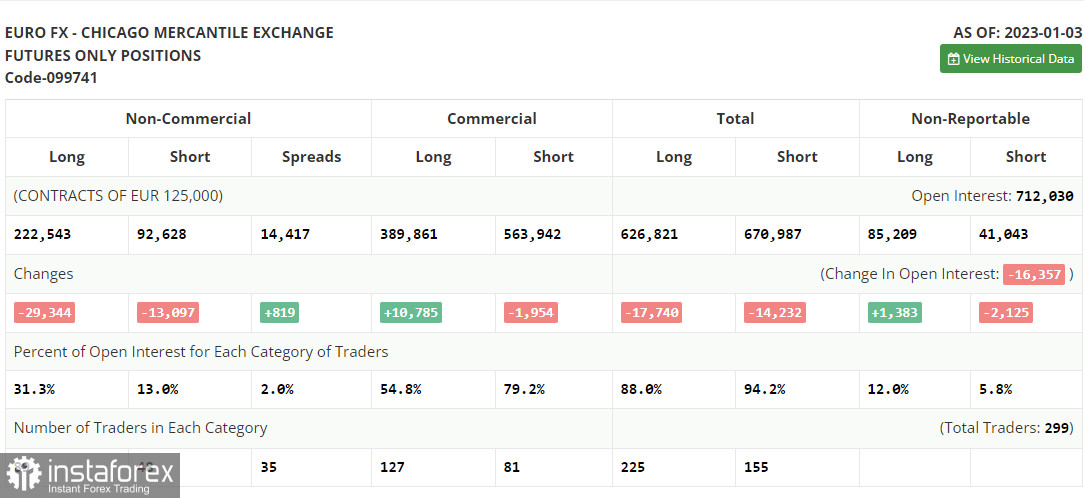

The COT report for January 3 showed that both long and short positions had a significant outflow. Before the uncertainty surrounding the Federal Reserve System's and the European Central Bank's future policy, traders preferred to lock in profits at the beginning of the year. It is the right time to slow down aggressive trading as inflation is beginning to decline, but nobody is going to do this just yet. This means that global economic recession is unlikely to be avoided this year. The demand for risky assets is constrained. Additionally, data on US inflation will be released soon, and the Federal Reserve System's policy will depend on this report. This week, Fed Chairman Jerome Powell will undoubtedly address this issue in his remarks. According to the COT data, short non-commercial positions fell by 13,097 to 92,628 while long non-commercial positions fell by 29,344 to 222,543. The total non-commercial net position was 142,279 at the beginning of the week. However, it was 129,915 on Friday. All of this shows that investors are still buying the euro, assuming that this year's harsh central bank measures would ease. Nonetheless, a new fundamental justification is required for the euro to continue to expand positively. The weekly closing price dropped to 1.0617 from 1.0690.

Signals of indicators

Moving Averages

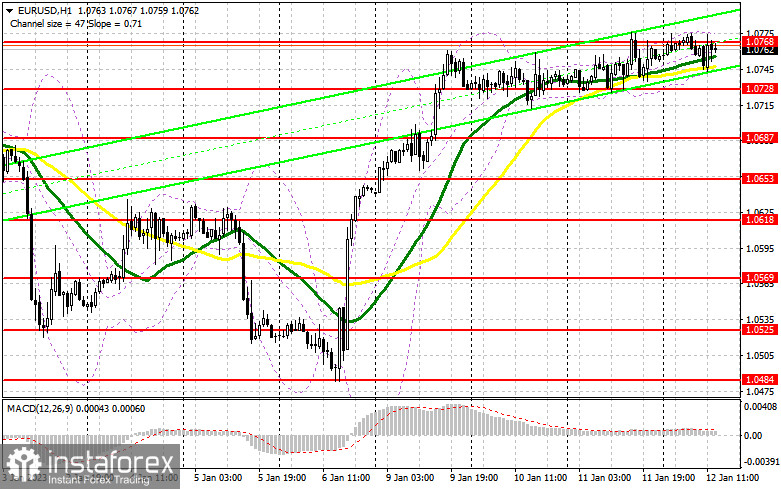

The pair is trading near the 30- and 50-day moving averages, suggesting that the market is moving sideways.

Note: The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

If the price increases, the upper band of the indicator near 1.0750 will offer resistance.

Description of indicators

- Moving average defines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart;

- Moving average defines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart;

- MACD (Moving Average Convergence/Divergence) indicator. Fast EMA 12. Slow EMA 26. SMA 9;

- Bollinger Bands. Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.