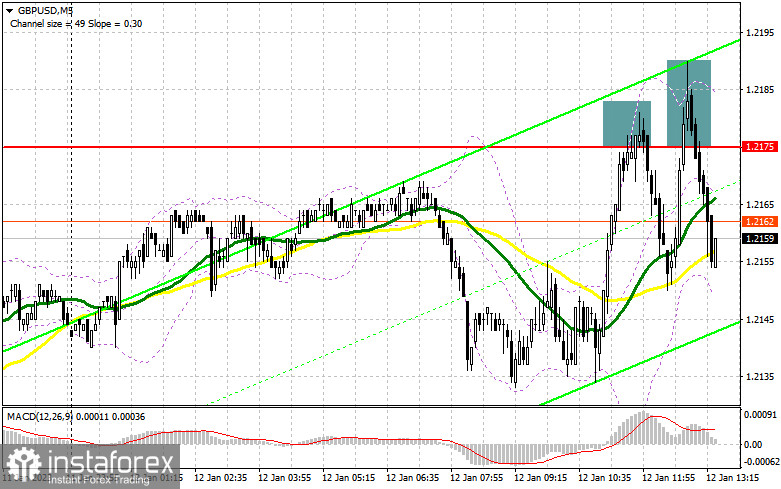

In the morning article, I turned your attention to 1.2175 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A rise and a false breakout of 1.2175 created a sell signal, which was still relevant at the time of writing the article. From the entry point, the pair declined by about 20 points. however, traders are anticipating crucial data – the US inflation report. This is why they are rather cautious. In the afternoon, the technical outlook changed slightly as well as the trading strategy.

When to open long positions on GBP/USD:

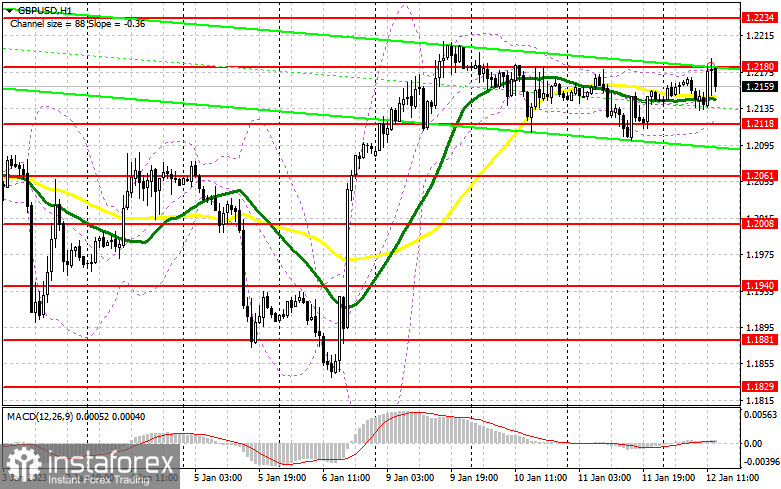

The pound sterling is likely to climb significantly following CPI data, especially if it exceeds the forecast. In this case, it is better to open long positions after a breakout of the resistance level of 1.2180. It could trigger a larger upward movement. Those who are afraid of trading in a period of high volatility may wait for a drop and a false breakout of the support level of 1.2118, formed yesterday. A new buy signal may appear, facilitating the uptrend. The pair could return to 1.2180 – a new resistance level formed today. A breakout of 1.2180 may occur without a downward retest. This is why one should pay attention to this level. If CPI data turned out to be better than economists' forecasts, it would be wise to open long positions with the prospect of a rise to 1.2234. A jump above 1.2234 with a similar retest will boost the pair to 1.2301 where I recommend locking in profits. A more distant target will be the 1.2350 level. However, the pair will hardly reach it if there are no strong fundamental or political factors. If the bulls fail to protect 1.2118 amid the news about a rise in inflation, a steeper downward correction is likely to take place. For this reason, I would advise you to postpone long positions until a decline and a false breakout near a low of 1.2061. You could buy GBP/USD at a bounce from 1.2008, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

As long as trading is carried out below 1.2180, there is a chance for a fall in the pound sterling and a sell signal. The bears are now defending the pivot resistance level of 1.2180. Of course, the best scenario for opening short potions when the pair is trading in a narrow range before inflation data would be a false breakout of the upper limit of 1.2180. However, keep in mind that any inflation figures could lead to a sharp market reversal. In case of a decline, the target level will be the support level of 1.2118. Only a breakout and an upward retest of this level will increase the pressure on the pound sterling. It will give a sell signal with the prospect of a drop to 1.2061 and 1.2008 where I recommend locking in profits. A more distant target will be the 1.1940 level. If GBP/USD rises and bears show no energy at 1.2185 in the afternoon, GBP bulls are likely to take the upper hand. The pair could advance to a monthly high. In this case, only a false breakout of the resistance level of 1.2234 will give an entry point into short positions with the prospect of a new downward movement. If bears show no activity there, you could sell GBP/USD at a bounce from a high of 1.2301, keeping in mind a downward intraday correction of 30-35 pips.

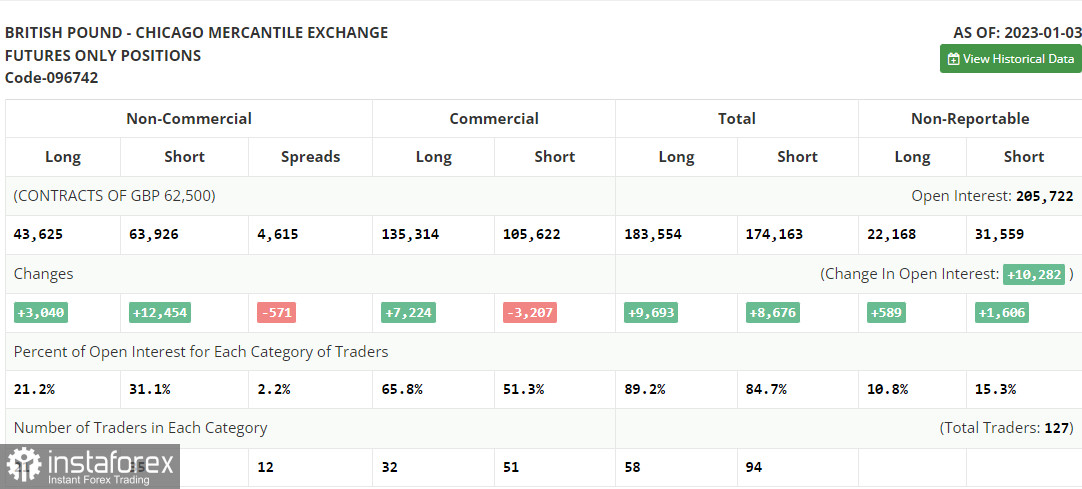

COT report

The COT report (Commitment of Traders) for January 3 logged an increase in long and short positions. Short positions exceeded long ones by almost four times. It clearly indicates that buyers see no reason for further growth of the pound sterling at the start of this year. Given that central banks are not going to change monetary policy yet and will continue to raise interest rates, the pound sterling could lack new drivers for a steady rise. The US economy has already entered a recession. The Bank of England is also going to cut rates. This is the main reason why the pound sterling is unlikely to continue its rally. If the US inflation rises, the pound sterling will be unable to resume an upward movement in the first quarter of this year. The latest COT report revealed that short non-commercial positions increased by 12,454, to 63,926, while long non-commercial positions jumped by 3,040, to 43,625. It led to a decline in the negative delta of the non-commercial net position to -20 301 versus -5,603 a week earlier. The fact that the delta has turned negative again proves once again that traders are unwilling to buy the pound sterling at current highs. The weekly closing price declined and amounted to 1.2004 against 1.2177.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages. It indicates that the pair is moving sideways.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD rises, the indicator's upper border at 1.2180 will serve as resistance. In case of a decrease, the indicator's lower border at 1.2118 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.